Introduction

In the dynamic realm of forex trading, mastering the concepts of balance and equity is pivotal to achieving financial success. Both terms, often used interchangeably, possess distinct meanings that traders must fully comprehend to navigate market fluctuations effectively. Understanding the interplay between balance and equity can empower traders to make informed decisions, manage risk prudently, and optimize their trading strategies.

Image: www.aximdaily.com

Balance and Equity Demystified

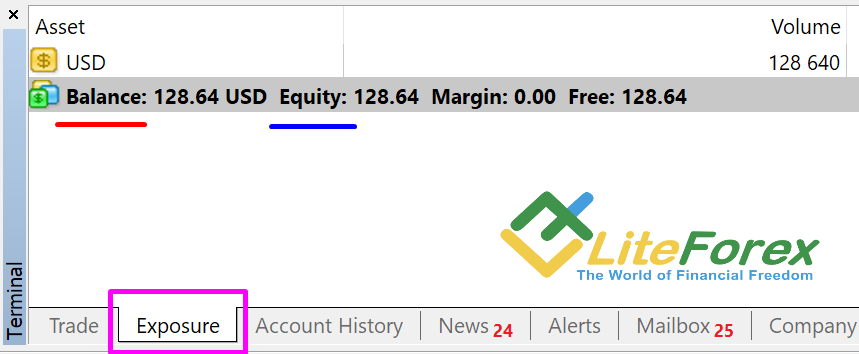

Trading balance represents the total value of a trader’s account, including both realized and unrealized profits and losses. It reflects the current financial position of the account, considering the value of open positions and the impact of market movements. In contrast, equity is the trading balance minus any outstanding margin requirements or commissions. Equity represents the amount of capital a trader has available to open or maintain positions.

Balance Dynamics in Forex Trading

The trading balance is subject to constant flux, influenced by market conditions and trading activity. When the market moves in a trader’s favor, resulting in positive unrealized gains, the balance increases. Conversely, adverse price movements lead to unrealized losses, decreasing the balance. Closed positions contribute to the balance by either increasing it with profits or decreasing it with losses.

Significance of Equity in Trading

Equity is a key indicator of a trader’s financial stability and risk tolerance. It determines the amount of capital available for further trading, including opening new positions or increasing the size of existing ones. Maintaining a healthy equity level is crucial to ensure the longevity of a trading account, as excessive drawdowns can result in margin calls or account closure.

Image: derivbinary.com

Impact of Unrealized Profit and Loss on Balance and Equity

Unrealized profit and loss (PnL) plays a significant role in shaping both balance and equity. When a trader has open positions with positive PnL, the balance increases while equity remains unchanged. Conversely, negative PnL decreases the balance but does not directly affect equity until the positions are closed.

Strategies for Managing Balance and Equity

Traders can employ various strategies to manage their balance and equity effectively:

-

Risk Management: Prudent risk management practices, such as stop-loss orders and position sizing, help mitigate losses and preserve capital.

-

Earnings Withdrawal: Retaining a portion of profits as earnings and withdrawing them from the trading account can reduce exposure to market volatility.

-

Hedging Strategies: Using hedging instruments like options can help offset potential losses in certain situations.

Conclusion

Distinguishing between balance and equity is crucial for forex traders to optimize their trading strategies and mitigate risk. By understanding the dynamics of each concept and implementing effective management techniques, traders can enhance their financial performance and achieve greater success in the dynamic currency market.

Difference Between Balance And Equity In Forex

FAQs

Q: How do I calculate my equity?

A: Equity = Trading Balance – Margin Requirements – Commissions

Q: Why is it important to monitor my balance regularly?

A: Regular monitoring of balance allows traders to track account performance and make necessary adjustments to trading strategies or risk management measures.

Q: Can I trade with a negative balance?

A: In most cases, trading with a negative balance is not permitted and may lead to account closure or margin calls.