In the realm of foreign exchange (forex), precision and timing are paramount. Understanding the intricate interplay between bid and offer rates empowers traders to make informed decisions that can impact their trading success. This in-depth analysis will delve into these pivotal concepts, clarifying their significance and equipping you with practical insights for navigating the complexities of forex trading.

Image: www.youtube.com

Unveiling the Bid Rate

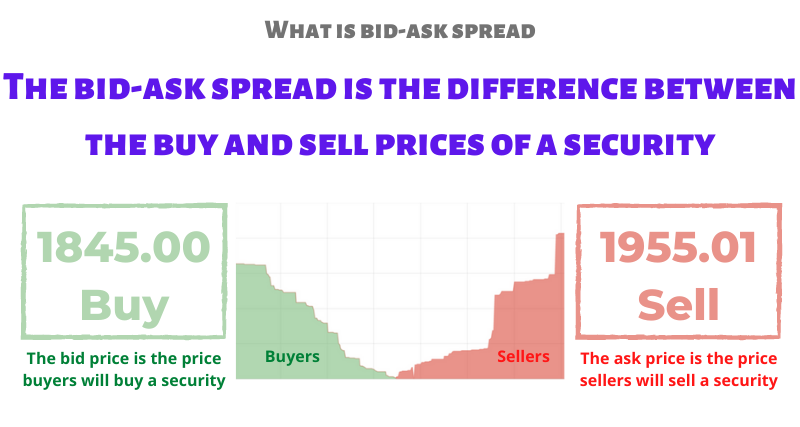

The bid rate represents the price at which a market maker or financial institution is willing to buy a particular currency pair from a trader. It reflects the lowest price at which the trader can sell their currency. The bid rate is typically displayed on trading platforms as “Bid.”

Deciphering the Offer Rate

Contrasting the bid rate, the offer rate denotes the price at which a market maker is ready to sell a currency pair to a trader. This represents the lowest price at which a trader can purchase the desired currency. Trading platforms display the offer rate as “Ask” or “Offer.”

The Spread: A Bridge Between Bid and Offer

The gap between the bid and offer rates is known as the spread. It constitutes the market maker’s profit or commission for facilitating the currency exchange. A narrower spread generally signifies lower transaction costs and greater liquidity in the market.

Image: seventrading.net

Influencing Factors: Unveiling the Determinants of Bid and Offer Rates

Numerous factors contribute to the constant fluctuation of bid and offer rates in the forex market:

- Economic news and data

- Political events and instability

- Central bank decisions

- Supply and demand

- Market sentiment

Bid and Offer Rates in Practice: Strategies for Success

Understanding how bid and offer rates interplay is crucial for effective forex trading. Here are key strategies to enhance your trading acumen:

-

Trading the Spread: Capitalize on the difference between bid and offer rates by buying at the bid price and selling at the offer price.

-

Market Orders: Execute trades instantly at the prevailing bid or offer rate to avoid potential slippage.

-

Limit Orders: Set specific buy or sell prices to execute trades only when the market reaches your desired levels.

-

Monitoring Market Depth: Analyze market depth to gauge the availability of buyers and sellers at different price levels.

Bid Rate And Offer Rate In Forex

Beyond Theory: Practical Tips for Utilizing Bid and Offer Rates

Maximize your forex trading potential by implementing these practical tips:

-

Identify Trends: Study bid and offer rate movements over time to discern market trends and anticipate future price movements.

-

Choose the Right Currency Pairs: Focus on currency pairs with higher liquidity and tighter spreads for optimal trading conditions.

-

Utilize Technology: Leverage online platforms and trading tools to monitor bid and offer rates in real-time and make informed decisions.

-

Embrace Patience and Discipline: Avoid impulsive trading decisions and adhere to a well-defined trading plan based on a thorough understanding of bid and offer rates.

Remember, mastering the nuances of bid and offer rates in forex trading empowers you to navigate market complexities with confidence. Through diligent research, strategic planning, and disciplined execution, you can unlock the full potential of the forex market.