In the realm of financial trading, timing is everything. Forex, the global currency market, is a 24/7 operation, offering endless opportunities for profit. But when is the optimal time to step into the arena and make your move? This article delves deep into the complexities of forex trading, unveiling the secrets of finding the ideal trading hours that can maximize your potential.

Image: www.forextradingbig.com

The Sunrise and Sunset Effect: Understanding Session Overlaps

The forex market operates in four primary trading sessions: the Sydney, Tokyo, London, and New York sessions. Each session overlaps with the others, creating periods of heightened activity and volatility. These overlaps, known as “interbank hours,” provide traders with the greatest liquidity and best trading conditions.

During interbank hours, traders from around the world converge, ensuring a steady flow of orders and tight spreads. The most active overlap occurs between the London and New York sessions, from 8 AM to 12 PM EST. This time slot is considered the “prime time” for forex trading, offering the most favorable conditions for profit-making.

Peak Periods: When the Market Comes Alive

While interbank hours provide optimal liquidity, certain time slots within these sessions exhibit even greater volatility and trading opportunities. These peak periods are typically driven by major economic news releases or events that impact currency values.

For instance, currency pairs involving the U.S. dollar tend to experience повышенный спрос around the time of U.S. employment data releases, such as the Non-Farm Payrolls report. Pinpointing these peak periods requires staying abreast of the economic calendar and anticipating market-moving events.

Region-Specific Opportunities: Tailoring Your Strategy

In addition to interbank hours and peak periods, the best time to trade forex can vary depending on your target currency pairs. Different regions have unique economic characteristics and trading patterns that can influence currency behavior.

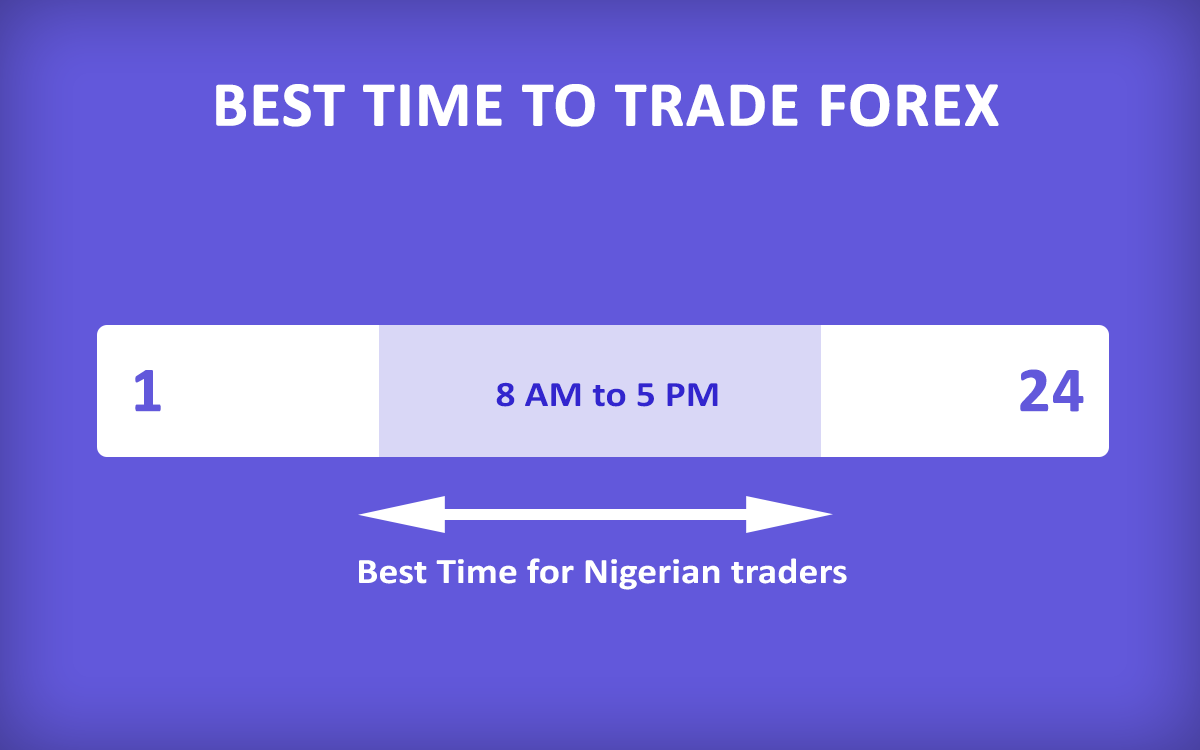

Traders targeting Asian currencies may find the Tokyo session (12 AM to 8 AM EST) more suitable due to increased liquidity and volatility during this time. Similarly, traders focusing on European pairs may prefer the London session (3 AM to 12 PM EST), when European markets are most active.

Image: www.forextrading.ng

Exploring Your Trading Style: When Does Your Strategy Shine?

Every trader has a unique trading style that influences the optimal trading time. If you favor short-term trades and scalp trading, intraday volatility during peak periods may be more advantageous. Longer-term traders, on the other hand, may prefer to trade during non-peak hours when market movements are less erratic.

Understanding your trading personality and goals is crucial for determining the best time to trade. Experiment with different time slots and identify the period that aligns best with your trading approach and risk tolerance.

The Psychological Edge: Morning Versus Evening Trading

Studies have shown that our cognitive abilities and alertness fluctuate throughout the day. Some traders thrive in the morning hours, exhibiting heightened focus and decision-making skills. Others find their “trading zone” later in the evening, when distractions are minimal and they can delve into market analysis more deeply.

The best time to trade forex not only depends on external factors but also on your own internal rhythm and psychological state. Determine the time slot that aligns with your peak performance and embrace the power of your unique trading clock.

When Is The Best Time To Trade Forex

Conclusion: Embracing the Optimal Trading Time

The quest for the best time to trade forex is an ongoing journey, one that requires a blend of market analysis, self-awareness, and trading discipline. By understanding session overlaps, peak periods, region-specific opportunities, trading styles, and psychological factors, you can create a tailored trading plan that maximizes your chances of success.

Remember, the forex market is a dynamic and ever-evolving landscape. Be prepared to adapt your trading strategy as market conditions change. By embracing the principles outlined in this article, you can navigate the forex world with confidence and uncover the optimal trading time that unlocks your financial potential.