Embark on Your Forex Success Journey

Welcome to the fascinating world of forex trading! Whether you’re a seasoned veteran or a newcomer eager to step into this dynamic market, there’s no denying the importance of backtesting your forex strategies before diving headfirst into live trading.

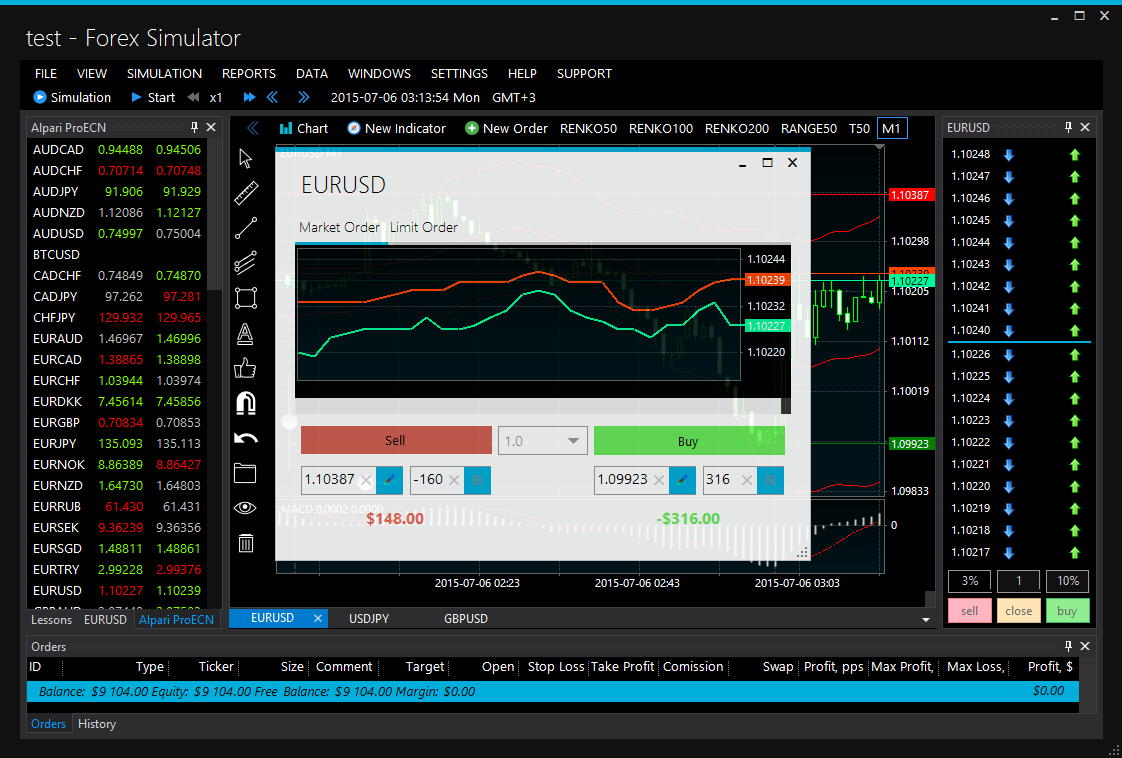

Image: forexsimulator.com

Backtesting allows you to test your trading strategies against historical data, providing invaluable insights into their performance and potential profitability. By utilizing reliable forex backtesting software, you can gain a competitive edge and increase your chances of success.

Unveiling the Power of Forex Backtesting Software

Forex backtesting software empowers traders with the ability to simulate real-life trading scenarios in a controlled environment. This software offers a comprehensive range of features tailored specifically for forex traders, such as:

- Import and analyze historical data from multiple sources

- Create and automate complex trading strategies

- Run multiple simulations simultaneously to compare strategies

- Generate detailed performance reports to assess strategy effectiveness

By harnessing the power of forex backtesting software, traders can fine-tune their strategies, identify potential pitfalls, and optimize their risk management techniques before putting their hard-earned capital at stake.

Maximizing Backtesting Results

To get the most out of your forex backtesting endeavors, it’s essential to follow these best practices:

- Use quality data from reputable sources

- Set realistic market conditions and account sizes

- Test multiple scenarios to account for various market conditions

- Interpret results cautiously and avoid overfitting

Expert Tips for Effective Forex Backtesting

As an experienced forex blogger, I’ve witnessed firsthand the transformative power of forex backtesting. Here are some expert tips I’ve gathered over the years:

- Start small: Begin with simple strategies and gradually increase complexity.

- Stress test your strategies: Run backtests under extreme market conditions to assess their robustness.

- Monitor your risk: Keep an eye on your risk-to-reward ratios and position sizing.

- Learn from your mistakes: Analyze unsuccessful backtests to identify areas for improvement.

Image: indicatorchart.com

Frequently Asked Questions about Forex Backtesting Software

Q: Is forex backtesting software free to use?

A: Yes, there are many free forex backtesting software options available online.

Q: Which is the best free forex backtesting software?

A: Some popular free forex backtesting software include MT4 Strategy Tester, TradeStation Simulator, and FXblue.

Q: How accurate is forex backtesting?

A: Backtesting results are not guaranteed to reflect future performance, but they can provide valuable insights and help you refine your strategies.

Forex Backtesting Software Free Download

Conclusion: Empower Your Forex Journey with Backtesting

In the ever-evolving world of forex trading, the ability to backtest your strategies is a cornerstone of success. By utilizing the latest forex backtesting software, you can minimize risk, optimize your performance, and increase your chances of profitability.

Take advantage of the free forex backtesting software options available online and embark on a journey toward informed and confident trading.

Are you ready to elevate your forex trading game with the power of backtesting? Download free forex backtesting software today and unlock the path to successful trading!