Navigating the complex world of forex trading can be daunting, especially for those seeking the most lucrative opportunities. Selecting the right currency pairs can significantly impact your trading success, influencing your profit margin and risk management strategies.

Image: www.audacitycapital.co.uk

Unlocking the Secrets: Understanding Currency Pairs

A currency pair represents the exchange rate between two currencies. In the forex market, traders speculate on the fluctuation of these rates, buying and selling currencies to profit from price movements. The choice of currency pairs depends on factors such as liquidity, volatility, and correlation.

Liquidity: A Trader’s Lifeline

Liquidity in currency pairs refers to the ease of buying or selling a pair without significant price impact. High-liquidity pairs, such as EUR/USD and USD/JPY, offer a steady flow of buyers and sellers, ensuring smooth execution of trades and tighter spreads (the difference between the bid and ask prices).

Volatility: A Double-Edged Sword

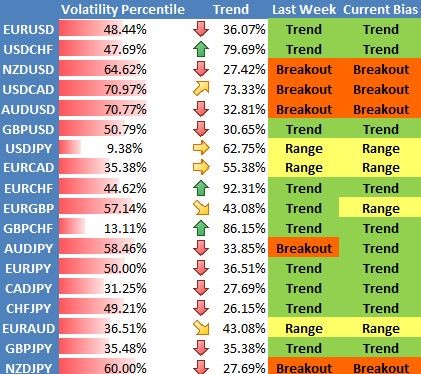

Volatility measures the extent of price fluctuations in a currency pair. While volatility can present opportunities for short-term gains, it also amplifies the risk of losses. Traders must balance the desire for potential profits with the tolerance for risk when selecting currency pairs with the appropriate level of volatility.

Image: congorsatu.vercel.app

Correlation: The Hidden Influence

Correlation measures the degree to which the price movements of two currency pairs are related. Positive correlation indicates that the pairs move in the same direction, while negative correlation suggests opposite movements. Understanding correlation helps traders diversify their portfolios and reduce overall risk.

Unveiling the Top Performers

Based on these factors, the following currency pairs emerge as top performers in forex trading:

- EUR/USD

The euro and the US dollar, known as “the Big Dog” of forex, form the most traded currency pair due to their high liquidity, low spreads, and moderate volatility.

- USD/JPY

The US dollar and the Japanese yen offer a high level of liquidity, making them suitable for day traders or those seeking short-term opportunities.

- GBP/USD

The British pound and the US dollar present a balance of liquidity, volatility, and the ability to capitalize on geopolitical events.

- USD/CHF

The US dollar and the Swiss franc provide a safe haven during market turmoil, making them ideal for risk-averse traders.

- AUD/USD

The Australian dollar and the US dollar exhibit a moderate level of volatility and correlation, creating opportunities for both short-term and long-term strategies.

Insider Tips: Unleashing Your Trading Potential

As you embark on your forex trading journey, embrace these expert tips:

- Research thoroughly: Understand the fundamentals of each currency pair, including economic indicators, central bank policies, and geopolitical events.

- Practice risk management: Implement stop-loss orders, position sizing strategies, and leverage management techniques to protect your capital.

- Control emotions: Avoid impulsive trading decisions influenced by fear or greed. Stick to your trading plan and manage your emotions effectively.

- Leverage technology: Utilize charting platforms, technical analysis tools, and market news to stay informed and make data-driven decisions.

- Seek knowledge continuously: Attend webinars, read books, and engage with experienced traders to expand your knowledge and enhance your trading skills.

Frequent Queries Answered

- Q: Which currency pair is best for beginners?

- A: EUR/USD, USD/JPY, GBP/USD are suitable options due to their liquidity and moderate volatility.

- Q: How much money do I need to start forex trading?

- A: The minimum amount can vary depending on the broker; however, starting with a small amount is recommended for beginners.

- Q: Can I make money in forex trading?

- A: Yes, it is possible to earn profits in forex trading; however, it requires knowledge, skill, and proper risk management.

- Q: What are the risks involved in forex trading?

- A: Forex trading involves the risk of losing capital due to adverse price movements and leverage mismanagement.

Best Currency Pairs In Forex

Conclusion

Selecting the right currency pairs in forex is crucial for success. By understanding liquidity, volatility, correlation, and top-performing pairs, traders can create a solid foundation for their trading strategies. Embrace expert tips, manage risks effectively, and enhance your knowledge to increase your chances of profitability in the dynamic world of forex trading.

Are you ready to explore the exciting world of forex trading with the best currency pairs? Take the first step today and dive into this exhilarating market!