Cracking the Code for Profitable Trades

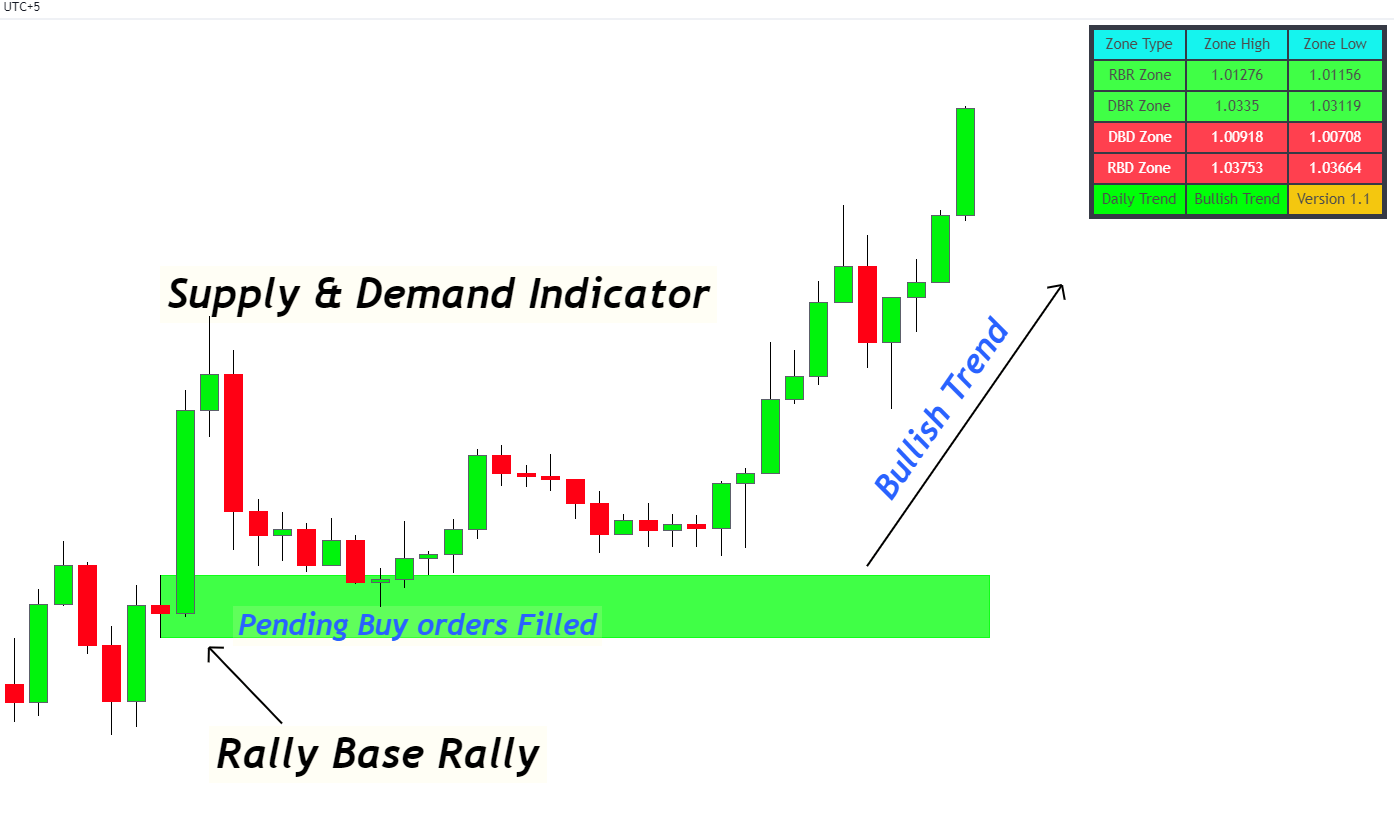

In the ever-evolving world of forex trading, understanding demand and supply zones is crucial for success. These zones represent areas of significant market activity, where the forces of buyers and sellers clash, creating potential opportunities for traders.

Image: www.dailyfx.com

Decoding Demand and Supply

A demand zone is an area where buyers are concentrated, pushing the price of a currency pair higher. Conversely, a supply zone is where sellers dominate, driving the price lower. Identifying these zones is essential for discerning the market’s underlying dynamics and uncovering potential trading setups.

Historical Significance

Demand and supply zones are formed over time as the market reacts to various factors such as economic data, news events, and geopolitical shifts. By studying historical price charts, traders can identify recurring patterns and areas where these zones tend to manifest.

Price Action as a Revelation

When the price repeatedly bounces off a specific price level, it indicates the presence of a demand or supply zone. A breakout above or below these zones confirms market momentum and often provides entry or exit points for traders.

Image: forexbee.co

Breaking Market Structure

Identifying demand and supply zones allows traders to recognize changes in market structure. A breakout above a supply zone suggests a bullish trend, while a drop below a demand zone signals a bearish shift. Understanding these structural breaks provides insights into the overall trend and potential reversals.

Confirmational Indicators for Confidence

Traders can corroborate demand and supply zone analysis with technical indicators. Support and resistance levels, moving averages, and volume patterns can provide additional confirmation for zone identification and trade validation.

Expert Advice: Mastering Zone Trading

Patience is a Virtue

Avoid jumping into trades prematurely. Allow the price to interact with the demand or supply zone multiple times to confirm its validity. Patience ensures that you enter trades at optimal levels with a higher probability of success.

Set Realistic Profit Targets

The size of your profit targets should be proportionate to the size of the demand or supply zone. Don’t be unrealistic and expect exorbitant profits from small price movements. Realistic targets preserve your capital and increase your profitability in the long run.

FAQ: Demystifying Zone Trading

Q: What is the difference between a demand and a supply zone?

A demand zone is where buyers are strong, while a supply zone is where sellers are dominant.

Q: How can I identify demand and supply zones?

Analyze historical price charts for recurring patterns and areas where price action reacts consistently.

Q: What are the best trading strategies for demand and supply zones?

Look for breakout trades, bounce trades off the zone, or wait for a confirmation break before entering.

Demand And Supply Zones In Forex

Conclusion: Embracing Market Dynamics

Demand and supply zones are invaluable tools for forex traders seeking to understand market dynamics and time their trades strategically. By incorporating the insights and expert advice provided in this article, traders can refine their zone trading skills and unlock profitable opportunities in the ever-evolving forex market.

Are you ready to embark on the journey of mastering demand and supply zone trading? Share your thoughts and queries in the comments below.