In the realm of international travel and global financial transactions, an HDFC Forex Card emerges as an indispensable companion, providing the convenience of hassle-free currency conversion and secure spending abroad. However, securing this coveted card requires thorough preparation, and understanding the necessary documents is paramount. Embark on this comprehensive guide as we navigate the essential documentation required for a successful HDFC Forex Card application, empowering you to unlock a world of borderless financial freedom.

Image: www.forex.academy

Introduction: Embracing the Power of an HDFC Forex Card

Traveling beyond national borders presents an array of financial challenges, from fluctuating currency rates to exorbitant transaction fees. In this globalized era, travelers yearn for a seamless and cost-effective solution to manage their finances overseas. Enter the HDFC Forex Card, a revolutionary financial tool that empowers globetrotters to explore the world without the weight of currency exchange worries. This preloaded card operates on the Mastercard or Visa network, offering widespread acceptance at millions of merchants and ATMs worldwide.

Beyond its convenience, an HDFC Forex Card offers a plethora of advantages. It safeguards travelers from the vagaries of currency fluctuations, ensuring they receive the most favorable exchange rates at any given moment. The card also eliminates the risk of carrying large sums of cash, providing enhanced security and peace of mind. Additionally, it allows for easy tracking of expenses, making it an ideal companion for both business and leisure travelers.

Section 1: Identity Proof – Establishing Your Individuality

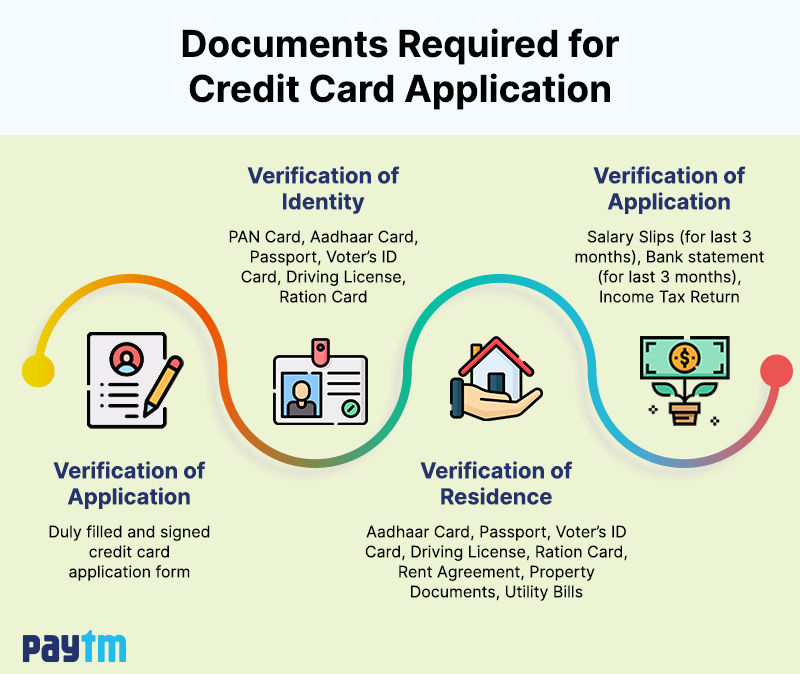

The foundation of any Forex Card application lies in establishing the applicant’s identity with clarity and precision. HDFC mandates the submission of original and self-attested copies of identity documents, each serving as a vital piece of the identity puzzle. The following documents are commonly accepted:

• Passport: An indispensable travel companion, your passport serves as the primary identity document for HDFC Forex Card applications. Ensure that the passport is valid for at least six months beyond the intended travel period.

• Voter ID Card: Issued by the Election Commission of India, the Voter ID Card carries significant weight as an identity document. Its tamper-proof nature and widespread recognition make it a reliable choice for Forex Card applications.

• Aadhaar Card: A unique 12-digit identification number issued by the Unique Identification Authority of India (UIDAI), the Aadhaar Card has revolutionized identity verification in India. Its biometric features provide an added layer of security, making it a popular identity document for financial transactions.

• Driving License: Recognized as an official identity document by various government agencies, a valid Driving License bearing the applicant’s photograph and signature is acceptable for HDFC Forex Card applications.

Section 2: Address Proof – Defining Your Place in the World

Establishing your residential address is an essential step in the HDFC Forex Card application process. HDFC requires original and self-attested copies of documents that corroborate your current place of residence. The following options are widely accepted:

• Utility Bills: These ubiquitous household bills, such as electricity, gas, or water bills, serve as reliable proof of address. Ensure that the bills are recent, within the last three months, and bear your name and current address.

• Bank Statement: A recent bank statement, preferably within the last three months, can effectively establish your residential address. It should clearly display your name, account number, and current address.

• Property Tax Receipt: For homeowners, a recent property tax receipt is an acceptable document to prove your address. It should bear your name, property address, and the corresponding tax assessment details.

• Rental Agreement: If you are a tenant, a registered rental agreement serves as valid address proof. It should clearly outline the terms of your tenancy, including the rental property address, your name, and the landlord’s details.

Image: paytm.com

Documents Required For Forex Card Hdfc

Section 3: Income Proof – Demonstrating Financial Stability

For HDFC to assess your financial credibility, it is essential to provide evidence of your income. Acceptable income proof documents vary depending on your employment status