In the dynamic world of forex trading, precision and planning are essential for navigating the volatile markets. Among the various intricacies that traders encounter, the concept of TP1 (Take Profit 1) holds immense significance. To decipher this enigmatic term, we embark on a comprehensive journey, unraveling its meaning, exploring its usage, and unlocking its potential in maximizing trading profits.

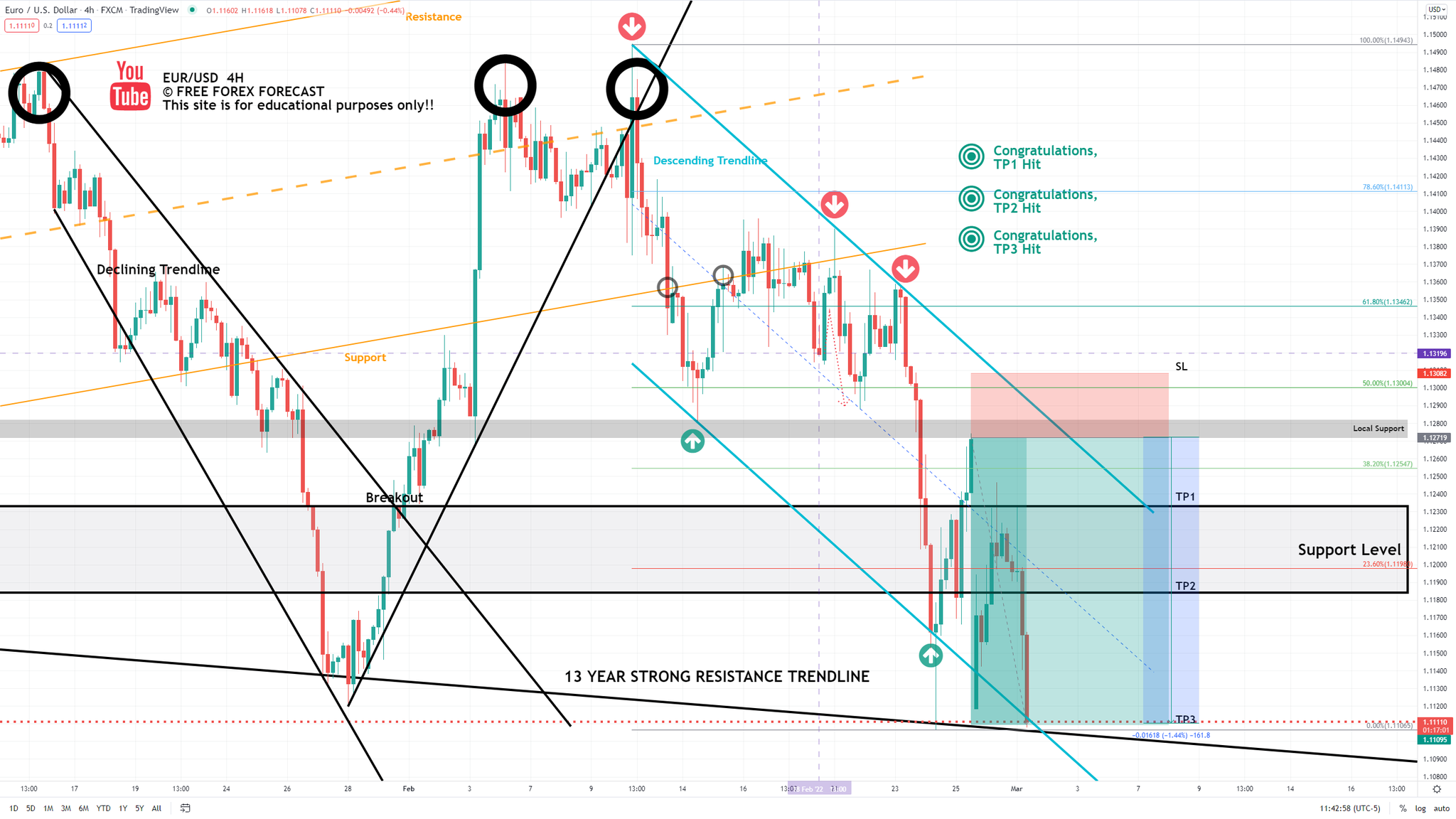

Image: fxtradinger.com

Defining TP1: The Trader’s Profit Threshold

TP1, or Take Profit 1, refers to a predefined price level at which a trader instructs their broker to automatically close an open position, thereby realizing a profit. It is a fundamental concept in risk management, allowing traders to establish a target profit point and secure their gains before market conditions turn unfavorable.

Purpose and Significance of TP1

Trading without a TP1 is akin to driving without a destination; it lacks purpose and direction. By setting a TP1, traders define their profit expectations and eliminate the risk of holding a position indefinitely, potentially subject to unexpected market fluctuations. TP1 provides a sense of control, empowering traders to exit trades at predetermined levels, ensuring that their profits are not eroded by unpredictable market behavior.

Setting TP1: A Balancing Act

Establishing an optimal TP1 level requires a delicate balance between ambition and realism. Setting the TP1 excessively high increases the risk of closing a position prematurely, missing out on potential further gains. On the other hand, placing the TP1 too conservatively limits potential profits and may not fully capitalize on market opportunities.

Image: twitter.com

Factors Influencing TP1 Placement

The choice of TP1 depends on several factors, including:

-

Market conditions and volatility

-

Risk tolerance and trading strategy

-

Position size and account balance

-

Technical analysis and chart patterns

Considering these factors enables traders to set TP1 levels that align with their individual circumstances and trading objectives.

Optimal Positioning of TP1

There is no one-size-fits-all approach to TP1 placement. However, certain guidelines can assist traders in making informed decisions:

-

Using technical indicators, such as support and resistance levels or moving averages, can provide guidance for TP1 levels.

-

Monitoring market sentiment and news events can help traders anticipate price movements and adjust TP1 levels accordingly.

-

Employing risk-reward ratios, such as aiming for a 1:2 or 1:3 ratio, where potential profits exceed potential losses, can optimize TP1 placement.

TP1 as Part of a Comprehensive Trading Strategy

TP1 is a critical component of a well-rounded trading strategy, complementing other risk management techniques such as stop-loss orders and position sizing. By combining these elements, traders create a comprehensive framework for mitigating risks and maximizing profit potential.

The Emotional Impact of TP1

The psychological aspect of TP1 cannot be overlooked. Seeing a trade close at the TP1 level can trigger a sense of accomplishment and validation for traders. It reinforces positive trading habits and instills confidence in their decision-making abilities. However, it is equally crucial to manage emotions when a TP1 is not hit, avoiding impulsive decisions or chasing losses.

What Does Tp1 Mean In Forex

Conclusion

In the ever-evolving landscape of forex trading, understanding and effectively utilizing TP1 is indispensable. By setting clear profit targets, traders can navigate market uncertainties with greater precision and control. Whether setting the TP1 at a conservative level to secure quick profits or extending it to maximize potential gains, the decision rests on the trader’s risk tolerance and trading strategy. Through careful planning and emotional discipline, TP1 empowers traders to seize opportunities and achieve their financial goals.