In the pulsating veins of the foreign exchange (forex) market, where currencies dance in a ceaseless ballet, two terms reign supreme: bid and ask. These are not mere words; they are the pulse of every transaction, the heartbeat of forex trading.

Image: beforedusk.com

Understanding the Bid and Ask: The Currency Tango

When you delve into the forex market, you will encounter currency pairs. For instance, EUR/USD represents the exchange rate between the Euro (EUR) and the US Dollar (USD). In this pair, the EUR is bid, meaning someone is willing to buy it, while the USD is asked, indicating someone is willing to sell it.

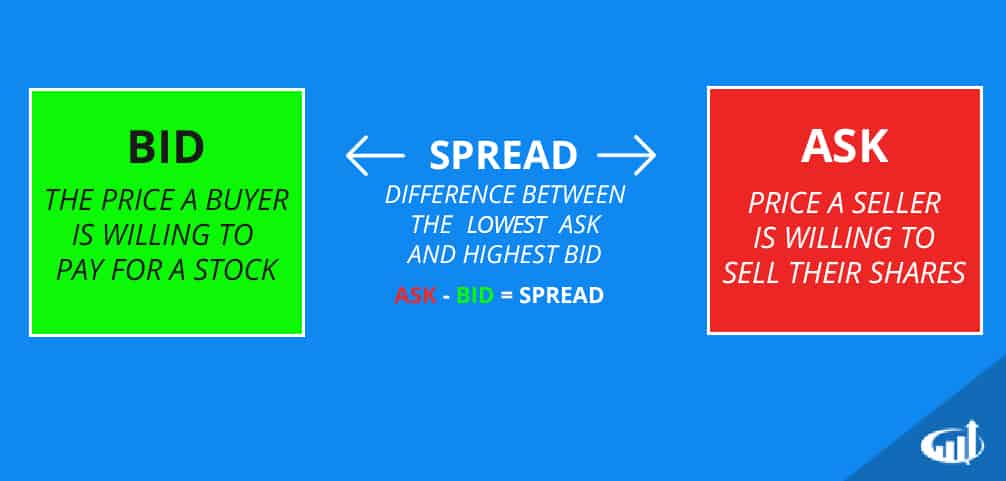

The bid price is the maximum amount a currency buyer is willing to pay for the asked currency. Conversely, the ask price is the minimum amount a currency seller demands for the bid currency. The difference between the bid and ask, known as the spread, is the profit margin for the broker facilitating the transaction.

The Bid-Ask Spread: A Gateway to Opportunity

The bid-ask spread is not a fixed entity; it fluctuates constantly. This dynamic dance is driven by various factors, including market liquidity, news events, economic data, and global events. Understanding how the spread behaves can open up a realm of opportunities.

When the spread is narrow, it indicates high liquidity and a more efficient market. This is akin to a well-oiled machine, facilitating smooth and cost-effective trades. On the other hand, a wide spread often signals lower liquidity, which can create challenges for traders.

Mastering the Art of Speculating: The Bid-Ask Dance

Seasoned forex traders treat the bid-ask spread as a tapestry woven with opportunities. By paying close attention to its movements, they can speculate on future price fluctuations. When the bid price rises or the ask price falls, it may signal a potential opportunity to buy or sell.

However, this dance can be exhilarating and perilous. Before you venture into the forex market’s embrace, equip yourself with knowledge and a sound trading strategy. Understanding the bid and ask will be your compass, guiding you through the market’s ever-changing landscape.

Image: events.mirposadhotel.by

Navigating the Forex Market: Expert Insights

“The bid-ask spread is not just a cost; it’s your window into market sentiment,” says Darius Weber, a renowned forex expert with decades of experience. “Watching the spread closely can give you valuable insights into how other traders are thinking and positioning themselves.”

Marie Moreau, another leading figure in the industry, emphasizes the need for caution. “The forex market is unforgiving,” she warns. “Never enter a trade without understanding the bid-ask spread and how it can impact your profitability.”

Trading with Bid and Ask: A Strategic Approach

Understanding bid and ask is not merely academic; it is the foundation for effective trading. When you execute a trade, you are essentially buying or selling currencies at the bid or ask price.

If you correctly predict that the currency you bought will rise in value, you can sell it for a profit at a higher ask price. Conversely, if your prediction proved incorrect, you may have to sell at a loss at a lower bid price.

The nuances of bid and ask are not just jargon; they are the tools with which traders craft their fortune. By mastering these concepts and applying them strategically, you can elevate your trading game and seize opportunities amidst the market’s relentless ebb and flow.

Bid And Ask In Forex Trading

Conclusion: The Pulse of the Forex Market

Bid and ask are not mere technical terms; they are the heart and soul of forex trading. Understanding these concepts empowers traders to make informed decisions, navigate market dynamics, and leverage profit-making opportunities.

Remember, the bid is the heartbeat of buying, while the ask is the pulse of selling. By grasping the interplay between these two forces, you can unlock the mysteries of the forex market and dance gracefully to its rhythm.