Introduction

The foreign exchange market, commonly known as the forex market, is the largest and most liquid financial market in the world. It involves the trading of currencies, with trillions of dollars exchanged daily. At the heart of this market lies the forex broker, a vital intermediary that connects traders to the global currency market.

Image: equalscollective.com

Forex brokers play a crucial role in facilitating currency transactions, providing traders with access to market liquidity, execution services, and analytical tools. Understanding the role of a forex broker is essential for anyone looking to venture into the dynamic world of currency trading.

What is a Forex Broker?

A forex broker is a financial institution that acts as an intermediary between traders and the forex market. When a trader desires to buy or sell currencies, they do not directly interact with the market but place orders through a forex broker.

Forex brokers connect traders to the interbank market where banks and other financial institutions trade currencies. These brokers provide platforms and technologies that enable traders to execute trades, analyze market conditions, and manage their portfolios.

Services Provided by Forex Brokers

Forex brokers offer a range of services to cater to the needs of traders. These services include:

- Trading Platforms: Forex brokers provide traders with trading platforms, also known as trading terminals, which serve as the interface for placing orders, managing positions, and analyzing market data.

<li><strong>Market Access:</strong> Forex brokers provide access to the interbank market, allowing traders to participate in the global currency market and capitalize on market fluctuations.</li>

<li><strong>Order Execution:</strong> Forex brokers execute trades on behalf of traders, matching buy and sell orders and facilitating the exchange of currencies.</li>

<li><strong>Analysis Tools:</strong> Many forex brokers offer analytical tools, such as technical indicators, charts, and economic calendars, to assist traders in making informed decisions.</li>

<li><strong>Customer Support:</strong> Forex brokers typically provide customer support services to assist traders with inquiries, account management, and any technical issues they may encounter.</li>How to Choose a Forex Broker

Selecting the right forex broker is crucial for a successful trading experience. Here are some key factors to consider:

- Regulation: Ensure that the potential broker is regulated by a reputable regulatory authority, which provides oversight and investor protection.

<li><strong>Reputation:</strong> Assess the broker's reputation by reviewing industry reviews, online forums, and testimonials from existing clients.</li>

<li><strong>Trading Costs:</strong> Compare the trading costs, including spreads, commissions, and swaps, between different brokers to minimize trading expenses.</li>

<li><strong>Platforms and Tools:</strong> Evaluate the trading platforms and analytical tools offered by the broker to align with your trading style and needs.</li>

<li><strong>Customer Support:</strong> Consider the availability and quality of the broker's customer support to ensure timely assistance when needed.</li>

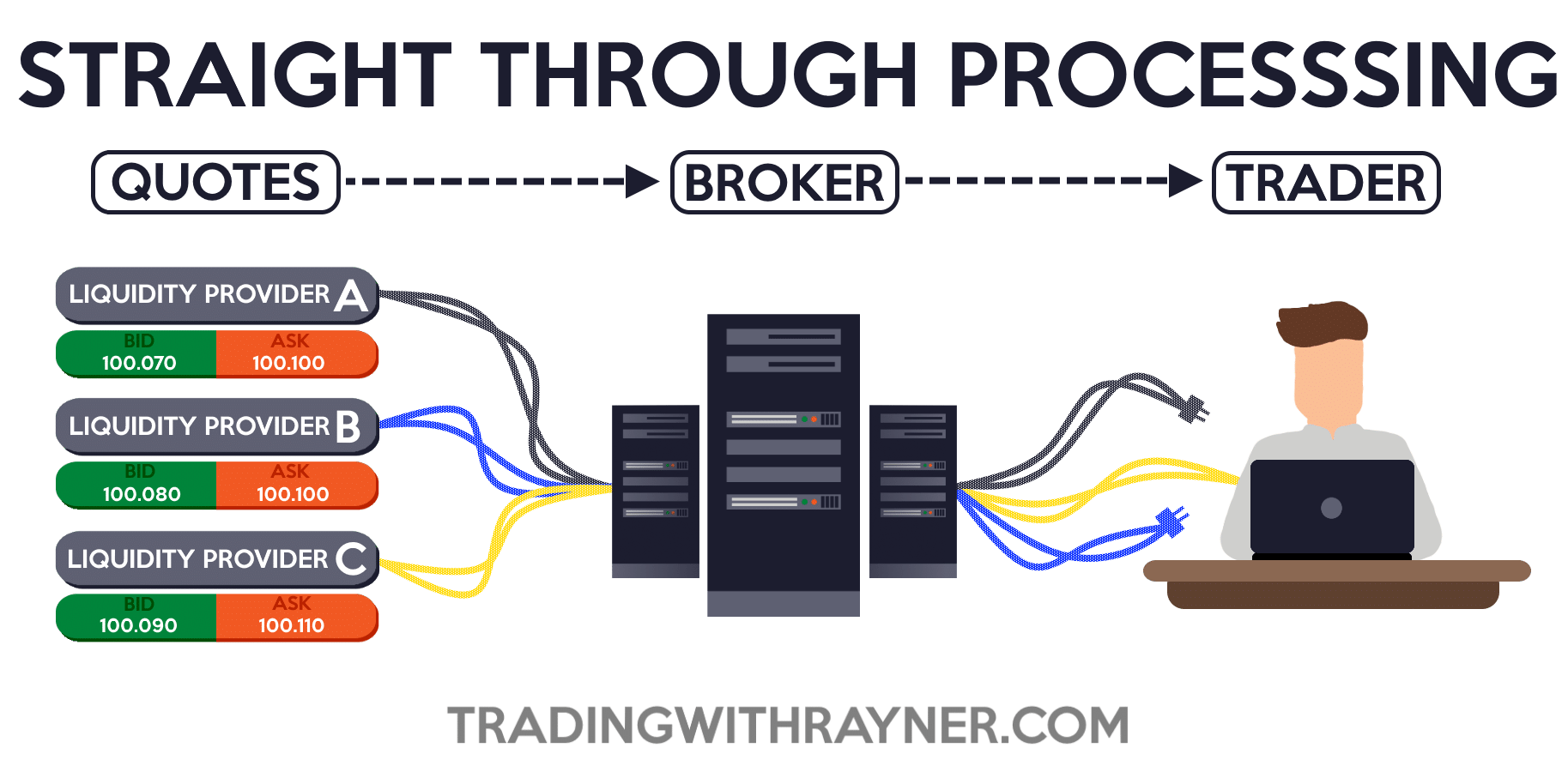

Image: www.tradingwithrayner.com

What Does A Forex Broker Do

Conclusion

Forex brokers play a pivotal role in the global foreign exchange market, empowering traders with access to the liquidity, execution, and analytical tools necessary for currency trading. Before venturing into forex, it is essential to understand the functions and offerings of a forex broker. By carefully evaluating and selecting a reputable broker, traders can increase their chances of success in the dynamic world of forex trading.