Unlocking the Secrets of EUR/USD: A Comprehensive Forex Technical Analysis Guide

Image: www.forex4noobs.com

In the ever-evolving world of financial markets, unlocking the intricacies of currency exchange is crucial for savvy investors and traders. The EUR/USD pair, fondly referred to as “The Big Dog,” is a formidable presence in the foreign exchange arena, offering unparalleled opportunities for profit. To navigate its dynamic landscape successfully, equipping oneself with a profound understanding of its technical analysis is imperative. This comprehensive guide will delve into the depths of EUR/USD technical analysis, empowering you with the knowledge and tools to master this financial behemoth.

Diving into the EUR/USD Technical Analysis Lexicon

Technical analysis, the art of deciphering price movements, relies heavily on patterns, trends, and indicators to unravel the secrets of a currency pair’s behavior. In the case of EUR/USD, meticulous examination of historical data and market trends unveils potential trading opportunities, enabling you to anticipate future price movements with greater precision.

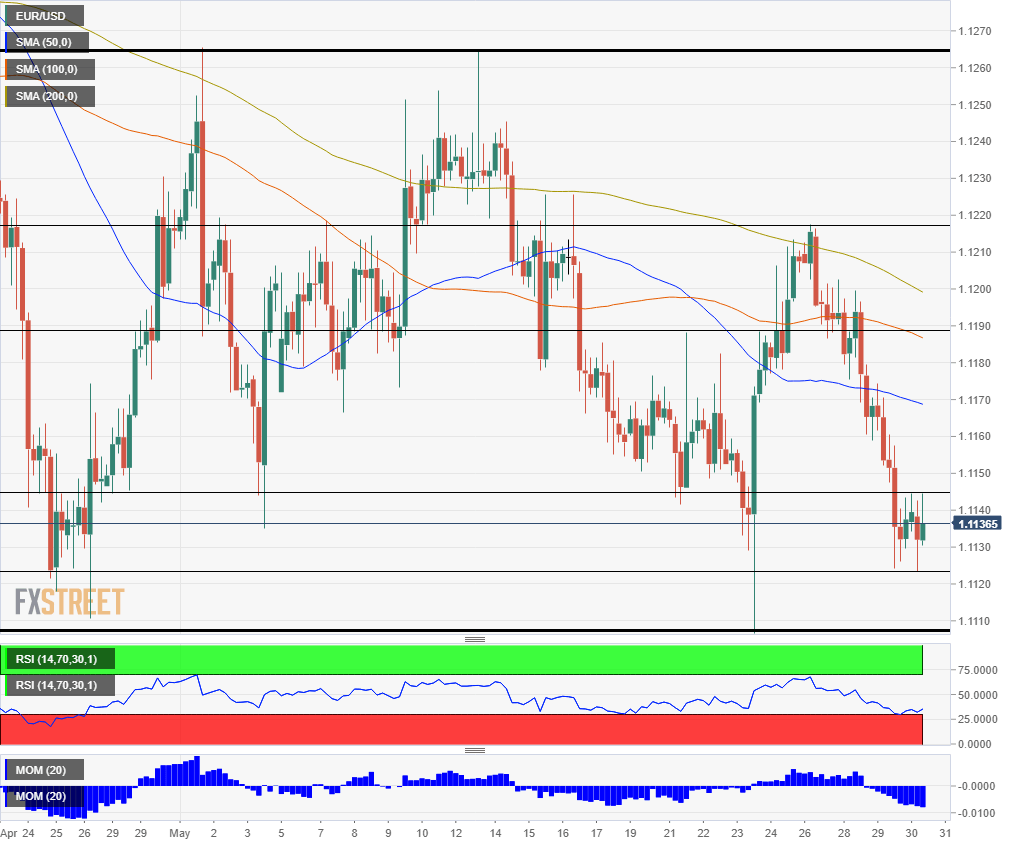

Price charts, the visual representation of currency prices over time, serve as the cornerstone of technical analysis. Line charts, bar charts, and candlestick charts are the most commonly employed chart types, depicting the evolution of the EUR/USD pair with varying degrees of detail. By scrutinizing these charts, analysts discern patterns, identify support and resistance levels, and forecast the trajectory of the currency pair.

Mastering Support and Resistance: The Pillars of Price Action

Support and resistance levels, akin to invisible barriers in the currency market, emerge when prices consistently encounter difficulty breaking above or below a specific price point. Identifying these levels is paramount for determining potential trading opportunities, as they often signify areas of price reversal or consolidation. Support levels are formed when prices decline to a particular point and then rebound, while resistance levels materialize when prices rise to a specific level and subsequently retreat.

Moving Averages: Smoothing Price Fluctuations

Moving averages, a ubiquitous technical indicator, provide a smoothed representation of price data, effectively filtering out market noise and highlighting the underlying trend. By calculating the average price over a predetermined period, moving averages act as a compass, guiding traders towards the direction of the trend and indicating potential trend reversals.

Momentum Indicators: Gauging Price Momentum

Momentum indicators, as their name suggests, measure the rate of price change, providing valuable insights into the strength and sustainability of a trend. These indicators, such as the Relative Strength Index (RSI) and the Stochastic Oscillator, help determine whether an asset is overbought or oversold, aiding in identifying potential trend reversals.

Trend Indicators: Unveiling the Long-Term Picture

Trend indicators, such as the Moving Average Convergence Divergence (MACD) and the Bollinger Bands, provide a comprehensive assessment of the prevailing trend and its potential continuation or reversal. By analyzing the relationship between moving averages and price action, trend indicators offer invaluable guidance in discerning long-term trading opportunities.

Fibonacci Levels: Embracing the Golden Ratio

Fibonacci levels, derived from the Fibonacci sequence, play a pivotal role in technical analysis, fostering identification of potential areas of support and resistance. These levels, based on the golden ratio (1.618), are believed to influence the ebb and flow of prices, creating opportunities for profitable trades.

Unlocking the Treasure Chest: Practical Tips for Success

-

Trend is Your Friend: Align your trading strategy with the prevailing trend. Buy when prices are trending upwards and sell when they are trending downwards.

-

Identify Support and Resistance Levels: These markers serve as crucial battlegrounds in the currency markets. Be prepared to adjust your trading positions accordingly.

-

Use Multiple Indicators: Employ a combination of indicators to enhance your analysis and minimize false signals.

-

Consider Risk Management: Protect your capital by incorporating stop-loss orders and position sizing strategies.

-

Patience is the Key: Avoid the allure of quick profits. Patience and discipline are the hallmarks of successful traders.

Conclusion: Ascending the Heights of Forex Mastery

The EUR/USD currency pair, a formidable titan in the foreign exchange arena, demands meticulous analysis to unlock its trading potential. By grasping the intricacies of technical analysis, you possess the key to unlocking the secrets of this financial behemoth. Through diligent study and disciplined application of the techniques outlined in this guide, you can ascend the heights of forex mastery and harness the power of the EUR/USD pair to your advantage. Let the charts guide your decisions, and may your trading endeavors yield bountiful rewards.

Image: www.forexcrunch.com

Eur Usd Forex Technical Analysis