As a fledgling forex enthusiast, I recall the confusion I faced when encountering the terms “bid” and “ask” rates. Their significance in determining market conditions perplexed me, until I stumbled upon a seasoned trader who illuminated their intricacies. This article unravels the complexities of bid and ask rates, equipping you with a comprehensive understanding of their role in the forex arena.

Image: www.investing.com

Market Dynamics: Unveiling Bid and Ask

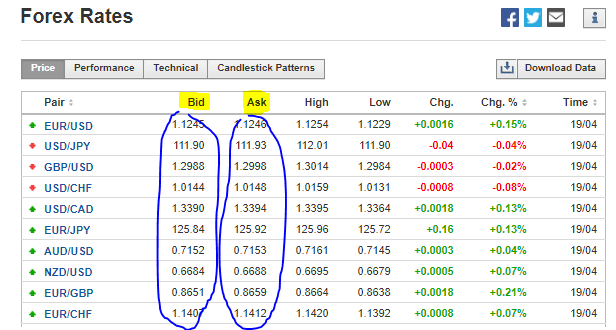

In currency trading, every transaction involves two prices: the bid price and the ask price. The bid price, denoted as “BID” or “sell price,” represents the rate at which a currency pair can be sold to a market maker (e.g., broker or bank). Conversely, the ask price, labeled as “ASK” or “buy price,” indicates the rate at which the currency pair can be purchased from a market maker.

The spread, often depicted as “bid-ask spread,” reflects the difference between the bid and ask prices. This spread represents the cost of transacting in the forex market, encompassing the profit margin for market makers and the liquidity of the currency pair.

Importance of Bid and Ask Rates

Understanding bid and ask rates is paramount for forex traders as it provides insights into market conditions and trading opportunities. Lower bid-ask spreads denote higher liquidity, attracting traders who seek swift executions at competitive rates. Conversely, wider spreads tend to hinder trading, leading to increased transaction costs and potential losses.

Moreover, bid and ask rates can indicate market sentiment and price direction. An expanding spread can signal market uncertainty or volatility, while a narrowing spread often implies increased trading activity and a clearer market trend.

Trends and Developments in the Forex Market

The forex market is constantly evolving, driven by economic policies, geopolitical events, and technological advancements. One significant trend includes the rise of electronic trading platforms (ETPs), which have increased access to the forex market for individual traders. ETPs provide real-time bid and ask quotes, facilitating efficient order execution.

Another noteworthy development is the emergence of mobile trading applications. These apps offer traders the convenience of accessing the market from their smartphones or tablets, enabling them to monitor bid and ask rates and execute trades on the go.

Image: www.youtube.com

Tips and Advice for Traders

Based on my experience, I’ve compiled some valuable tips for navigating the intricacies of bid and ask rates:

- Monitor Spreads: Keep an eye on bid-ask spreads, especially during volatile market conditions. Tight spreads offer opportunities for profitable trades, while excessive spreads can eat into your returns.

- Choose Low-Spread Currency Pairs: Opt for currency pairs with consistently low spreads to minimize transaction costs and enhance profitability.

- Capitalize on Market News: Stay informed about economic and political events that can influence bid and ask rates. Timely execution of trades can yield positive results.

- Utilize Order Types: Consider employing limit orders to enter trades at specific bid or ask prices, ensuring execution at favorable rates when the market reaches your desired levels.

- Consider Hedging Strategies: Hedging techniques, such as using opposite positions in different currency pairs, can mitigate the impact of fluctuating bid and ask rates.

Frequently Asked Questions

Q: What factors influence bid and ask rates?

A: Bid and ask rates are shaped by supply and demand, economic data, political events, and market sentiment.

Q: How can I stay updated on bid and ask rates?

A: Forex trading platforms and mobile apps provide real-time bid and ask quotes, allowing traders to monitor market fluctuations effectively.

Q: Is it possible to profit from bid and ask rates?

A: Yes, traders can capitalize on bid and ask rates by identifying price discrepancies, utilizing arbitrage strategies, and executing trades at advantageous levels.

Bid And Ask Rate In Forex

Conclusion

Bid and ask rates are fundamental concepts in forex trading, providing invaluable information about market conditions and trading opportunities. By comprehending these rates, traders can make informed decisions, minimize costs, and maximize profits in the dynamic forex market. I encourage you to delve deeper into the fascinating world of bid and ask rates and explore its potential to enhance your trading prowess.