The Fibonacci sequence is a series of numbers in which each number is the sum of the two preceding numbers. The sequence begins with 0 and 1, and continues with 1, 2, 3, 5, 8, 13, and so on. The Fibonacci sequence is found in many natural phenomena, including the arrangement of leaves on a stem, the spiral of a seashell, and the branching of trees.

Image: homecare24.id

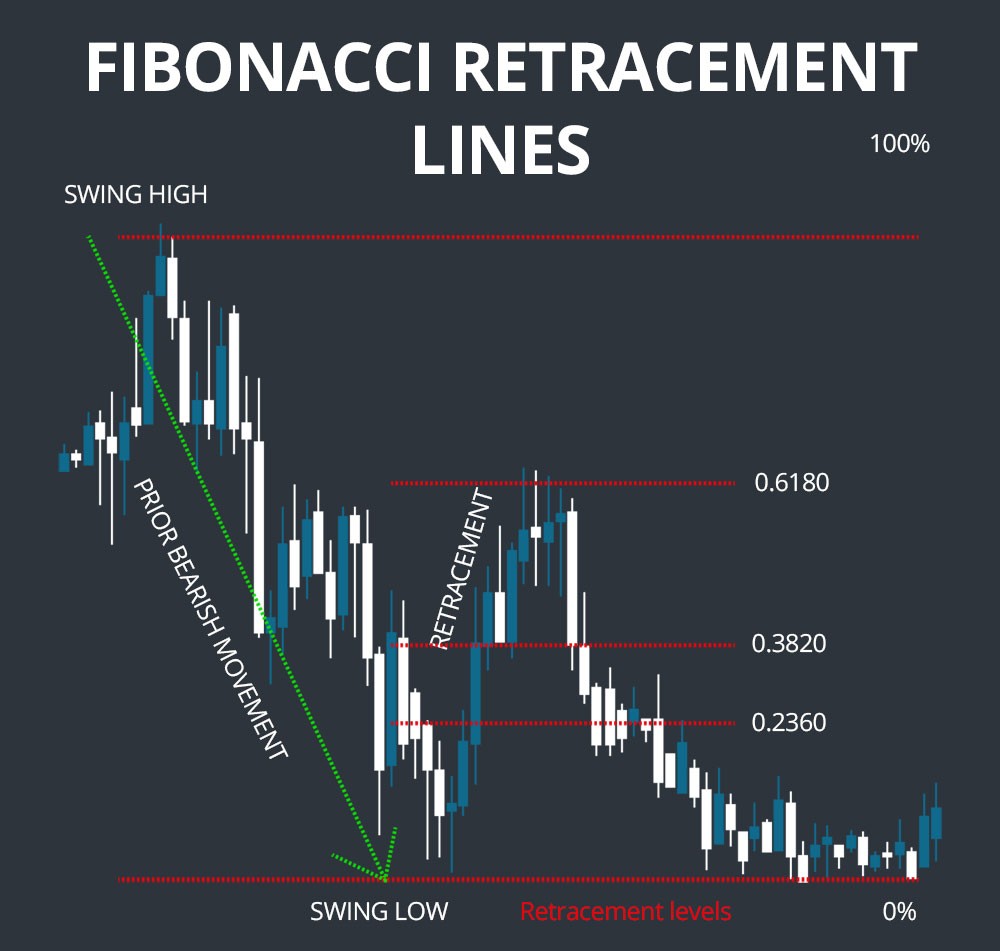

Fibonacci numbers have also been used for centuries in financial markets to predict price movements. The theory is that prices move in waves, and that these waves can be identified by using Fibonacci ratios. Fibonacci ratios are simply the ratios of two consecutive Fibonacci numbers. The most common Fibonacci ratios are 0.618, 0.382, and 0.236.

How to Use Fibonacci in Forex

There are many different ways to use Fibonacci in forex trading. One common method is to use Fibonacci retracements. Fibonacci retracements are lines that are drawn on a price chart to identify potential areas of support and resistance. The lines are drawn at the Fibonacci ratios of 0.618, 0.382, and 0.236.

Another common method is to use Fibonacci extensions. Fibonacci extensions are lines that are drawn on a price chart to identify potential targets for price movements. The lines are drawn at the Fibonacci ratios of 1.618, 2.618, and 3.618.

Tips for Using Fibonacci in Forex

Here are a few tips for using Fibonacci in forex trading:

- Use Fibonacci retracements to identify potential areas of support and resistance.

- Use Fibonacci extensions to identify potential targets for price movements.

- Do not rely on Fibonacci alone to make trading decisions.

- Use Fibonacci in conjunction with other technical analysis tools.

- Trade with a sound risk management plan.

FAQs About Fibonacci

- What is the Fibonacci sequence?

- How is Fibonacci used in forex?

- Is Fibonacci accurate?

The Fibonacci sequence is a series of numbers in which each number is the sum of the two preceding numbers. The sequence begins with 0 and 1, and continues with 1, 2, 3, 5, 8, 13, and so on.

Fibonacci numbers are used in forex to identify potential areas of support and resistance, and to identify potential targets for price movements.

Fibonacci is not a perfect tool, but it can be a helpful tool for identifying potential trading opportunities.

Image: libertex.org

What Is Fibonacci In Forex

Conclusion

Fibonacci is a powerful tool that can be used to identify potential trading opportunities in the forex market. However, it is important to remember that Fibonacci is not a perfect tool, and it should not be used alone to make trading decisions. Fibonacci should be used in conjunction with other technical analysis tools, and it should be used with a sound risk management plan.

Are you interested in learning more about Fibonacci trading? If so, I recommend checking out the following resources: