In the fast-paced world of forex trading, scalping has emerged as a lucrative strategy for those seeking quick profits. Among the various scalping strategies, the 1-minute timeframe offers unparalleled opportunities for scalpers due to its short duration and high volatility. In this comprehensive guide, we delve deep into the best 1-minute forex scalping strategy, unlocking the secrets of successful scalping in the foreign exchange market.

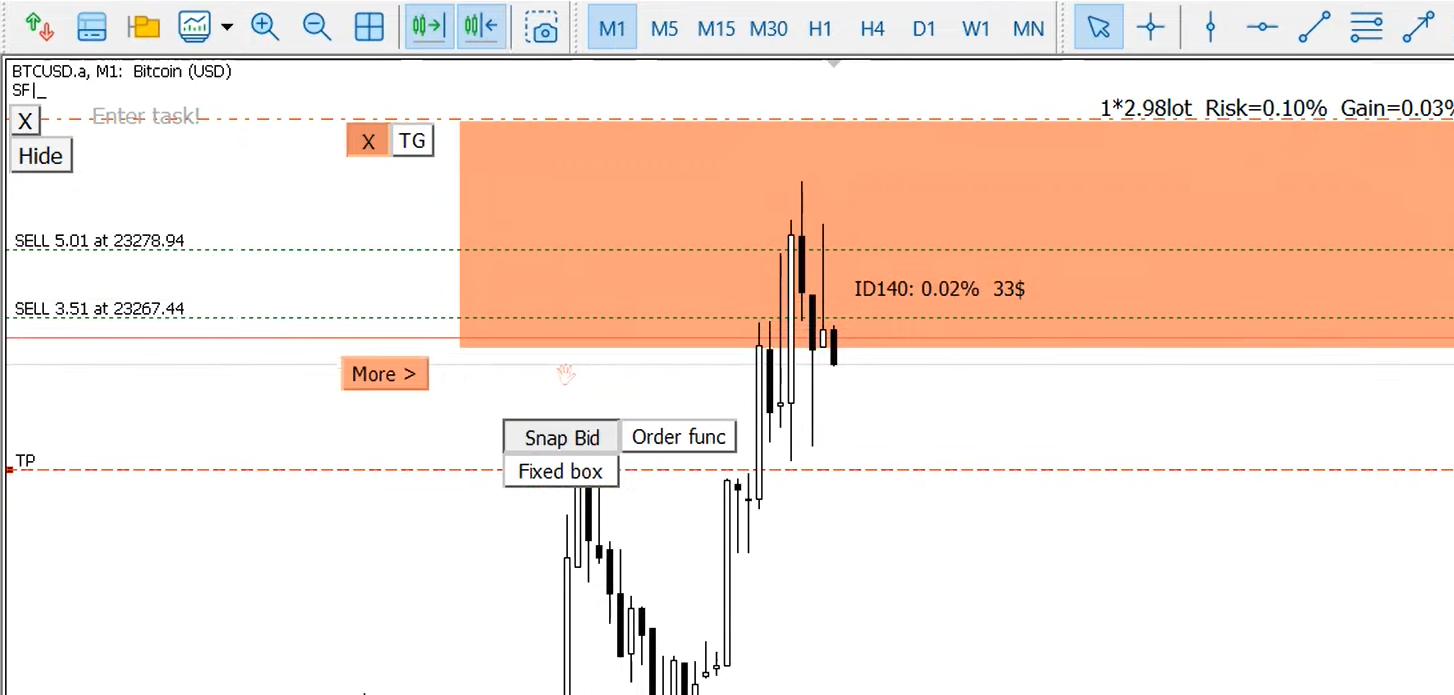

Image: www.mql5.com

Are you ready to join the ranks of profitable forex scalpers? Embark on this journey with us and discover the secrets to mastering the art of 1-minute scalping.

1-Minute Forex Scalping: A Lucrative Frontier

Effective forex scalping hinges on exploiting price fluctuations within short timeframes. The 1-minute chart provides an ideal playground for scalpers, offering ample opportunities to capitalize on even the slightest price movements. This timeframe allows traders to enter and exit positions within minutes, capturing small profits that accumulate over time.

The highly volatile nature of the 1-minute timeframe presents challenges for novice traders. However, seasoned scalpers have devised robust strategies to navigate these volatile waters, ensuring consistent profitability. In this guide, we unveil the secrets to harnessing the power of 1-minute scalping, empowering you with the tools to unlock its full potential.

Trading Channels: A Foundation for Success

The foundation of successful 1-minute scalping lies in identifying and trading within price channels. These channels are formed by two parallel lines, one representing support and the other representing resistance. Price tends to bounce back and forth within these channels, creating opportunities for scalpers to profit from short-term fluctuations.

Seasoned scalpers employ various methods to identify price channels, including trendlines, moving averages, and Bollinger Bands. Once a channel is established, traders can anticipate future price movements and position themselves accordingly. The following steps outline a systematic approach to trading within price channels:

- Identify the support and resistance levels that define the price channel.

- Anticipate price reversals at these levels.

- Identify the direction of the trend (upward or downward) within the channel.

- Place buy orders close to the support level during uptrends and sell orders close to the resistance level during downtrends.

- Capture profits by exiting positions when price reaches the opposite end of the channel.

Candlestick Patterns: Enhancing Accuracy

Candlestick patterns play a crucial role in confirming price reversals within channels. These patterns provide visual cues that help traders anticipate the direction of future price movements. Scalpers often rely on specific candlestick patterns to increase the accuracy of their trades.

Among the most common candlestick patterns used in 1-minute scalping are engulfing patterns, inside bars, and pin bars. Engulfing patterns occur when a small candle is completely consumed by a larger candle, indicating a strong reversal. Inside bars form when the current candle’s range is completely contained within the range of the previous candle, suggesting a period of consolidation. Pin bars have long wicks and small bodies, signaling a rejection of the current price level. Scalpers can incorporate these patterns into their trading strategies to enhance precision and improve profitability.

Image: www.youtube.com

Risk Management: The Cornerstone of Success

Risk management is paramount in any trading strategy, and 1-minute scalping is no exception. The fast-paced nature of scalping can tempt traders to make rash decisions, which can lead to substantial losses. Prudent risk management practices are vital to preserve capital and ensure sustainability in the long run.

One of the most effective risk management techniques is position sizing. Traders should carefully determine the amount they are willing to risk on each trade, taking into account their available capital and risk tolerance. Stop-loss orders play a critical role in limiting potential losses by automatically exiting positions when the price moves against the trader’s position. Scalpers should place stop-loss orders at critical levels, such as outside the price channel or at key support and resistance levels.

Conclusion

Mastering the art of 1-minute forex scalping requires dedication, disciplined risk management, and a deep understanding of the underlying market dynamics. By embracing the strategies outlined in this guide, traders can harness the full potential of this lucrative technique and achieve consistent profitability in the fast-paced world of forex trading. Remember, success in forex scalping is not guaranteed. However, by equipping yourself with the right knowledge and implementing sound trading practices, you can increase your chances of becoming a successful scalper.

Are you ready to delve deeper into the world of 1-minute forex scalping? Let us know in the comments below. Share your thoughts and experiences, and let’s embark on this exciting journey together.

Best 1 Minute Forex Scalping Strategy

FAQs

Q: What are the advantages of 1-minute forex scalping?

A: 1-minute scalping offers several advantages, including frequent trading opportunities due to the short timeframe, potential for small but quick profits, and the ability to capture price fluctuations within channels using technical analysis.

Q: How can I identify price channels for scalping?

A: Identifying price channels involves observing the formation of support and resistance levels. Traders can use trendlines, moving averages, or Bollinger Bands to draw channels that contain price movements.

Q: What are the key candlestick patterns used in 1-minute scalping?

A: Engulfing patterns, inside bars, and pin bars are common candlestick patterns used by forex scalpers. These patterns provide visual cues and help traders anticipate price reversals.

Q: How important is risk management in 1-minute scalping?

A: Risk management is crucial in all trading, including 1-minute scalping. Techniques like position sizing and stop-loss orders are essential for managing risk and protecting capital. The fast-paced nature of scalping requires disciplined risk management practices.