Embarking on the exhilarating realm of foreign exchange trading entails a myriad of decisions, one of them being the judicious selection of leverage. Leverage is a double-edged sword, amplifying both profits and losses, rendering it imperative for traders to fully comprehend its implications before wielding it. This article will delve into the intricacies of leverage, exploring its advantages and risks, and providing insights into the optimal leverage ratios for various trading strategies.

Image: freeforexcoach.com

Understanding Leverage: A Key Forex Concept

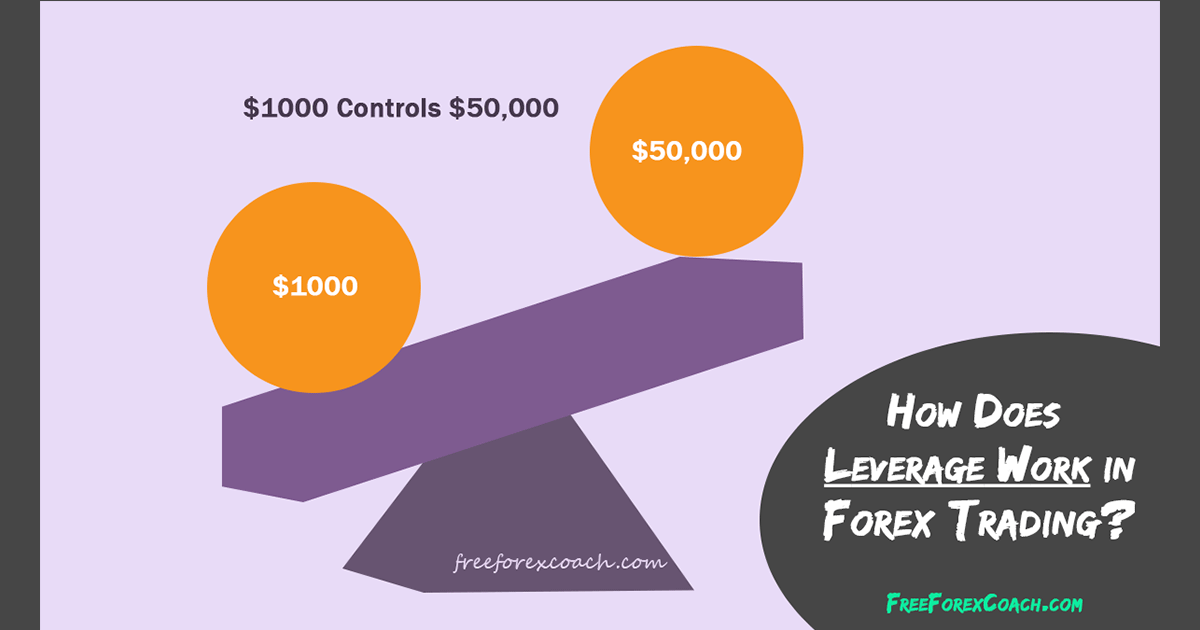

Leverage is a financial tool that enables traders to control a larger position size with a relatively small deposit, potentially magnifying their profits. However, it also exacerbates losses, making it crucial for traders to exercise prudence when employing it. The leverage ratio is expressed as a multiple, such as 1:50, 1:100, or 1:500, indicating the proportion of the actual position size that is financed by the broker.

For instance, a trader with a leverage ratio of 1:100 and a deposit of $1000 could potentially control a position worth $100,000. Conversely, if the market moves against the trader, the losses would also be magnified by the same multiple.

Advantages and Risks of Using Leverage

Advantages:

- Increased profit potential: Leverage can amplify profits, especially for short-term trades.

- Reduced capital outlay: Traders can control larger positions with lower capital requirements.

- Increased trading flexibility: Leverage allows traders to diversify their portfolio or trade multiple instruments simultaneously.

Risks:

- Magnified losses: Leverage can exacerbate losses, potentially leading to a margin call or substantial depletion of the trading account.

- Increased volatility: Leveraged positions are more susceptible to market fluctuations, amplifying both gains and losses.

- Emotional trading: Leverage can tempt traders to take excessive risks, fueled by the potential for amplified profits, but also increasing the likelihood of losses.

Optimal Leverage Ratios: A Balancing Act

The optimal leverage ratio is contingent upon an array of factors, including the trader’s risk tolerance, trading strategy, and market conditions. There is no one-size-fits-all formula; the ideal leverage ratio varies depending on the individual’s circumstances.

Conservative traders: Individuals with a low risk appetite and a focus on preserving capital should opt for a lower leverage ratio, such as 1:10 or 1:20. This approach minimizes potential losses and provides a safety net during market fluctuations.

Aggressive traders: Traders seeking higher returns and willing to assume greater risk can consider higher leverage ratios, such as 1:50 or 1:100. However, it is paramount to manage risk effectively and adhere to sound trading practices.

Image: ezikipayipobo.web.fc2.com

Expert Tips and Advice for Prudent Leverage Use

- Understand your risk tolerance: Determine your tolerance for potential losses to guide your leverage selection.

- Match leverage to strategy: Choose a leverage ratio that aligns with your trading strategy, considering factors such as time horizon, market volatility, and position size.

- Monitor market conditions: Be cognizant of market sentiment and volatility. Adjust your leverage ratio accordingly, reducing it during volatile periods to mitigate risks.

- Always use stop-loss orders: Protect your positions from excessive losses by employing stop-loss orders, which automatically close trades when prices hit predetermined levels.

- Practice risk management principles: Diversify your portfolio, manage risk-to-reward ratios, and avoid overtrading to safeguard your capital.

FAQ on Leverage in Forex Trading

Q: What is margin call?

A: A margin call occurs when a trader’s losses exceed their equity, requiring them to deposit additional funds to maintain their position.

Q: Can I lose more money than my deposit?

A: Yes, leverage can amplify losses beyond your initial capital if you do not manage risk appropriately.

Q: What is the maximum leverage I can use?

A: The maximum leverage varies between brokers and regulators. Check with your broker to ascertain the permissible leverage ratios.

Q: Is it better to use high or low leverage?

A: The optimal leverage ratio depends on your individual circumstances. Consider your risk tolerance, strategy, and market conditions when selecting a leverage ratio.

What Is The Best Leverage To Use In Forex

Conclusion

Leverage is a powerful tool in forex trading, but it is imperative to use it judiciously. By comprehending the advantages and risks, selecting an appropriate leverage ratio, and adhering to sound risk management principles, traders can harness the potential of leverage to enhance their trading performance. However, it is equally important to be aware of the potential pitfalls and to avoid excessive risk-taking. Are you interested in learning more about the topic of leverage in Forex trading?