In the tumultuous world of foreign exchange trading, selecting the right type of brokerage firm is paramount. Navigating this complex landscape requires an understanding of the nuances that differentiate dealing desk and non-dealing desk (NDD) forex brokers. This article will delve into the intricacies of NDD forex brokers, highlighting their advantages and guiding you toward making an informed decision that will empower your trading journey.

Image: www.pinterest.fr

What Distinguishes Non-Dealing Desk Forex Brokers?

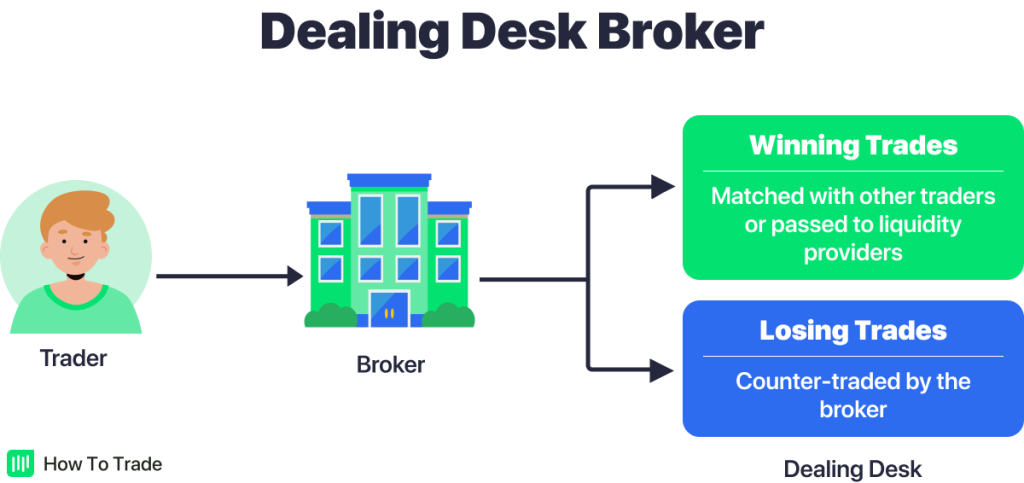

Unlike dealing desk brokers, NDD brokers do not assume the opposite side of your trades. They act solely as intermediaries, bridging the gap between traders and liquidity providers. This fundamental distinction translates into a conflict-free trading environment, ensuring that your interests are always prioritized. NDD brokers facilitate direct access to the interbank market, providing you with competitive spreads and real-time execution.

Benefits of Trading with Non-Dealing Desk Forex Brokers:

-

Transparency and Fairness: NDD brokers eliminate the potential for conflicts of interest by not trading against their clients. This transparency fosters trust and ensures that your trading decisions are solely driven by market forces, not the broker’s agenda.

-

Superior Execution: By connecting directly to liquidity providers, NDD brokers bypass the potential for requotes and slippage, ensuring that your orders are executed at the best available prices. This enhances your trading efficiency and minimizes losses due to unfavorable execution.

-

Competitive Pricing: NDD brokers typically offer tighter spreads and lower commissions compared to dealing desk brokers. As they do not assume the risk of your trades, they can pass on the savings to you, reducing your trading costs and maximizing your profitability.

-

Objective Market Analysis: NDD brokers are not incentivized to sway your trading decisions. They provide unbiased market analysis and educational resources to empower traders with the knowledge they need to make informed choices.

How to Identify a True Non-Dealing Desk Forex Broker:

-

STP (Straight-Through Processing): Opt for brokers that utilize STP, which ensures that your orders are directly executed to the interbank market without any manual intervention or desk trading.

-

ECN (Electronic Communication Networks): Brokers connected to ECNs offer access to a vast pool of liquidity providers, resulting in tighter spreads and faster execution.

-

Transparent Pricing: Genuine NDD brokers clearly disclose their spreads and commissions upfront, avoiding hidden fees and ensuring cost transparency.

-

Independent Verification: Seek brokers that have been independently audited and certified by reputable third-party organizations, confirming their compliance with NDD principles.

Conclusion:

Choosing a NDD forex broker is a crucial step toward enhancing your trading experience and achieving long-term success. By embracing the transparency, fairness, and superior execution offered by NDD brokers, you empower yourself to navigate the forex market with confidence and maximize your trading potential. Conduct thorough research, carefully evaluate each broker’s offerings, and select the one that aligns best with your trading objectives. The world of NDD forex trading awaits, promising a rewarding journey where your every trade is fueled by integrity and accountability.

Image: howtotrade.com

Best Non Dealing Desk Forex Broker