Introduction

In the turbulent waters of the global currency market, understanding market sentiment is akin to having a compass amidst a storm. The Forex Currency Meter serves as an invaluable tool for traders, illuminating the emotional undercurrents that drive price action. By deciphering the collective sentiment towards a currency, traders can anticipate market trends, capitalize on opportunities, and navigate risks with greater precision.

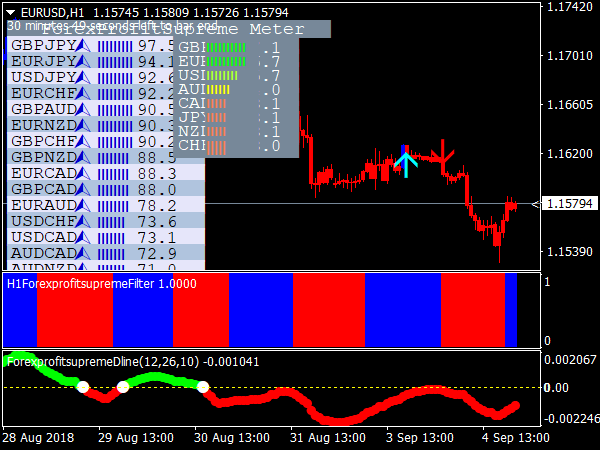

Image: www.bank2home.com

Unveiling the Forex Currency Meter

The Forex Currency Meter is a sophisticated instrument that aggregates data from various sources, including interbank orders, social media chatter, news articles, and macroeconomic indicators. It quantifies the market’s emotional bias towards a particular currency on a scale ranging from extreme bearishness to extreme bullishness.

Price Action as a Mirror of Emotions

Price action in the Forex market is a profound reflection of the emotional interplay between buyers and sellers. Bulls, fueled by optimism, drive prices higher, while bears, gripped by fear or pessimism, push prices lower. The Forex Currency Meter provides a window into this emotional tug-of-war, enabling traders to gauge market sentiment in real-time.

Capturing Market Moods

The Forex Currency Meter categorizes market sentiment into five primary emotions: extreme fear, fear, neutral, optimism, and extreme optimism. Each emotion signifies a unique set of price action patterns and trading strategies.

- Extreme Fear: A market gripped by panic, reflected in sharp price declines and high volatility. Traders may seek to short the currency.

- Fear: An atmosphere of uncertainty, often leading to sideways price action or subtle downward trends. Traders may adjust positions or exit.

- Neutral: A state of equilibrium, with neither exuberance nor pessimism dominating, characterized by range-bound price action. Traders may consolidate positions.

- Optimism: A market driven by confidence and buying pressure, resulting in rising prices and steady gains. Traders may consider long positions.

- Extreme Optimism: A euphoric market, susceptible to rapid price spikes. Traders may exercise caution and consider profit-taking.

Image: www.youtube.com

Expert Insights: Navigating Emotional Waters

“Market sentiment plays a crucial role in Forex trading,” emphasizes Dr. Mark Jenkins, a leading Forex strategist. “By understanding the emotional undertones of the market, traders can align their strategies with the prevailing trend, enhancing their chances of success.”

According to Ms. Emily Carter, a seasoned Forex analyst, “The Forex Currency Meter provides an invaluable glimpse into the collective psyche of the market. Traders who embrace this tool gain a competitive edge by anticipating price movements and managing risks effectively.”

Actionable Tips for Traders

- Monitor the Forex Currency Meter: Regularly consult the meter to gauge market sentiment for the currencies you trade.

- Align with the Trend: Identify the prevailing emotion and align your trading strategy accordingly.

- Identify Reversal Points: Look for signs of extreme emotional readings, as they often indicate potential trend reversals.

- Manage Risk: Adjust your trading volume and leverage based on the level of market uncertainty.

- Avoid Overtrading: Resist the temptation to overtrade during periods of high volatility or emotional extremes.

Forex Currency Meter & Price Action

Conclusion

The Forex Currency Meter has become an indispensable tool for Forex traders, shedding light on the emotional forces that shape the market. By harnessing its insights, traders can unlock the secrets of price action, anticipate market movements, and make informed trading decisions that align with the collective sentiment. Embrace the power of the Forex Currency Meter and navigate the turbulent waters of the global currency market with confidence.