Introduction

As a frequent traveler, you’ve likely faced the dilemma of choosing between a forex card and an international credit card. Both offer advantages and drawbacks, so understanding their nuances is crucial for making an informed decision. Let’s explore the key differences to help you navigate this financial conundrum.

Image: goniyo.com

Understanding the Fundamentals

Forex Card

A forex card, also known as a currency card, stores multiple currencies and allows you to make international purchases and withdrawals at competitive exchange rates. They typically offer low or no transaction fees and provide added security features, such as chip-and-PIN protection.

International Credit Card

An international credit card is a standard credit card that can be used for international transactions. While they offer the convenience of one card for all expenses, they often incur higher exchange rate fees and transaction charges. Additionally, they may come with additional security risks if not handled responsibly.

Image: www.moneycontrol.com

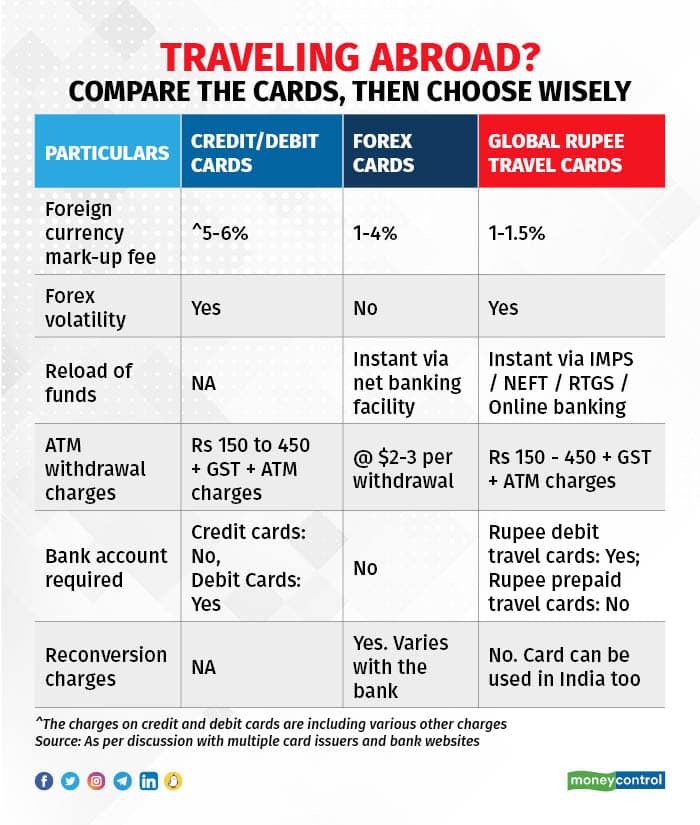

Comparative Analysis

To help you make a well-informed decision, let’s delve into a detailed comparison of forex cards and international credit cards.

- Exchange Rates: Forex cards generally provide more favorable exchange rates than international credit cards, resulting in potential cost savings.

- Transaction Fees: While forex cards often charge nominal transaction fees, international credit cards can incur higher fees, especially for currency conversions.

- Security: Forex cards offer enhanced security features like chip-and-PIN technology, reducing the risk of fraud. International credit cards may offer similar features but may be more susceptible to fraudulent use.

- Convenience: International credit cards provide the convenience of a single card for all your expenses, while forex cards require managing multiple currencies if you visit various countries frequently.

- Acceptance: Forex cards may have limited acceptance compared to international credit cards, which are widely accepted worldwide.

Latest Trends and Developments

The forex card industry is constantly evolving, with new features and enhancements emerging. Some notable developments include:

- Virtual Forex Cards: These digital cards allow you to make online purchases without carrying a physical card.

- Mobile Apps: Many forex card providers offer mobile apps for convenient account management, currency conversion, and transaction tracking.

- Travel Insurance and Benefits: Some forex cards offer additional benefits like travel insurance, discounts on flights and accommodations, and travel rewards.

Expert Advice and Tips

To maximize the benefits of your forex card or international credit card, consider these tips:

- Compare Rates and Fees: Before choosing a card, compare exchange rates and transaction fees to find the most cost-effective option.

- Consider Security Features: Protect your funds by using a card with chip-and-PIN technology and up-to-date security measures.

- Plan for Currency Needs: Estimate the currencies you’ll need and load your forex card accordingly to avoid unnecessary fees.

- Monitor Spending Habits: Track your transactions regularly to avoid overspending or unauthorized usage.

- Inform Issuers of Your Travel Plans: Notify your card issuer about your travel dates to prevent your card from being blocked due to unusual activity.

Frequently Asked Questions (FAQ)

- What is the difference between a forex card and a debit card?

A forex card is specifically designed for international transactions and offers competitive exchange rates, while a debit card is linked to your bank account for local purchases and withdrawals. - Can I use a forex card in my home country?

Yes, but it’s advised to use it primarily for international transactions to avoid unnecessary conversion fees. - Which card is better for large purchases?

Both forex cards and international credit cards can be used for large purchases, but it’s wise to compare exchange rates and fees before committing to a transaction.

Forex Card Vs International Credit Card

Conclusion

Choosing between a forex card and an international credit card depends on your specific travel patterns, financial needs, and preferences. By thoroughly understanding the key differences, the latest trends, expert advice, and frequently asked questions, you can make an informed decision that best suits your financial objectives. Remember, expanding your financial toolbox allows you to navigate the world more confidently and efficiently. Are you interested in finding out more about the multifaceted world of forex cards and international credit cards?