Unlock the Power of Forex High-Frequency Trading: A Comprehensive Guide

Image: www.youtube.com

In the fast-paced world of financial markets, time is everything. Forex high-frequency trading software has emerged as a game-changer, empowering traders with split-second precision and lightning-fast execution. Its potential to multiply profits and streamline operations is undeniable, but understanding how this technology works is paramount. Enter this comprehensive guide, meticulously crafted to unravel the intricacies of forex high-frequency trading software and equip you with the knowledge to harness its power.

Embracing the Cutting Edge of Forex Trading

Simply put, forex high-frequency trading (HFT) software is an automated system that executes hundreds,甚至数千份, 订单在毫秒尺度内. 它的高超速度允许交易者:

- Exploit fleeting market inefficiencies

- Capitalize on minuscule price movements

- Automate their trading strategies, 无需人工干预

Demystifying the Forex HFT Landscape

The realm of forex HFT software is dynamic and ever-evolving. Trading platforms are relentlessly pushing the boundaries, integrating cutting-edge algorithms and AI-driven features to enhance performance.

- Machine Learning and AI: HFT algorithms are increasingly incorporating machine learning and AI techniques, enabling them to adapt to changing market conditions, identify high-probability trading opportunities through predictive modeling, and optimize trading strategies in real-time.

- Algorithms and Strategies: A multitude of sophisticated algorithms power HFT strategies, each with unique characteristics. Scalping, for instance, targets minute price fluctuations and rapid execution, while arbitrage strategies simultaneously buy and sell the same asset across different markets to capitalize on price disparities.

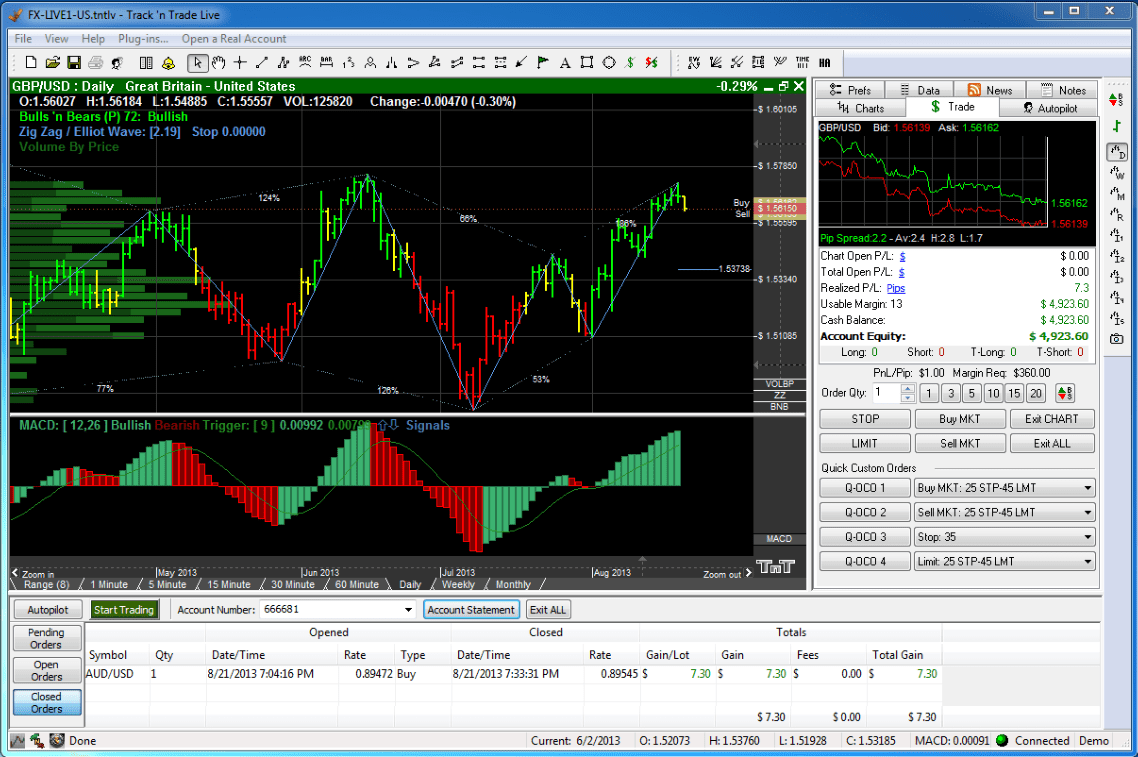

- Data Analysis and Visualization: Advanced data analytics tools dissect vast quantities of market data, providing traders with real-time insights, predictive analytics, and risk assessment capabilities. By visualizing complex data in real-time charts and dashboards, HFT traders gain a bird’s-eye view of market dynamics.

Mastering the Art of Forex HFT

To excel in forex high-frequency trading, a combination of technical expertise and disciplined risk management is essential.

- Understanding the Language: Forex HFT involves complex algorithms, market microstructure, and financial jargon. Equip yourself with the vocabulary of this specialized domain to effectively navigate its intricacies.

- Simulate and Optimize: Before unleashing HFT software in real-time markets, practice and fine-tune strategies in simulation environments. This enables you to refine parameters, test different algorithms, and minimize risks.

- Managing Risks Wisely: Mitigate potential losses by employing risk management tools, such as stop-loss orders, trailing stops, and position sizing strategies. Monitor positions closely and be prepared to adjust strategies or exit trades as needed to safeguard your capital.

Embrace the Future of Forex Trading

Forex high-frequency trading software is revolutionizing the way traders interact with financial markets. It offers opportunities to access high-impact trading strategies, execute trades with unparalleled swiftness, and seize a competitive edge in the ever-evolving world of forex. By understanding its nuances and embracing best practices, you can unlock the true potential of this transformative technology and propel your trading success to new heights.

Image: mavink.com

Forex High Frequency Trading Software