**Introduction: Unlocking the Secrets of Currency Markets**

In the fast-paced world of foreign exchange, understanding the underlying factors that drive currency values is paramount. Fundamental analysis is a powerful tool that can empower traders to make informed decisions and capitalize on market opportunities. This comprehensive guide provides an invaluable overview of fundamental analysis, including its history, methodology, and practical applications.

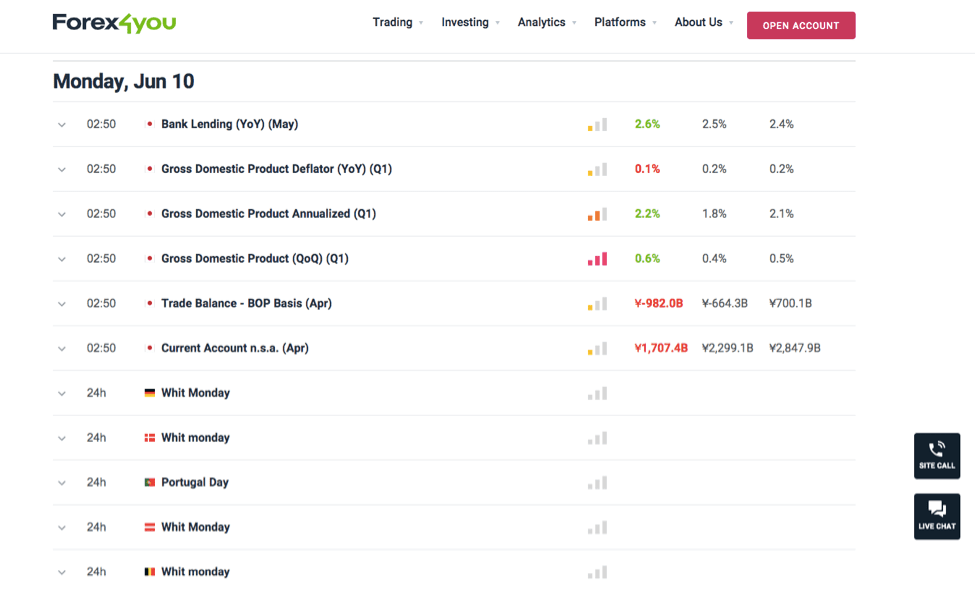

Image: www.forex4you.com

Join us on this journey of financial exploration as we delve into the fundamental forces that shape currency markets. Prepare to gain actionable insights, expert advice, and a downloadable guide that will elevate your foreign exchange trading strategies.

**Defining Fundamental Analysis: The Bedrock of Currency Valuation**

Fundamental analysis is an approach to currency trading that seeks to assess the intrinsic value of a currency based on economic, political, and social factors. By analyzing these fundamentals, traders can determine whether a currency is overvalued or undervalued, enabling them to capitalize on potential opportunities.

This method contrasts with technical analysis, which focuses on price movements and chart patterns. While both approaches can provide valuable insights, fundamental analysis offers a more comprehensive understanding of the underlying drivers of currency values.

**Essential Elements of Fundamental Analysis: A Holistic Approach**

Understanding the core components of fundamental analysis is crucial for accurate and profitable currency trading. These elements include:

- Economic Data: Interest rates, gross domestic product (GDP), inflation, employment data, and trade balances provide insights into a country’s economic health.

- Political Stability: Political events, elections, and policy changes can significantly impact currency values.

- Social Factors: Culture, demographics, and social trends can influence economic growth and consumer sentiment.

By carefully analyzing these factors, traders can develop a comprehensive understanding of a currency’s intrinsic value and make informed decisions.

**Practical Applications of Fundamental Analysis: Empowering Traders**

Fundamental analysis empowers traders to navigate currency markets effectively. By identifying undervalued or overvalued currencies, traders can:

- Identify Trading Opportunities: Exploit disparities between a currency’s actual value and its perceived value.

- Manage Risk: Understand the factors that may impact a currency’s value and mitigate potential losses.

- Make Informed Decisions: Base trading decisions on a comprehensive analysis of the currency’s fundamentals.

Mastering fundamental analysis opens doors to more profitable and strategic currency trading.

Image: community.ig.com

**Tips and Expert Advice: Enhance Your Fundamental Analysis Skills**

To elevate your fundamental analysis skills, consider the following expert advice:

- Stay Updated: Keep abreast of the latest economic, political, and social news.

- Analyze Multiple Sources: Gather insights from various sources, including news articles, economic reports, and social media.

- Develop a Trading Plan: Based on your fundamental analysis, create a clear trading plan, outlining your entry and exit points, risk management strategies, and profit targets.

- Practice and Learn: The more you practice fundamental analysis, the more proficient you will become.

By incorporating these tips into your approach, you can enhance the accuracy and profitability of your foreign exchange trading.

**FAQ: Currency Trading Queries Answered**

What is the difference between fundamental and technical analysis?

Fundamental analysis focuses on economic, political, and social factors, while technical analysis analyzes price movements and chart patterns.

What are the most important economic factors to consider in fundamental analysis?

Interest rates, GDP, inflation, employment data, and trade balances.

Can I download a comprehensive guide to fundamental analysis?

Yes, click here to download the guide in PDF format.

Forex A Guide To Fundamental Analysis Pdf

**Conclusion: Unlocking the Power of Currency Analysis**

Harnessing the power of fundamental analysis empowers traders with the knowledge and insights necessary to succeed in the foreign exchange market. By understanding the underlying factors that drive currency values, traders can make informed decisions, identify trading opportunities, and minimize risk. Embrace the principles of fundamental analysis today and elevate your currency trading strategies.

Are you interested in deepening your understanding of fundamental analysis and unlocking the potential of currency markets? Share your thoughts and comments below and let us guide you on your trading journey.