Navigating the world of international finance can be daunting, especially when it comes to managing foreign currencies. However, the State Bank of India (SBI) offers a convenient solution to empower travelers and global citizens alike: the SBI Forex Card. This prepaid card allows you to carry multiple currencies simultaneously, making it an indispensable tool for business trips, vacations, or studying abroad.

Image: www.scribd.com

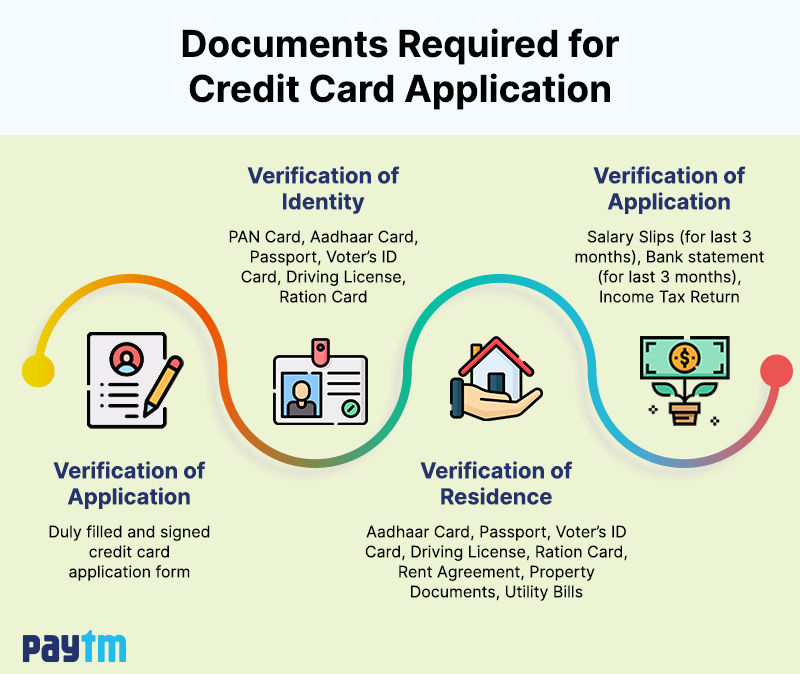

To obtain this invaluable card, ensuring you have the necessary documents is paramount. Let’s delve into the specifics, guiding you through the straightforward process of acquiring an SBI Forex Card with confidence.

Essential Documents for Your SBI Forex Card

The application process for an SBI Forex Card is designed with simplicity in mind, requiring a concise set of documents that provide proof of your identity, address, and financial status.

-

Proof of Identity: Your valid passport is the primary document to establish your identity. Ensure it has a minimum validity of 6 months from the date of application.

-

Address Proof: Submit a recent utility bill (electricity, water, or gas) or a bank statement that clearly displays your current residential address.

-

Income Proof: If you are employed, a recent salary slip will suffice. Self-employed individuals can provide a copy of their Income Tax Returns (ITR) for the previous financial year.

-

PAN Card: A Permanent Account Number (PAN) is mandatory for all Indian residents to verify their financial transactions. Submit a copy of your PAN card along with the application.

-

Recent Photograph: Attach a passport-sized photograph to complete your application.

Additional Requirements

-

Minimum Age: Applicants must be at least 18 years of age to apply for an SBI Forex Card.

-

Eligibility: Indian residents with a valid Indian passport are eligible to obtain an SBI Forex Card. Non-resident Indians (NRIs) may also apply, subject to specific eligibility criteria.

Experience the World with SBI Forex Card

With your SBI Forex Card in hand, the world becomes your financial playground. Enjoy the convenience of carrying multiple currencies, eliminating the hassle of exchanging cash or using multiple credit cards. The card is accepted at millions of locations worldwide, ensuring seamless transactions at hotels, restaurants, shopping malls, and ATMs.

The SBI Forex Card offers numerous benefits that simplify your international endeavors:

-

Competitive Exchange Rates: Access real-time exchange rates, ensuring you get the best value for your money.

-

Safety and Security: The card incorporates advanced security features to protect your financial information and transactions.

-

Convenience: Manage your card effortlessly through SBI’s online banking platform or mobile app. Enjoy real-time transaction tracking and account balance updates.

-

No Transaction Fees: Transact in foreign currencies without incurring any transaction fees, allowing you to maximize your savings.

Image: paytm.com

Documents Required For Sbi Forex Card

Embrace the Future of Global Finance

In today’s interconnected world, the SBI Forex Card has become an indispensable tool for those seeking to navigate international financial transactions with ease and confidence. The straightforward application process, coupled with the numerous benefits and security features, empowers you to embrace the future of global finance.

Don’t let paperwork hold you back from exploring the world. Gather the required documents, apply for your SBI Forex Card today, and embark on a journey of limitless financial freedom and global connectivity.