An Immersive Exploration into the Currency Dynamics Driving Chennai’s Economy

Amidst the bustling streets of Chennai, a vibrant hub of commerce, exchanges countless hands daily. These exchanges, known as forex rates, play a pivotal role in connecting Chennai to the global market, enabling seamless trade and driving economic prosperity. Immerse yourself in the intricate world of forex exchange rates in Chennai, where financial powerhouses collide to determine the value of money.

Image: forextradechennai.com

Basics of Forex Rates: The Language of International Commerce

Foreign exchange rates measure the value of one currency relative to another. In Chennai, the dominant currency is the Indian rupee (INR). When exchanging INR for a foreign currency, say the US dollar (USD), the forex rate indicates how many rupees are needed to acquire one dollar. These rates fluctuate constantly, influenced by a complex interplay of economic factors that shape the global financial landscape.

Major Determinants of Forex Rates in Chennai

A myriad of economic indicators impact forex rates in Chennai. Here are some key factors:

- Economic Growth: A strong and growing economy signals investor confidence, leading to a higher demand for the local currency and a subsequent increase in its value.

- Interest Rates: If Chennai’s central bank raises interest rates, it makes rupee-denominated investments more attractive to foreign investors, strengthening the rupee.

- Inflation: High inflation rates erode the purchasing power of a currency and weaken its value in the forex market.

- Political Stability: Forex rates are sensitive to political events that could destabilize the economy or shake investors’ confidence.

- Global Economic Conditions: Forex rates in Chennai are intertwined with global economic fluctuations affecting major economies like the US and China.

Exporters, Importers, and the Currency Conundrum

In Chennai’s dynamic export-import ecosystem, forex rates hold tremendous significance for businesses. Exporters earn revenue in foreign currencies when they sell their products and services abroad. Conversely, importers incur expenses in foreign currencies when they purchase goods or services from other countries. Favorable forex rates can boost profitability for both exporters and importers by reducing their respective costs.

Image: vitocejayem.web.fc2.com

Forecasting Forex Rates: A Crucible of Precision

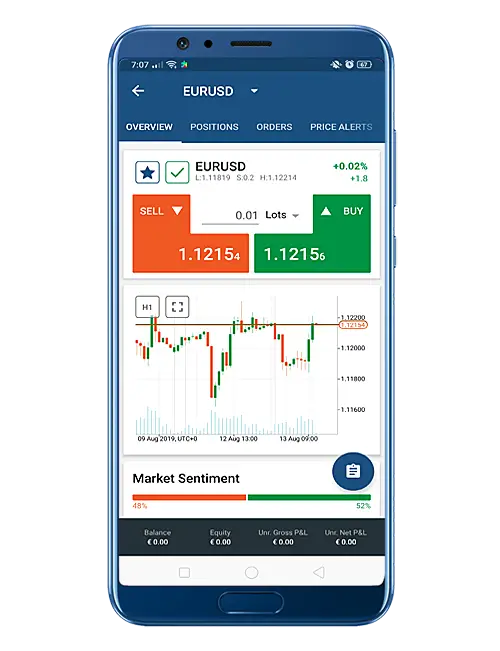

Accurately forecasting forex rates is a challenging yet crucial skill in the realm of international finance. Currency traders and analysts rely on advanced econometric models, technical charts, and a deep understanding of economic variables to predict future rate movements. The ability to make accurate forex rate forecasts can yield significant profits for savvy traders who navigate the volatile currency markets.

Central Bank Intervention: Guiding the Forex Waters

In times of significant currency fluctuations that could disrupt economic stability, the Reserve Bank of India (RBI) may intervene in the forex market to stabilize exchange rates within a desired range. The RBI can buy or sell foreign exchange reserves to influence the demand and supply of rupees, thereby managing forex rate volatility.

Challenges and Opportunities in Forex Trading

Venturing into forex trading presents both challenges and opportunities for aspiring traders. Forex markets offer the potential for significant profits due to high leverage and relatively low transaction costs. However, the market’s inherent volatility can also lead to substantial losses if not managed prudently. Success in forex trading hinges upon a thorough understanding of market dynamics, strategic risk management, and emotional discipline.

Forex Exchange Rates In Chennai

Conclusion: Understanding Forex Rates – A Catalyst for Economic Empowerment

Foreign exchange rates are the lifeblood of global commerce, influencing the flow of goods, services, and capital across borders. In Chennai, forex rates play a pivotal role in driving economic growth, facilitating international trade, and providing opportunities for businesses and individuals alike. To harness the transformative power of forex rates, it is imperative to understand their determinants, leverage forecasting techniques, and recognize the central bank’s role. Whether you’re an aspiring trader or an economist seeking to decipher monetary fluctuations, this exploration of forex exchange rates in Chennai has equipped you with invaluable knowledge to navigate the ever-evolving world of international finance.