In the tumultuous world of forex trading, where fortunes can turn on a dime, savvy traders seek refuge in the time-honored practice of hedging. Like a financial shield, hedging offers a means to mitigate risk and potentially lock in profits, ensuring a steady stream of green amidst market volatility.

Image: www.youtube.com

A Guiding Light in Currency Fluctuations

Forex hedging involves employing strategic combinations of currency pairs to offset potential losses or magnify gains. Traders capitalize on correlations between currencies, effectively neutralizing exposure to adverse price movements in one currency with profits from another.

Types of Hedging Strategies: Navigating the Maze

The forex hedging arsenal encompasses a diverse array of strategies, each tailored to specific risk appetites and market conditions. Common approaches include:

- Natural Hedging: Pairing currencies with intrinsic economic ties, such as the euro and the Swiss franc, which tend to exhibit similar price trends.

- Synthetic Hedging: Utilizing financial instruments like futures or forwards to create artificial correlations between currencies.

The Art of Execution: Precision and Timing

Executing a hedging strategy demands precision and impeccable timing. Traders must diligently:

- Identify correlated currency pairs: Analyze market data and economic indicators to pinpoint currencies with strong correlations.

- Determine the optimal hedge ratio: Calculate the appropriate ratio of currency pairs to offset risk effectively while maximizing potential profits.

- Monitor market conditions: Vigilantly track currency movements to adjust the hedge ratio as needed to maintain an optimal balance.

Image: www.forexcracked.com

Unveiling the Benefits: A Path to Profits

Forex hedging unveils a myriad of benefits for savvy traders:

- Mitigated Risk: Offsetting exposure to currency fluctuations, reducing the potential for substantial losses.

- Enhanced Profits: Magnifying gains by capitalizing on price movements in correlated currencies.

- Stability and Security: Providing a sense of peace of mind in volatile market conditions.

- Portfolio Diversification: Expanding investment horizons and hedging against systemic market risks.

Expert Tips for Success: Wisdom from the Masters

To enhance your hedging prowess, embrace expert insights:

- Comprehend the Underlying Fundamentals: Gain an in-depth understanding of currency markets, correlations, and economic factors driving price movements.

- Continuously Monitor Market Conditions: Stay abreast of news, economic data, and geopolitical events that can influence currency values.

- Risk Management First: Prioritize risk management by setting stop-loss orders and managing position sizes prudently.

- Patience and Discipline: Successful hedging demands patience and discipline to withstand market fluctuations and reap long-term rewards.

Frequently Asked Questions: Illuminating the Shadows

Q: Can hedging guarantee profits?

A: While hedging can significantly reduce risk and enhance profit potential, it does not guarantee profits.

Q: What is the best hedging strategy?

A: The optimal hedging strategy varies depending on market conditions and individual risk tolerance. Conduct thorough research to find the most suitable strategy.

Q: Is hedging suitable for all traders?

A: Hedging is particularly beneficial for traders seeking risk mitigation and portfolio diversification.

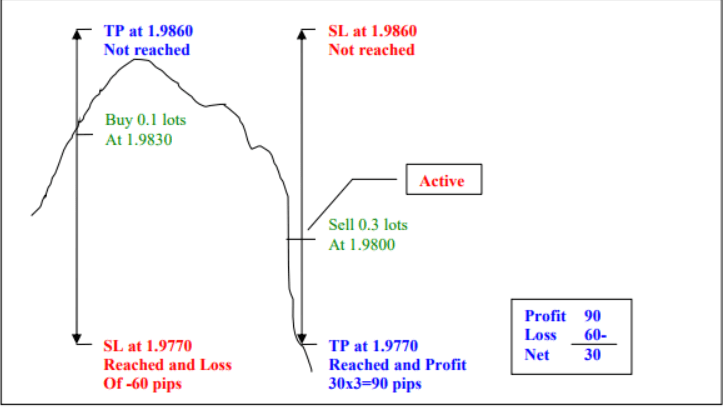

Always In Profit Forex Hedging Strategy

Conclusion: Embracing the Power of Hedging

By harnessing the transformative power of forex hedging, traders can navigate the unpredictable terrain of currency markets with confidence and resilience. This time-honored strategy offers a beacon of hope in tumultuous times, guiding traders towards a path of sustained profitability and unwavering financial security. Embrace the wisdom of hedging and unlock the secrets to a forever profitable forex adventure.

Are you ready to embark on your own hedging journey? Delve into the fascinating world of currency correlations and explore the vast potential of this time-tested profit-enhancing strategy.