Unlimited Access to Global Currency

Tired of the hassles of carrying cash abroad? With the HDFC Forex Card, traveling has never been easier. This prepaid card allows you to access foreign currencies effortlessly, making your international trips a breeze. Join us for a comprehensive guide on applying for your HDFC Forex Card online, empowering you to unlock a world of seamless global payments.

Image: www.youtube.com

Simplify Your International Finance

The HDFC Forex Card is a revolutionary tool that simplifies your international financial transactions. Forget the uncertainties of dealing with currency exchange counters; with this card, you’re in control. Load it with multiple currencies, saving you the trouble of carrying cash or waiting in long queues at airports and banks. Whether shopping, dining, or booking tours, the HDFC Forex Card ensures seamless payments at millions of establishments worldwide.

Benefits that Elevate Your Travel Experience

-

Enhanced Security: Chips and PINs protect your card from unauthorized access, giving you peace of mind.

-

Competitive Exchange Rates: HDFC offers some of the best exchange rates in the market, ensuring maximum value for your money.

-

Real-Time Transactions: No more waiting for payments to clear; your Forex Card processes transactions instantly.

-

24×7 Customer Support: A dedicated team is always available to assist you with any queries or emergencies.

Applying for Your HDFC Forex Card Online: A Step-by-Step Guide

Applying for your HDFC Forex Card is a convenient and straightforward process:

-

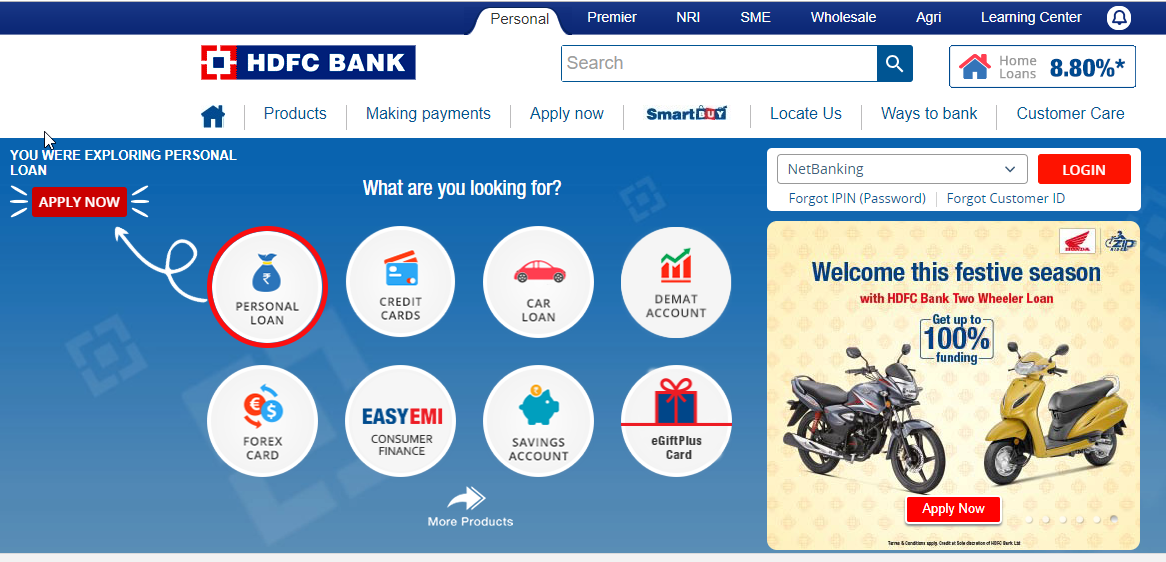

Log in to HDFC NetBanking: Access your HDFC account securely through NetBanking.

-

Navigate to the Forex Card Page: Find the “Forex Card” option within the “Cards” tab.

-

Provide Personal Information: Enter your personal details, including your name, contact information, and travel details.

-

Choose Currencies and Amount: Select the currencies you need and specify the amount you wish to load onto the card.

-

Pay Online: Complete the payment process securely through HDFC’s online banking platform.

-

Receive Your Card: Your HDFC Forex Card will be delivered to your doorstep within 3-5 business days.

Image: forextradinghowtogetstarted.blogspot.com

Tips for a Hassle-Free Experience

-

Plan Ahead: Apply for your Forex Card well in advance of your travel dates to avoid delays.

-

Double-Check Currency Exchange Rates: Compare rates from different providers to secure the best deal.

-

Monitor Your Balance: Keep track of your card balance online to avoid overspending and stay informed about your funds.

-

Seek Expert Advice: Consult with an HDFC financial advisor for personalized recommendations and guidance.

Frequently Asked Questions

-

What documents are required to apply for an HDFC Forex Card?

-

Identity proof (PAN card, passport, or voter ID)

-

Address proof (utility bills, bank statements)

-

Proof of travel (flight ticket or visa)

-

-

Are there any age restrictions for applying?

- Individuals aged 18 years and above are eligible to apply for an HDFC Forex Card.

-

What is the maximum amount I can load onto my Forex Card?

- The maximum amount you can load is subject to FEMA regulations and may vary depending on your purpose of travel.

Apply For Forex Card Hdfc Online

Embrace the Global Currency Revolution

The HDFC Forex Card is the ultimate solution for travelers seeking convenience, security, and value. Embark on your global adventures with confidence, knowing that your financial needs are expertly handled. With its unparalleled benefits and user-friendly online application process, the HDFC Forex Card empowers you to embrace the world of global currency with ease. Join the millions who have simplified their international travels with HDFC, and let your next adventure be hassle-free.

Are you ready to unlock the world with the HDFC Forex Card? Apply online today and embark on a journey of seamless global payments.