Image: forexinfobotindicator.blogspot.com

A Moving Guide to Conquer the Forex Markets

In the high-stakes arena of forex trading, where volatility reigns supreme, finding a reliable technical indicator to guide your decisions is paramount. Amidst the plethora of technical tools available, the moving average (MA) stands tall as a time-honored and versatile tool that can empower traders to make informed decisions and maximize their profit potential.

What is a Moving Average?

A moving average is a technical indicator that calculates the average price of a security over a specified period. By smoothing out price fluctuations, the MA reveals market trends more clearly and helps traders identify potential trading opportunities.

Types of Moving Averages

There are several types of moving averages, each with its unique characteristics and applications. The most commonly used types are:

- Simple Moving Average (SMA): The SMA simply averages all the prices over the specified period.

- Exponential Moving Average (EMA): The EMA places more weight on recent prices, making it more responsive to price changes.

- Weighted Moving Average (WMA): The WMA assigns different weights to prices based on their proximity to the current price, giving more importance to recent prices.

Image: www.youtube.com

Choosing the Right Moving Average for Forex Trading

The choice of the best moving average for forex trading depends on the trader’s trading style and time horizon:

- Short-Term Traders: EMA (10-30 periods) or WMA (10-20 periods) are suitable for traders looking to capitalize on short-term price movements.

- Trend Followers: SMA (50-200 periods) is preferred for traders aiming to ride long-term trends and identify major turning points.

- Swing Traders: The EMA (100-200 periods) strikes a balance between responsiveness and noise filtering, making it ideal for swing traders looking to capture mid-term trends.

Trading Strategies with Moving Averages

Trend Identification: Moving averages can help identify bullish or bearish trends. An upward trend occurs when the prices are consistently above the MA, while a downward trend indicates prices below the MA.

Support and Resistance Levels: When a MA holds as support (on the upside) or resistance (on the downside), it can provide valuable insights into potential trading opportunities.

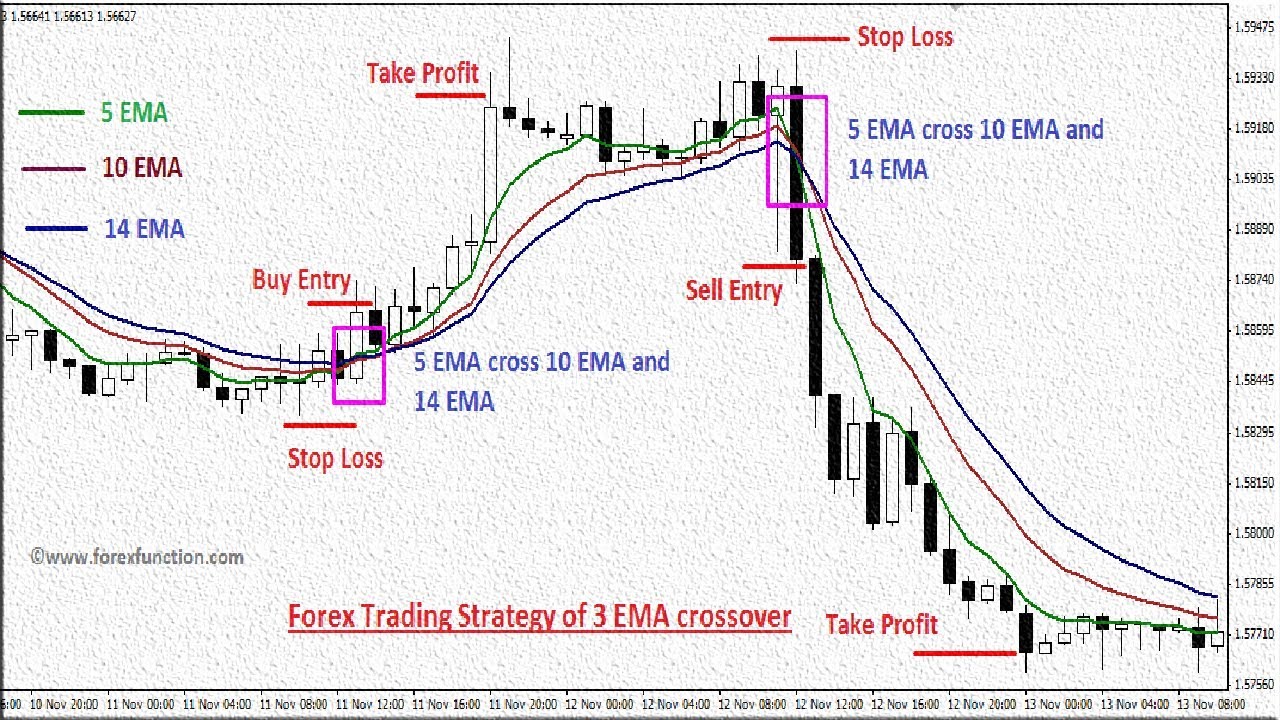

Trading Signal Generation: Crossovers of moving averages can generate trading signals. For example, when a shorter-term MA crosses above a longer-term MA, it can indicate a potential buy signal.

Improving Risk Management: Moving averages can also enhance risk management strategies. By setting stop-loss orders below a critical moving average, traders can limit their potential losses in case of unfavorable price action.

Best Moving Average For Forex Trading

Leveraging Moving Averages in Your Forex Trading

By employing moving averages strategically, traders can gain a deeper understanding of market trends, identify profitable trading opportunities, and manage their risks more effectively. Remember, the key lies in choosing the appropriate MA based on your trading style and pairing it with sound market analysis.

Empower yourself with the knowledge of moving averages and unlock the potential for trading success in the dynamic forex markets. As you embark on this journey, keep refining your trading strategies, embracing learning and adapting to the ever-changing market landscape. The rewards of disciplined trading await you on the horizon.

Disclaimer: Trading involves substantial risk of loss and is not suitable for all investors. Before trading, carefully consider your investment objectives, level of experience, and risk tolerance. Past performance is not indicative of future results. Always consult with a qualified financial advisor to determine if trading is right for you.