Navigating the Ever-Changing Forex Landscape

The foreign exchange market, commonly known as Forex, is a global decentralized marketplace where currencies are traded electronically. As the world’s largest financial market, it offers traders a dynamic landscape of opportunities and challenges. One key currency pair in Forex is the EUR/USD, representing the exchange rate between the Euro and the US Dollar. Following market movements and staying abreast of the latest news and updates is crucial for successful trading in this volatile market. This article delves into the world of EUR/USD Forex, providing a comprehensive overview, analyzing market dynamics, and sharing expert insights to empower traders with knowledge.

Image: dibsmethodforexfactory.blogspot.com

Understanding the EUR/USD Currency Pair

The EUR/USD currency pair represents the exchange rate between the Euro and the US Dollar. The Euro is the official currency of the European Union, a supranational political and economic union of 28 member states. The US Dollar, on the other hand, is the official currency of the United States and is widely used as a reserve currency around the world. The EUR/USD pair is one of the most traded currency pairs in Forex, accounting for a significant portion of daily trading volume.

Factors Influencing EUR/USD Movements

A multitude of factors influence the EUR/USD exchange rate, including macroeconomic data, interest rate decisions, political events, and market sentiment. Economic indicators like GDP growth, unemployment rates, and consumer confidence provide insights into the economic health of the Eurozone and the United States, affecting the demand for their respective currencies. Central bank interest rate decisions can also significantly impact the EUR/USD pair, as higher interest rates tend to make a currency more attractive to investors. Political events, such as elections or changes in government policies, can also create volatility in the market. Additionally, market sentiment plays a role, as traders’ perceptions and expectations can drive the direction of the exchange rate.

Analyzing Market Trends and Developments

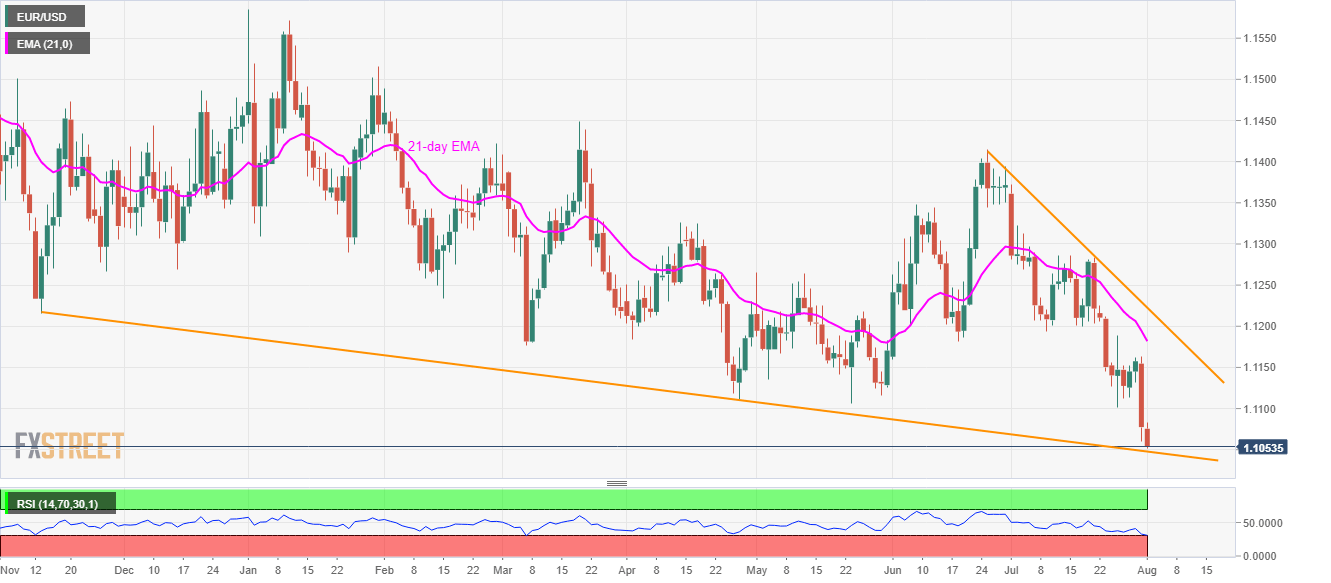

Staying abreast of the latest trends and developments in the EUR/USD market is essential for successful trading. Monitoring economic data releases and central bank announcements is crucial for understanding the fundamental factors influencing the exchange rate. Additionally, following market news and analysis from reputable sources can provide valuable insights into market sentiment and potential trading opportunities. Utilizing technical analysis tools and charting techniques can also assist traders in identifying trends and making informed decisions.

Image: www.tradingpedia.com

Expert Tips and Advice for EUR/USD Trading

-

Manage Risk Effectively: Risk management is paramount in Forex trading. Determining appropriate position sizes, using stop-loss orders, and diversifying investments can help mitigate potential losses.

-

Capitalize on Volatility: The EUR/USD pair is known for its volatility, providing traders with opportunities for both profit and loss. Understanding how to manage risk and identify trading opportunities in volatile markets is essential.

-

Follow Market News and Analysis: Staying informed about market news, economic indicators, and central bank decisions can provide valuable insights for trading decisions.

-

Utilize Technical Analysis: Technical analysis tools, such as price charts, indicators, and trendlines, can assist traders in identifying trading opportunities based on historical price data.

-

Practice Discipline and Patience: Successful trading requires discipline and patience. Following a trading plan, maintaining emotional control, and avoiding excessive leverage can enhance trading performance.

FAQs on EUR/USD Forex Trading

- What are the trading hours for the EUR/USD market?

The EUR/USD market is open 24 hours a day, five days a week, from Sunday evening to Friday evening (Eastern Time).

- What is the minimum deposit required to trade EUR/USD?

The minimum deposit required to trade EUR/USD varies depending on the broker. Some brokers offer micro accounts with deposits as low as $50.

- What is the average spread on EUR/USD?

The average spread on EUR/USD is typically around 1-2 pips, making it a relatively low-cost currency pair to trade.

- What is the recommended leverage for EUR/USD trading?

Leverage should be used with caution. While higher leverage can increase potential profits, it also magnifies potential losses. A conservative leverage ratio of 10:1 to 50:1 is recommended for beginners.

- How to find a reputable broker for EUR/USD trading?

Consider factors such as regulation, trading platform, fees, customer support, and educational resources when choosing a broker.

Eur Usd Forex Live News

https://youtube.com/watch?v=zcmuwM2J96Y

Conclusion

Navigating the EUR/USD Forex market requires a comprehensive understanding of market dynamics, expert insights, and sound risk management practices. By staying informed about economic data, following market news, utilizing technical analysis, and incorporating expert advice, traders can enhance their chances of success in this dynamic financial landscape. Embrace the complexities of the EUR/USD market, embrace learning, and seek continuous improvement to maximize your trading potential.

Is EUR/USD Forex trading a topic that interests you? Share your thoughts and questions in the comments below, and let’s continue the conversation.