Pakistan’s foreign exchange reserves, held by the State Bank of Pakistan, play a crucial role in safeguarding the country’s economic stability and financial integrity. These reserves, comprising various foreign currencies, gold, and Special Drawing Rights (SDRs), serve as a cushion against external shocks and provide flexibility in managing the country’s international obligations. Fluctuations in these reserves can influence the stability of Pakistan’s currency, inflation, and overall economic growth.

Image: www.aranca.com

Composition and Significance of Forex Reserves

Pakistan’s forex reserves are primarily composed of U.S. dollars, euros, British pounds, and other major currencies. Gold, held as physical bullion, also forms a significant portion of these reserves. SDRs, a type of international reserve asset issued by the International Monetary Fund (IMF), complement Pakistan’s foreign exchange holdings.

The significance of forex reserves lies in their ability to meet international payment obligations, such as imports of goods and services, foreign debt repayments, and investments abroad. Sufficient reserves provide confidence to foreign investors and promote economic stability by safeguarding against exchange rate volatility.

Factors Influencing Forex Reserves

Fluctuations in Pakistan’s forex reserves are influenced by several factors, including:

-

Trade Balance: A trade deficit, where imports exceed exports, leads to a depletion of forex reserves as the country must use reserves to finance the import bill. Conversely, a trade surplus contributes to an increase in reserves.

-

Foreign Direct Investment (FDI): Inflows of FDI boost forex reserves, as foreign investors bring in capital to invest in Pakistan’s economy.

-

Remittances: Overseas Pakistanis sending money back to their families contribute to forex reserves, augmenting the country’s foreign currency holdings.

-

Debt Repayments: Repayment of foreign debt obligations by the government and private sector drains forex reserves.

Recent Trends and Challenges

In recent years, Pakistan’s forex reserves have experienced fluctuations due to various factors. The COVID-19 pandemic and its impact on trade and remittances led to a decline in reserves. Additionally, the ongoing geopolitical uncertainties, particularly in the aftermath of Russia-Ukraine conflict, have affected Pakistan’s external trade and foreign currency inflows.

To address the challenges, the Pakistani government has implemented measures to increase exports, attract FDI, encourage remittances, and prudently manage foreign debt.

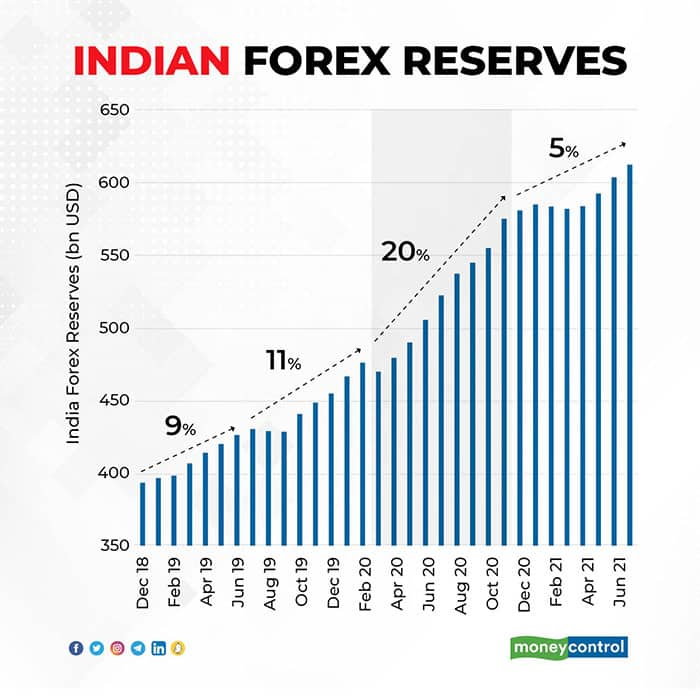

Image: www.moneycontrol.com

Impact of Forex Reserves on Economy

Pakistan’s forex reserves have a direct and indirect impact on the economy:

-

Exchange Rate Stability: Adequate forex reserves help stabilize the Pakistani rupee against foreign currencies, preventing excessive volatility that could harm trade and investment.

-

Inflation Control: Forex reserves allow the country to import essential goods, such as food and energy, without facing foreign exchange shortages. This helps control inflation by preventing price spikes due to supply constraints.

-

Debt Management: Foreign exchange reserves provide a buffer for Pakistan to meet its foreign debt obligations, allowing the government to repay foreign loans without resorting to unsustainable borrowing or default.

-

Economic Growth: Sufficient forex reserves foster investor confidence, making Pakistan an attractive destination for foreign investors. This facilitates economic growth by increasing investment in infrastructure, manufacturing, and other sectors.

Forex Exchange Reserve Of Pakistan

Future Prospects and Policy Implications

Ensuring adequate forex reserves remains crucial for Pakistan to maintain economic stability and resilience. The government needs to prioritize export promotion, attract FDI, encourage remittances, and manage foreign debt sustainably.

Additionally, monetary and fiscal policies should be geared towards maintaining financial discipline, curbing inflation, and promoting a favorable investment environment. By effectively managing its forex exchange reserves, Pakistan can safeguard its economic development and pave the way for inclusive and sustainable growth in the years to come.