HDFC Forex Card is a prepaid card that allows you to make international payments and withdrawals conveniently. It’s a safer and more cost-effective alternative to carrying cash while traveling abroad. However, to utilize the card’s benefits, you must first activate it and track its status regularly.

Image: www.youtube.com

In this comprehensive guide, we’ll delve into the various methods to check your HDFC Forex Card status and provide valuable tips to manage your card effectively.

Methods to Check HDFC Forex Card Status

1. HDFC Bank NetBanking

- Log in to your HDFC Bank NetBanking account.

- Navigate to the “Cards” tab.

- Select “Forex Cards” and then “Enquire.”

- Enter your card number and registered mobile number.

- You’ll receive an OTP (One-time Password) on your registered mobile number.

- Enter the OTP to retrieve your card status, transaction details, and available balance.

2. HDFC Bank Mobile Banking App

- Download the HDFC Bank Mobile Banking app on your smartphone.

- Log in using your customer ID and password.

- Tap on the “Forex Cards” option.

- Select “Enquire” and enter your card number and registered mobile number.

- Enter the OTP received on your mobile number.

- You’ll find your card status, balance, and transaction history.

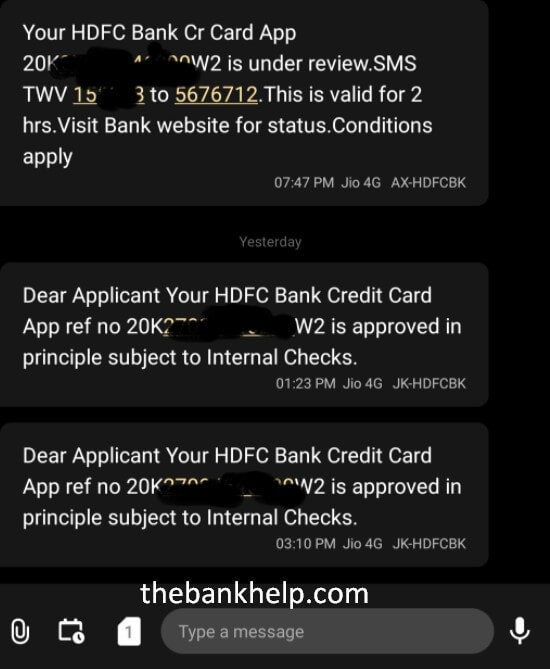

3. SMS Banking

- Send an SMS to 5676712 from your registered mobile number.

- The SMS should be in the following format: FXCBL <Last 4 digits of your card number>

- You’ll receive an SMS containing your card balance and status.

4. Phone Banking

- Call HDFC Bank’s customer care number at 1800-266-6666 or 1800-419-4334.

- Select the option for “Forex Cards.”

- Follow the prompts to provide your card details and personal information.

- The customer care representative will verify your details and provide you with your card status and other relevant information.

5. Branch Visit

- Visit your nearest HDFC Bank branch with your Forex Card and government-issued ID proof.

- Request the bank representative to check your HDFC Forex Card status.

- They will verify your details and provide you with the necessary information.

Image: thebankhelp.com

Check Hdfc Forex Card Status

Tips for Managing Your HDFC Forex Card

- Track Your Expenses: Regularly check your card status to track your expenses and avoid overspending.

- Maintain Card Security: Protect your card by setting a PIN, limiting online transactions, and reporting any suspicious activity to HDFC Bank immediately.

- Avoid Dynamic Currency Conversion: Decline the option to convert transactions at the point of sale to avoid additional charges.

- Use Chip and PIN: Always use the chip and PIN option when making payments to enhance security.

- Carry a Backup: Consider carrying a secondary payment option, such as a credit card or cash, in case your Forex Card is lost or stolen.

- Notify HDFC Bank of Your Travel Plan: Inform HDFC Bank about your travel plans to prevent any issues with card usage abroad.

- Dispute Unwanted Transactions: If you notice unauthorized transactions on your card, report them to HDFC Bank promptly to initiate a dispute.

- Use Currency Converter Tools: Utilize currency converter tools to compare exchange rates and make informed decisions while spending abroad.

By following these methods to check your HDFC Forex Card status and adhering to the management tips outlined above, you can ensure the smooth and secure use of your card during your international travels.