As the cosmopolitan heart of Southeast Asia, Singapore has emerged as a thriving hub for forex trading. With its robust financial infrastructure and strategic location, the city-state offers a dynamic marketplace for currency traders. However, timing is everything when it comes to forex trading, and Singapore’s unique time zone presents both opportunities and challenges.

Image: blog.moneysmart.sg

In this comprehensive guide, we’ll delve into the intricacies of the forex market in Singapore, exploring the best trading hours, historical performance data, and expert insights to help you maximize your profits.

Capitalizing on the Singapore Forex Trading Window

Singapore’s forex market operates from 5:30 am to midnight Singapore Time (SGT), aligning with the global forex market’s daily cycle. However, certain trading sessions present optimal conditions for profitability.

“The early bird truly gets the worm in Singapore’s forex market. The overlap with the London session, from 5:30 am to 1 pm SGT, presents abundant liquidity and market volatility.” – Marcus Loh, Senior FX Trader at DBS Bank

The London session is known for its high trading volume and significant price movements, making it an ideal time for traders seeking fast-paced action. The Asian session, from 12 am to 4 pm SGT, also offers opportunities for traders due to the release of important economic data from major Asian economies like China and Japan.

Historical Trends and Market Analysis

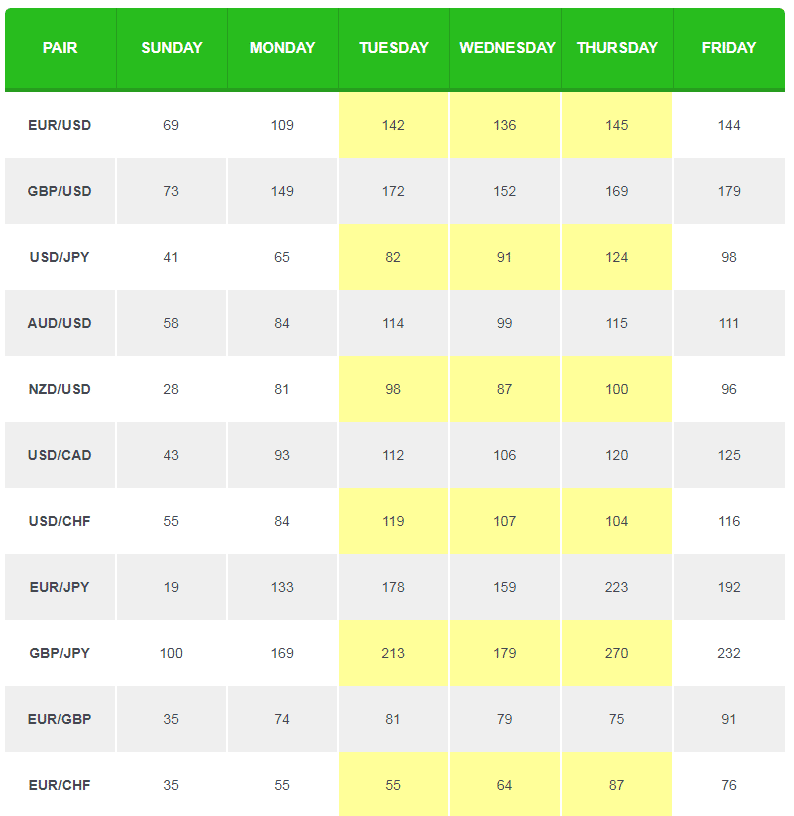

Historical data reveals that the most profitable trading hours in Singapore fall within the London overlap session. This is because the confluence of major currency pairs, including EUR/USD, GBP/USD, and USD/JPY, creates ample market liquidity and trading opportunities.

According to a study conducted by FXTM, a leading online forex broker, the average daily range (ADR) for EUR/USD reached its peak during the London-Singapore overlap session, with a significant increase in volatility and trading volume. This surge in market activity presents lucrative opportunities for scalpers and day traders.

Expert Tips and Strategies for Success

To maximize your trading potential in Singapore’s forex market, experienced traders recommend adopting the following strategies:

- Focus on major currency pairs: During the London-Singapore overlap, trade highly liquid currency pairs like EUR/USD and GBP/USD for maximum liquidity and profit potential.

- Analyze economic data: Stay informed about global economic news and events, as market volatility often coincides with the release of important economic data.

- Implement technical analysis: Utilize technical indicators, such as moving averages and support/resistance levels, to identify trading opportunities and make informed decisions.

- Manage risk effectively: Set appropriate stop-loss and take-profit orders to limit your potential losses and secure your profits.

By adhering to these expert tips, you can increase your chances of successful trading in Singapore’s forex market.

Image: www.tradingwithrayner.com

FAQs on Forex Trading in Singapore

- What is the best trading platform in Singapore?

Several reputable forex brokers offer trading platforms in Singapore, including MetaTrader 4, MetaTrader 5, and cTrader.

- Is forex trading legal in Singapore?

Yes, forex trading is legal in Singapore and regulated by the Monetary Authority of Singapore (MAS).

- What is the minimum deposit required to start trading forex in Singapore?

The minimum deposit requirement varies depending on the forex broker; typically, it ranges from SGD 100 to SGD 1,000.

- How much can I earn from forex trading in Singapore?

The potential earnings from forex trading in Singapore can vary significantly depending on your trading strategy, market conditions, and risk tolerance.

Best Time To Trade Forex In Singapore

Conclusion

The best time to trade forex in Singapore is during the London-Singapore overlap session, from 5:30 am to 1 pm SGT. This period offers exceptional liquidity, market volatility, and ample profit potential. By leveraging historical data, expert strategies, and sound risk management, traders can optimize their trading experience in Singapore’s dynamic forex market.

Remember, forex trading involves both rewards and risks. If you’re considering this pursuit, it’s crucial to thoroughly research the market, understand the risks involved, and seek professional guidance if needed.