Introduction

In the volatile world of foreign exchange (forex) trading, every advantage counts. Seasoned traders rely on a wide array of tools and techniques to navigate the unpredictable market landscape. Among these essential tools, forex candle predictors stand out as a powerful aid that can significantly enhance your trading strategy. In this comprehensive guide, we will delve into the world of forex candle predictors, exploring their genesis, fundamental concepts, and real-world applications. We will guide you through the latest trends and developments in this field, equipping you with the knowledge to make informed trading decisions.

Image: benchmarkinstitute.org

Image: benchmarkinstitute.orgNavigating the Forex Market: The Importance of Forex Candle Predictors

Forex, the world’s largest and most liquid financial market, presents traders with dynamic trading opportunities. However, it can also be a daunting landscape, especially for newcomers. Market participants navigate the constant ebb and flow of currency prices, relying on technical and fundamental analysis to forecast future price movements. Forex candle predictors emerge as invaluable tools in this context, helping traders make informed decisions based on historical price patterns.

Decoding Forex Candlestick Patterns

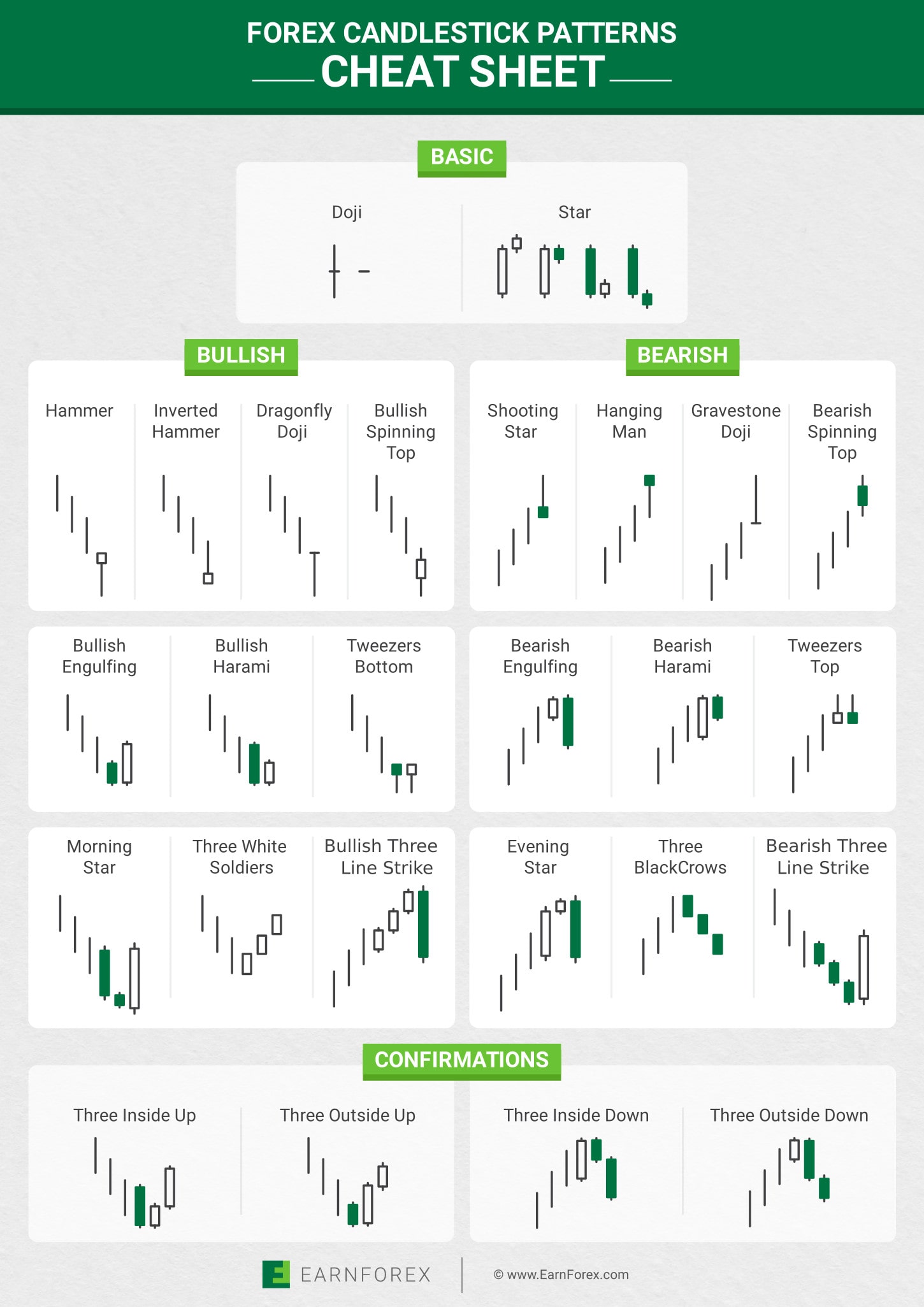

The foundation of forex candle predictors lies in candlestick patterns, graphical representations of price action over a specific period. The shape, color, and position of these candles can provide insights into market sentiment, potential trend reversals, and future price movements. By identifying and interpreting candlestick patterns, traders gain a deeper understanding of market dynamics, enabling them to make strategic trading decisions.

Revealing the Power of Forex Candle Predictors

Forex candle predictors harness the power of these candlestick patterns, combining them with advanced algorithms to forecast future price movements. These sophisticated models analyze historical data, identifying recurring patterns and trends. Based on this analysis, they generate predictions about the potential direction of currency pairs, giving traders an edge in the unpredictable forex market.

Image: maisiewood.z13.web.core.windows.net

Types of Forex Candle Predictors: Delving into the Options

A diverse array of forex candle predictors is available, each with its unique strengths and applications. Popular types include:

-

Pattern Recognition Predictors: These predictors focus on identifying specific candlestick patterns and correlating them with future price movements. They can detect bullish or bearish patterns, signaling potential reversals or continuations.

-

Trend Following Predictors: Designed to capture the momentum of a prevailing trend, these predictors analyze the direction and strength of price movements to identify potential breakout or pullback opportunities.

-

Support and Resistance Predictors: These models rely on historical support and resistance levels to forecast potential areas of price reversal. They identify key price points where the market has consistently reacted, helping traders determine optimal entry and exit points.

-

Time-Based Predictors: Leveraging the concept of cyclical price movements, these predictors analyze past data to identify recurring patterns based on time intervals, such as daily, weekly, or monthly cycles.

How to Choose the Right Forex Candle Predictor: Matching Needs to Models

Selecting the most suitable forex candle predictor is crucial for maximizing its effectiveness. Consider the following factors when making your choice:

-

Trading Style: Determine whether the predictor aligns with your trading strategy. For example, trend-following predictors complement long-term trading, while pattern recognition predictors suit short-term traders.

-

Risk Tolerance: Assess the risk profile of the predictor. Some predictors may generate frequent signals, while others are more conservative. Align your risk tolerance with the predictor’s risk-reward ratio.

-

Currency Pairs and Time Frames: Ensure that the predictor supports the currency pairs and time frames you trade. Different predictors may specialize in specific currency pairs or time frames.

-

Reliability and Accuracy: Evaluate the predictor’s historical performance and accuracy rates. Reliable predictors provide consistent results over time, minimizing false signals.

Harnessing the Power of Forex Candle Predictors: Best Practices

To maximize the benefits of forex candle predictors, follow these best practices:

-

Confirmation: Rely on multiple indicators or analysis methods to confirm the signals generated by the predictor. Avoid relying solely on one predictor, as markets can be unpredictable.

-

Risk Management: Implement a sound risk management strategy to limit potential losses. Utilize stop-loss orders and position sizing techniques to manage risk effectively.

-

Calibration: Regularly review and adjust the predictor’s parameters to optimize its performance. Different market conditions may require adjustments to the predictor’s settings.

-

Emotional Discipline: Maintain emotional discipline while trading with forex candle predictors. Avoid making impulsive decisions based on fear or greed. Stick to your trading plan and manage emotions effectively.

Emerging Trends and Innovations in Forex Candle Predictors

The world of forex candle predictors is constantly evolving, with new trends and innovations emerging:

-

Machine Learning and AI: Predictive models are incorporating machine learning and artificial intelligence (AI) algorithms, enhancing their ability to identify complex patterns and self-adjust to changing market conditions.

-

Hybrid Predictors: Combining multiple types of predictors or integrating fundamental data into candle-based analysis is gaining popularity, aiming to provide more comprehensive insights.

-

Mobile Trading Integration: Forex candle predictors are becoming increasingly accessible through mobile trading platforms, allowing traders to monitor and respond to market movements from anywhere.

-

Crowdsourcing: Platforms enabling traders to share their own candlestick-pattern insights and predictions are emerging, fostering a collaborative approach to market analysis.

Forex Candle Predictor Free Download

Conclusion: Empowering Forex Traders with Candle Predictors

Forex candle predictors have revolutionized the way traders analyze and forecast market movements. By harnessing the power of historical price patterns and advanced algorithms, these tools provide valuable insights into potential price directions, enabling traders to make informed decisions and maximize their trading potential. However, it is essential to remember that forex trading involves inherent risks, and candle predictors should be used as one component of a comprehensive trading strategy that includes sound risk management practices.