Introduction

In the dynamic world of finance, foreign exchange (Forex) trading has emerged as a lucrative opportunity for investors and traders alike. The Forex market, with its high liquidity and 24/7 availability, offers boundless possibilities for profit generation. However, navigating this complex market requires reliable and feature-rich tools that empower traders to make informed decisions. This comprehensive guide delves into the intricacies of building a robust Forex trading platform that caters to the evolving needs of modern-day traders.

Image: www.xtremetrading.net

From understanding the fundamental concepts of Forex trading to implementing cutting-edge technologies, this article will arm you with the knowledge and insights necessary to create a platform that stands out in the competitive landscape. Whether you’re an aspiring trader or a seasoned developer, this article is your definitive guide to building a Forex trading platform that delivers exceptional user experiences and profitable outcomes.

Main Body

Defining Forex Trading and Its Significance

Forex trading involves the buying and selling of currency pairs, such as EUR/USD or GBP/JPY. Unlike stock markets, Forex trading operates without centralized exchanges, enabling traders to access the market 24 hours a day, 5 days a week. The decentralized nature and high liquidity of the Forex market make it an attractive option for traders seeking volatility and profit potential.

Essential Components of a Forex Trading Platform

-

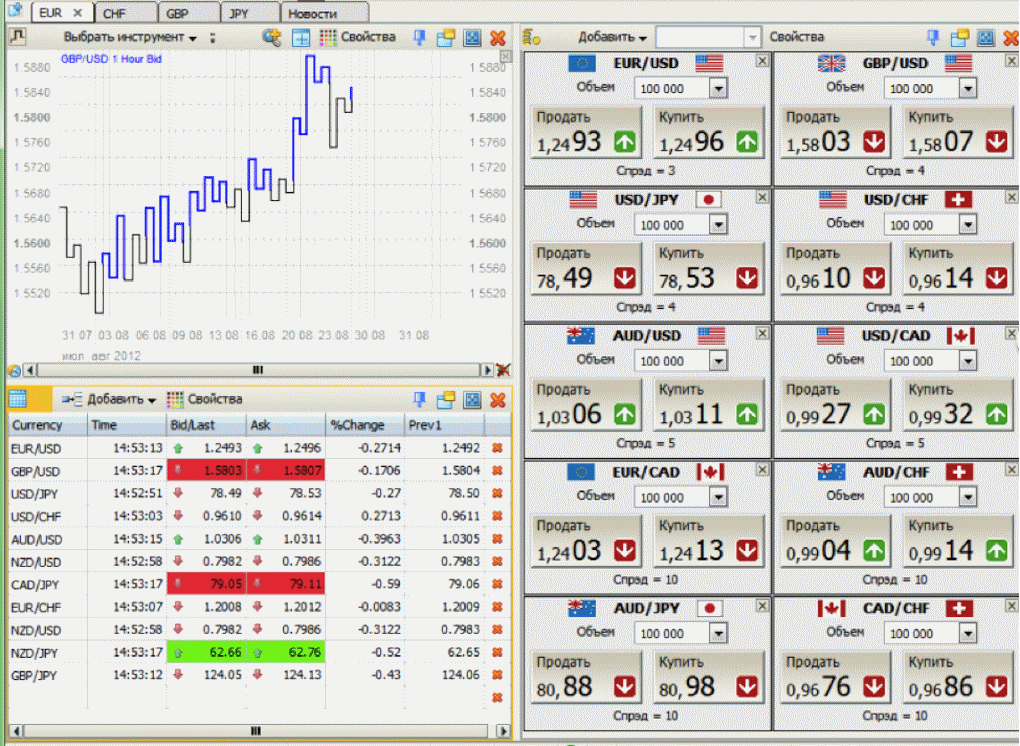

User Interface: The user interface (UI) is the gateway between the trader and the trading platform. It should be intuitive, easy to navigate, and customizable to suit individual trading preferences.

-

Trading Engine: The backbone of the trading platform, the trading engine executes trades, monitors market data, and calculates profit and loss in real-time. It should be reliable, fast, and capable of handling high trading volumes.

-

Charting and Analysis Tools: Visual representation of market data is vital for technical analysis. The platform should provide advanced charting tools, technical indicators, and drawing capabilities to aid traders in identifying trading opportunities.

-

Order Management: Efficient order management allows traders to place, modify, and cancel orders with ease. The platform should support various order types, including market orders, limit orders, and stop-loss orders.

-

Risk Management: Risk management is paramount in Forex trading. The platform should incorporate tools to manage risk effectively, such as stop-loss and take-profit orders, margin management, and risk-reward calculators.

Image: www.forex-ratings.com

Integrating Innovative Technologies

-

Artificial Intelligence (AI): AI algorithms can analyze market data, identify patterns, and generate trading signals. By incorporating AI into your trading platform, you can empower traders with predictive insights and enhance their decision-making capabilities.

-

Blockchain Technology: Blockchain provides a decentralized and secure way to record and execute trades. Integrating blockchain into your platform can enhance transparency, security, and the settlement of transactions.

-

Mobile Trading: With the rise of mobile devices, offering mobile trading capability is essential. Developing a mobile-responsive platform allows traders to access their accounts and execute trades from anywhere, at any time.

Embracing Data Analytics and Reporting

-

Performance Analytics: The ability to track and analyze trading performance is invaluable for traders. The platform should provide detailed reports that include metrics such as profit factor, win rate, and average trade duration.

-

Market Analysis: Market analysis tools can assist traders in understanding global economic factors that influence currency prices. By integrating market news, economic calendars, and geopolitical alerts, you can provide traders with the data they need to make informed decisions.

Build A Forex Trading Platform

Conclusion

Building a Forex trading platform that meets the demands of modern-day traders requires a deep understanding of market dynamics, technological advancements, and trader needs. By incorporating the principles and best practices outlined in this article, you can create a platform that empowers traders with advanced tools, seamless execution, and valuable data-driven insights. Remember, in the ever-evolving world of Forex trading, continuous innovation and user-centricity are the keys to