When it comes to investing in the financial markets, understanding the nuances between stock trading and forex trading is paramount. These two distinct avenues offer unique opportunities and challenges, shaping your financial journey. Embark on this comprehensive guide as we unravel the intricacies of both stock trading and forex, empowering you to make informed decisions.

Image: www.forex.academy

Deciphering Stock Trading: A Share of Ownership

Stock trading revolves around the buying and selling of company shares, granting you partial ownership in the respective corporations. Imagine yourself as a part-owner of Apple or Microsoft, reaping the potential rewards of their success. Stock prices fluctuate based on various factors, including company performance, industry trends, and broader economic conditions. By carefully selecting stocks and navigating these dynamics, savvy investors can capitalize on market movements and build wealth over time.

Unveiling Forex: A Currency Convergence

Forex, short for foreign exchange, delves into the trade of world currencies. Unlike stock trading, forex involves exchanging one currency for another, offering a global reach that transcends national borders. Traders speculate on the fluctuations in currency values, anticipating changes influenced by economic news, geopolitical events, and central bank decisions. Currency pairs, such as EURUSD or GBPJPY, serve as the vehicles through which these transactions occur, with the potential for significant gains and losses.

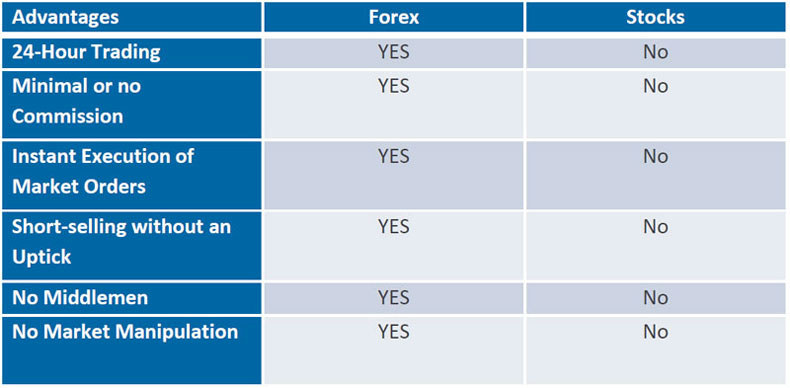

Charting the Differences: Unveiling Distinct Characteristics

-

Underlying Assets:

a. Stock trading: Company shares representing ownership in businesses.

b. Forex: Currencies from different countries.

-

Market Hours:

a. Stock trading: Typically operates during specific trading hours set by exchanges (e.g., 9:30 AM – 4:00 PM EST).

b. Forex: Open 24 hours a day, 5 days a week, spanning different time zones.

-

Risk and Reward:

a. Stock trading: Generally higher risk than forex, with potential for substantial gains and losses influenced by company-specific factors.

b. Forex: Lower risk than stocks, but leverage and high volatility can amplify both profits and losses.

-

Minimum Capital:

a. Stock trading: Can vary depending on the brokerage firm and type of stocks traded.

b. Forex: Minimal capital required to initiate trades, making it accessible to a broader range of investors.

-

Regulation:

a. Stock trading: Heavily regulated by entities like the Securities and Exchange Commission (SEC).

b. Forex: Less regulated than stocks, although regulatory frameworks vary across jurisdictions.

Embracing the Similarities: Common Ground

Despite their differences, stock trading and forex share a common thread: the pursuit of financial gain. Both require meticulous analysis, risk management, and a deep understanding of market dynamics. Successful investors leverage fundamental and technical analysis techniques, scrutinizing financial statements, economic indicators, and price charts to inform their trading decisions.

Choosing Your Path: A Matter of Goals and Risk Tolerance

The choice between stock trading and forex ultimately hinges on your individual investment goals, financial situation, and risk tolerance. For those seeking potential growth over the long term with a higher degree of risk, stock trading may be a suitable option. Conversely, if your preference leans toward short-term trading with lower risk and wider accessibility, forex trading could align better with your objectives.

Seeking Enlightenment: Resources for Education

Embarking on a journey into stock trading or forex requires a commitment to education and self-improvement. Countless resources are available to empower investors of all levels:

-

Online Courses: Platforms like Coursera and Udemy offer online courses covering the fundamentals of stock trading and forex.

-

Books and Articles: Dive into reputable books and articles from respected authors, such as “The Intelligent Investor” by Benjamin Graham or “Forex Trading for Beginners” by Kathy Lien.

-

Webinars and Seminars: Attend webinars and seminars hosted by brokers and financial institutions to gain insights and connect with industry experts.

Harnessing the Power: A Prudent Approach

Whether you navigate the world of stock trading or forex, the key to success lies in prudence and responsible investing. Always conduct thorough due diligence, invest within your financial means, and never risk more than you’re prepared to lose. Seek guidance from financial professionals when necessary, and remember that financial markets are inherently volatile, with no guarantees of profit.

In Conclusion: Unlocking Financial Freedom

As you venture into the realms of stock trading and forex, embrace a spirit of continuous learning, calculated risk-taking, and a deep understanding of your own financial goals. With dedication, vigilance, and a well-informed approach, you can unlock the potential for financial freedom and embark on a rewarding journey in the world of investments.

Image: howtotradeonforex.github.io

Difference Between Stock Trading And Forex