Introduction:

Step into the captivating world of intraday forex trading, where adrenaline meets calculated strategies. With a daily turnover exceeding $5 trillion, forex trading presents an unparalleled opportunity for traders to capitalize on currency fluctuations. Intraday trading, the art of entering and exiting trades within a single trading day, demands a keen eye, lightning-fast reflexes, and a mastery of proven strategies. In this comprehensive guide, we will delve into the intricacies of intraday forex trading, arming you with the knowledge and tools necessary to navigate this dynamic market and emerge as a successful trader.

Chapter 1: The Basics of Intraday Forex Trading

Before embarking on your intraday trading journey, it is imperative to establish a solid foundation. This chapter will lay the groundwork, defining key concepts and introducing the fundamental principles that govern intraday forex trading. We will explore currency pairs, bid-ask spreads, and the various order types at your disposal. Furthermore, you will gain insights into the different types of intraday trading strategies, equipping you with the knowledge to tailor your approach to your unique trading style and risk tolerance.

Chapter 2: Technical Analysis for Intraday Forex Traders

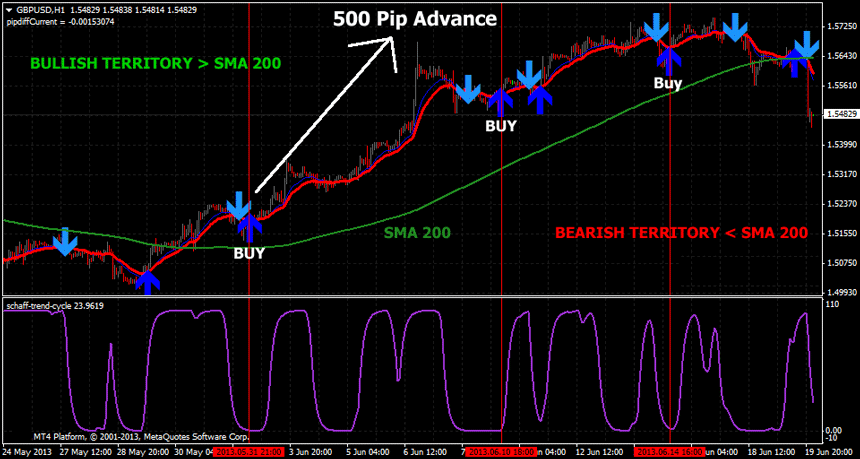

Technical analysis, the art of deciphering price charts to identify trading opportunities, plays a pivotal role in intraday forex trading. Chapter 2 will provide you with a comprehensive toolbox of technical indicators and chart patterns. You will learn how to use moving averages, Bollinger Bands, and MACD to gauge market momentum and identify potential trend reversals. We will also delve into candlestick charting, a powerful visual representation of price action that can reveal valuable insights into trader sentiment and market psychology.

Chapter 3: Fundamental Analysis for Intraday Forex Traders

While technical analysis focuses on price action, fundamental analysis examines economic and political events that can influence currency valuations. In this chapter, we will explore key economic indicators, such as GDP, inflation, and interest rates, and discuss how they can impact forex market dynamics. You will also learn how to analyze geopolitical events and central bank announcements to anticipate market movements and make informed trading decisions.

Chapter 4: Risk Management for Intraday Forex Traders

Managing risk is the cornerstone of successful intraday forex trading. Chapter 4 will equip you with a comprehensive suite of risk management strategies. We will discuss stop-loss orders, take-profit orders, and position sizing to limit potential losses and protect your trading capital. You will also learn about the importance of risk-reward ratios and how to calculate them to ensure your trades have a favorable risk-to-reward profile.

Chapter 5: Psychology of Intraday Forex Trading

The psychological aspect of trading often goes overlooked, yet it is just as critical as technical and fundamental analysis. Chapter 5 will delve into the psychology of intraday forex trading, exploring the emotions and biases that can cloud your judgment. We will discuss FOMO (fear of missing out), overtrading, and the importance of maintaining a clear and disciplined trading mindset. Understanding and managing your emotions will give you a significant edge in the fast-paced and emotionally charged world of intraday forex trading.

Chapter 6: Trading Strategies for Intraday Forex Traders

Now that you have a solid foundation in the basics of intraday forex trading, it is time to explore specific trading strategies. Chapter 6 will present a wide range of strategies, from scalping and day trading to trend following and range trading. We will discuss the pros and cons of each strategy, providing you with the tools to select the approach that best aligns with your trading style and risk tolerance. Real-world examples and case studies will help you visualize how these strategies are applied in practice.

Chapter 7: Trading Tools and Resources for Intraday Forex Traders

In today’s digital age, traders have access to a wealth of trading tools and resources. Chapter 7 will introduce you to charting platforms, technical analysis software, and trading simulators. We will review the features and benefits of each tool, empowering you to create a customized trading toolkit that meets your specific needs. You will also learn about online trading communities and educational resources where you can connect with fellow traders and expand your knowledge.

Chapter 8: Conclusion: Embarking on Your Intraday Forex Trading Journey

As you conclude this comprehensive guide, you are now armed with the knowledge, strategies, and tools necessary to embark on your intraday forex trading journey with confidence. Remember, successful trading is not just about applying fancy indicators or complex strategies but about developing a holistic approach that encompasses technical analysis, fundamental analysis, risk management

Image: boomingbulls.com

Image: www.fxchief-indonesia.com

Best Intraday Forex Trading Strategy