Introduction

In the dynamic world of forex trading, technical analysis plays a pivotal role in unraveling market trends and seizing profitable opportunities. Among the myriad of indicators available, moving averages (MAs) stand out as a versatile tool, offering traders a straightforward and effective way to identify trading setups. By combining multiple MAs, traders can craft crossover strategies that can enhance their decision-making process and potentially lead to substantial gains.

Image: www.pinterest.co.uk

Understanding Moving Averages

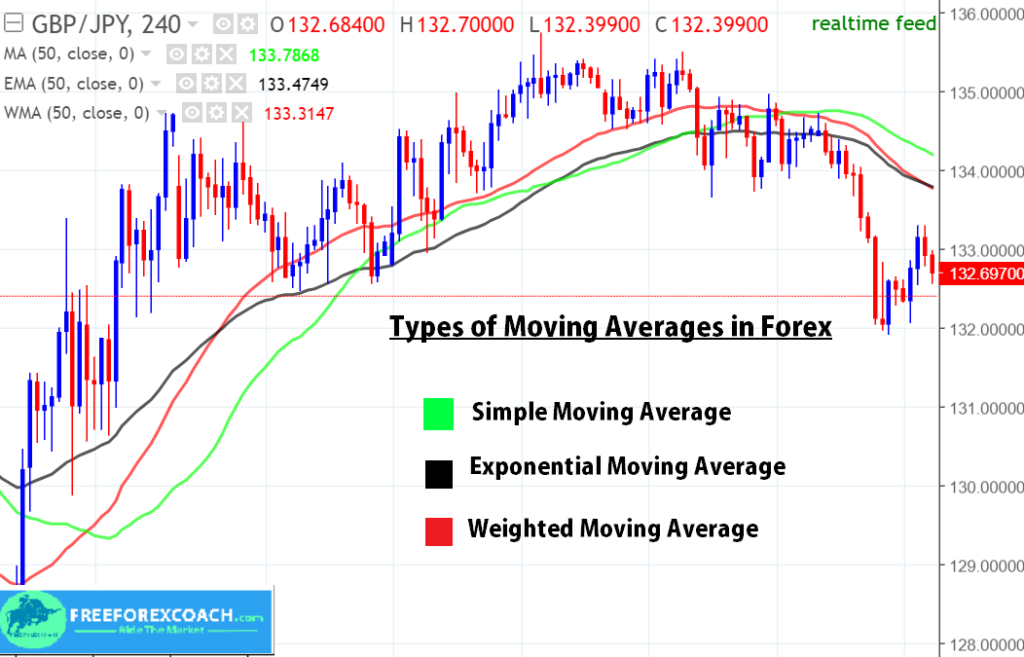

A moving average is a technical indicator that smooths out price fluctuations by calculating the average of closing prices over a specified period. The most commonly used MAs are simple moving averages (SMAs) and exponential moving averages (EMAs), which assign different weights to past closing prices. By visually overlaying one or more MAs on a price chart, traders can gain insights into the overall trend and potential reversal points.

The Essence of Crossover Strategies

Crossover strategies capitalize on the intersection of two or more MAs to detect potential trend changes. When a shorter-term MA crosses above a longer-term MA, it typically signals an uptrend, indicating that buyers are gaining momentum. Conversely, when a shorter-term MA crosses below a longer-term MA, it suggests a downtrend, hinting at the strengthening of selling pressure.

Choosing the Optimal MA Pair

The effectiveness of a crossover strategy hinges on the judicious selection of the MA pair. The rationale behind this is to balance sensitivity and reliability. Shorter-term MAs, such as the 5-period or 10-period MA, react swiftly to price changes, making them more sensitive to short-term trends but also more prone to false signals. Conversely, longer-term MAs, such as the 50-period or 200-period MA, provide a more accurate depiction of the prevailing trend but may be slower to capture intraday moves.

Image: freeforexcoach.com

Confirmatory Indicators Enhance Accuracy

While crossover strategies can provide valuable signals, incorporating additional technical indicators can bolster their accuracy and minimize false positives. Relative strength index (RSI), stochastic oscillator, and moving average convergence divergence (MACD) are popular indicators that can be employed to corroborate crossover signals. A convergence of signals from multiple indicators enhances confidence in the projected trend.

Risk Management: A Cornerstone of Success

Effective forex trading necessitates a firm grasp of risk management principles. Market volatility and unexpected price movements are inherent features of forex trading. Employing stop-loss orders or implementing position sizing strategies can help traders mitigate potential losses while preserving capital. Disciplined risk management practices are paramount to long-term profitability.

Psychology in Trading: Mastering the Mind

The psychological aspects of trading play a crucial role in achieving consistent profits. Emotional biases, impatience, and greed can cloud judgment and lead to poor decision-making. Developing psychological resilience, practicing patience, and implementing trading strategies that align with one’s temperament can empower traders to overcome these challenges.

Best Moving Average Crossover Strategy Forex

https://youtube.com/watch?v=235nioN_8gE

Conclusion

Comprehending the principles and techniques of moving average crossover strategies is an invaluable asset for forex traders. By carefully selecting the appropriate MA pair, incorporating confirmatory indicators, and prioritizing risk management, traders can improve their trading performance and capitalize on market opportunities. Yet, it is essential to remember that no strategy is foolproof, and continuous learning and adaptation remain indispensable traits for success in the ever-evolving forex market. Embracing the intricate interplay between technical analysis, psychology, and risk management can unlock the full potential of crossover strategies and pave the way towards consistent forex profits.