Are you an aspiring Forex trader looking to maximize your earnings? Knowing the best time to trade can significantly boost your chances of success. Forex, the world’s largest financial market, offers ample opportunities for traders willing to study its dynamic nature and capitalize on market movements. This article unveils the optimal days for Forex trading, empowering you with knowledge that can elevate your trading performance.

Image: admiralmarkets.com

Unveiling the Best Days for Trading Success

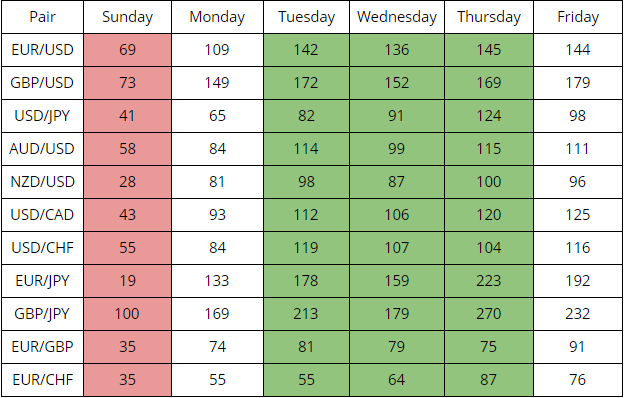

Navigating the complexities of the Forex market requires an understanding of its weekly cycle. While Forex trading is possible throughout the week, certain days present more favorable conditions for profitability. Let’s delve into the best days to trade:

Mondays: A Fresh Start with Volatility

Mondays often witness elevated volatility due to the opening of major markets after the weekend break. As institutions and traders adjust their positions, trends tend to be more pronounced, creating potential trading opportunities. The initial hours of Monday morning offer a volatile environment for those comfortable with short-term trades.

Tuesdays: Continuation and Consolidation

Tuesdays typically experience a continuation of the trends established on Monday. Market participants analyze weekend news and economic data, further solidifying positions and contributing to the stability of market movements. This stability can provide opportunities for swing traders and those employing longer-term trading strategies.

Image: taniforex.com

Wednesdays: Equal Balance, Equal Opportunity

The middle of the week brings balanced market conditions on Wednesdays. Volatility tends to moderate, offering opportunities for both mean-reverting trades and trend-following strategies. This day’s stability makes it suitable for traders seeking moderate risk and steady gains.

Thursdays: Momentum and News Flow

Thursdays bring a resurgence of volatility as the market approaches the end of the week. Major economic announcements, such as interest rate decisions and GDP reports, often occur on Thursdays, injecting the market with heightened price fluctuations. News-driven trading strategies can thrive during these periods, offering opportunities for short-term traders.

Fridays: Cautious Trading and Early Closures

Fridays signal the winding down of the trading week, often resulting in a more cautious and subdued market. Reduced liquidity and shortened trading hours can lead to choppier market conditions. Friday afternoon trading is often characterized by low volume and higher volatility, making it less suitable for inexperienced traders.

Choose Your Weapon: Tailoring Strategies to Day Profiles

The optimal Forex trading strategy depends on individual risk tolerance and trading goals. Here’s how to align your strategy with the best trading days:

Scalpers and Day Traders: Monday Momentum

High volatility on Mondays favors scalpers and day traders looking for quick profits from small price movements. Short-term trading strategies aimed at capturing intraday fluctuations can thrive in the initial hours of Monday trading.

Swing Traders: Tuesday-Wednesday Stability

Swing traders, who hold positions for several days to weeks, find stability in Tuesday’s and Wednesday’s market conditions. They can identify and exploit trends that develop during these periods.

Position Traders: Wednesday-Thursday Balance

Position traders, with longer-term horizons, can benefit from the balance and consolidation that characterize Wednesday and Thursday trading. They can establish and maintain positions during these periods, taking advantage of gradual market shifts.

News Traders: Thursday Action

News traders, seeking volatility in response to economic announcements, should focus on Thursdays. They can anticipate market reactions to news and execute trades accordingly.

Best Days For Forex Trading

Embrace the Power of Knowledge

Understanding the best days for Forex trading is a crucial step toward successful outcomes. By aligning your trading strategies with the unique opportunities each day presents, you can maximize your potential profits. Remember, knowledge is power in the Forex market. Use it to your advantage and conquer every trading week.