Introduction:

In the dynamic world of forex trading, accuracy and timing are everything. Enter and exit indicators provide traders with a powerful tool to optimize their decision-making and maximize their profit potential. Join us on an enlightening journey as we explore the intricacies of forex entry and exit indicators, empowering you with the knowledge to conquer the financial markets.

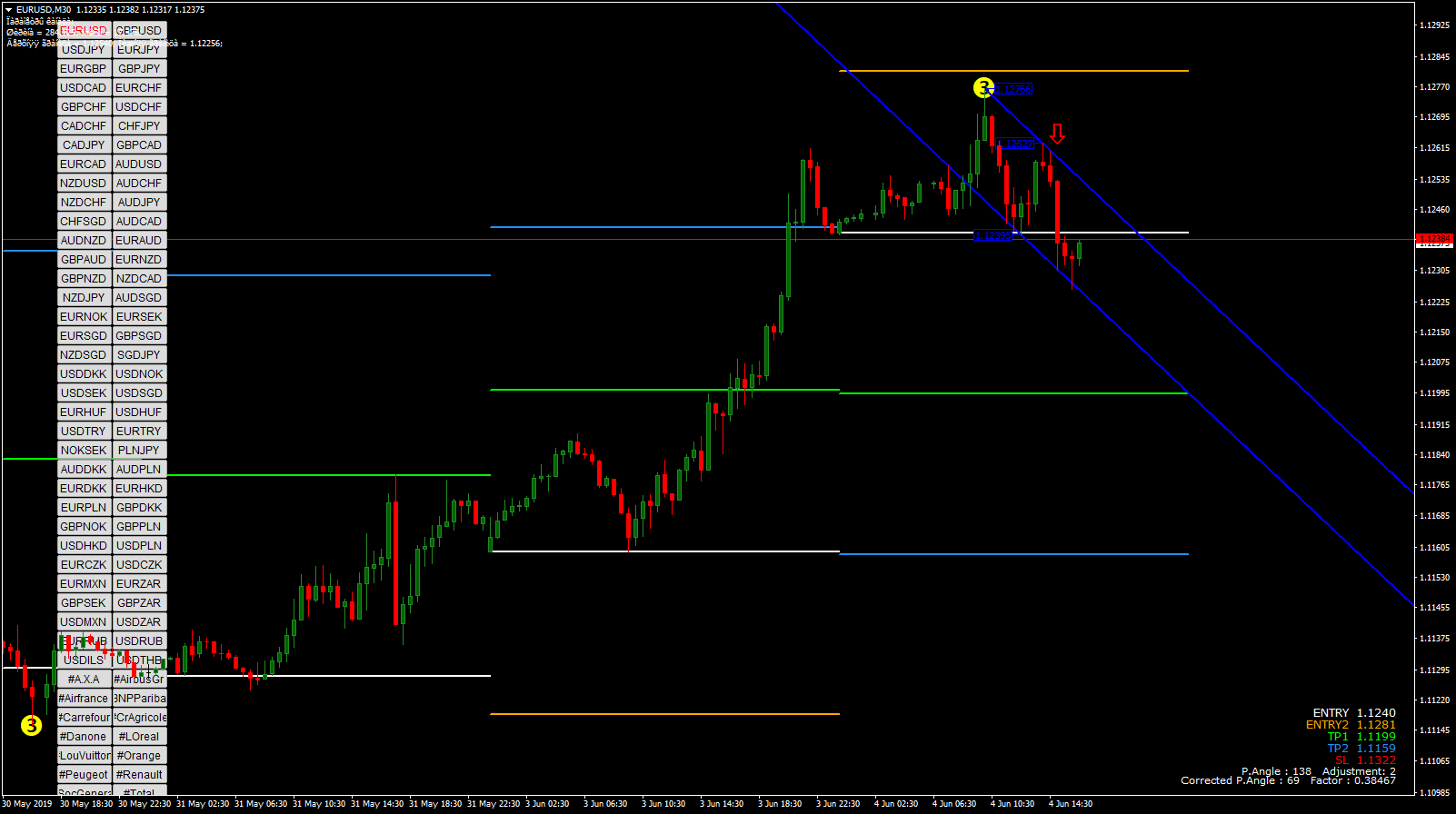

Image: forexdeviceea.blogspot.com

Deciphering Entry and Exit Indicators:

Forex entry and exit indicators are technical tools that analyze price movements and market patterns to suggest optimal points for entering and exiting trades. They provide an objective perspective, removing the guesswork and emotional biases that can cloud judgment.

Types of Entry and Exit Indicators:

- Volume Indicators: Measure trading volume to gauge market sentiment and potential trading opportunities.

- Moving Averages: Smooth out price fluctuations to reveal underlying trends and support/resistance levels.

- Pivot Points: Identify potential reversal points based on previous day’s trading range.

- Bollinger Bands: Define areas of high and low price volatility, providing insights into overbought or oversold conditions.

- Relative Strength Index (RSI): Measures the magnitude of price changes to assess market momentum and trend strength.

Unlocking the Power of Convergence:

The true strength of entry and exit indicators lies in their convergence. When multiple indicators align, it provides a powerful confirmation for potential trades. This triangulation approach reduces the risk of false signals and enhances trading accuracy.

Image: www.ainfosolutions.com

Expert Perspectives:

“Entry and exit indicators are indispensable tools for demystifying market behavior,” says Mark Howard, a seasoned trader with over a decade of experience. “They provide objective insights that enable traders to navigate volatile markets with confidence.”

From Theory to Practice:

- Identify Trends: Use moving averages to establish the long-term trend direction.

- Spot Trading Opportunities: Employ volume indicators to pinpoint areas of high trading volume and potential price breakouts.

- Confirm Signals: Seek convergence from multiple indicators before executing trades.

- Manage Risk: Utilize RSI to gauge market momentum and understand the potential for retracements or reversals.

Conclusion:

Forex entry and exit indicators empower traders to make informed decisions, maximize their profit potential, and mitigate trading risks. By embracing these valuable tools and applying the strategies outlined in this guide, you can unlock the key to successful forex trading. Remember, the journey to financial freedom begins with a solid foundation of knowledge and a commitment to disciplined trading practices.

Forex Entry And Exit Indicator

Call to Action:

Dive deeper into the world of forex entry and exit indicators. Explore online resources, attend workshops, and engage with experienced traders to expand your trading knowledge and elevate your trading acumen. The path to forex trading success lies in continuous learning and relentless pursuit of knowledge.