Unlock the Power of Price Action: Identifying Supply and Demand to Maximize Trading Opportunities

Welcome to the captivating realm of supply and demand zones, a pillar of price action trading in the competitive foreign exchange market. These zones are areas in the market where imbalances occur between supply (orders to sell) and demand (orders to buy), creating distinct turning points in the price trajectory. By mastering the concept of supply and demand zones, you can significantly enhance your ability to identify potential trade opportunities, minimize risks, and maximize profits.

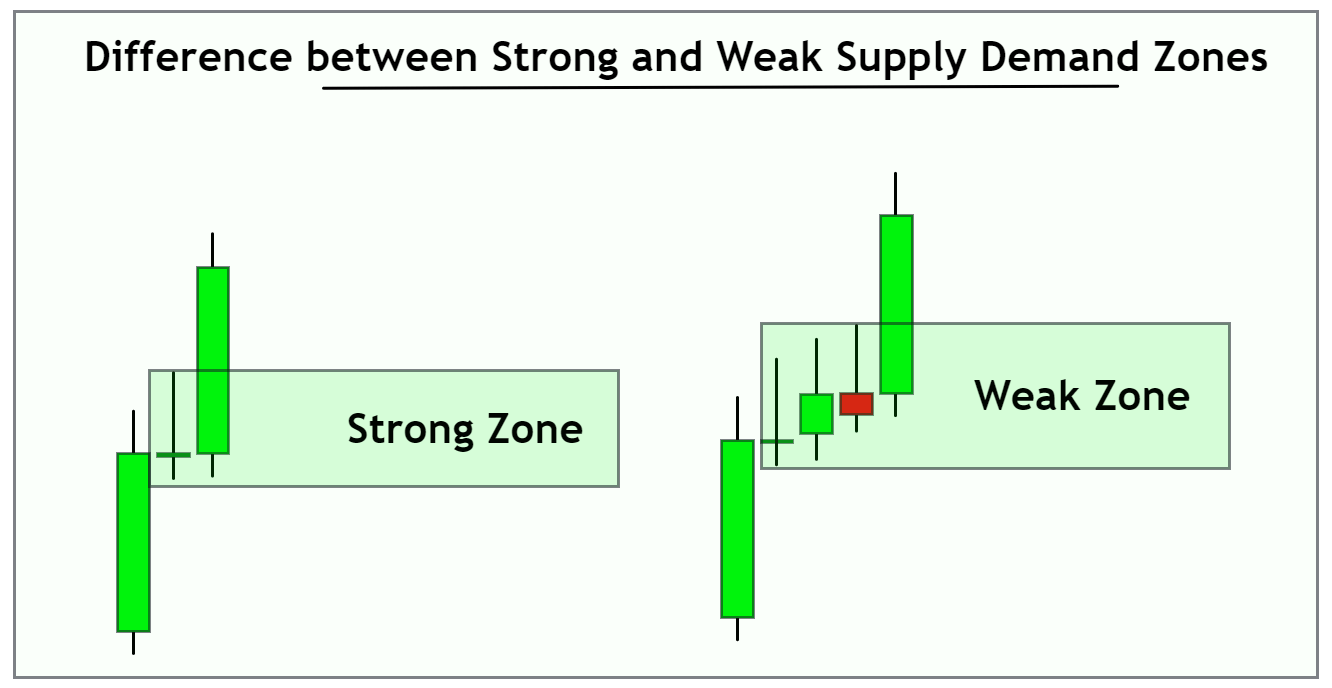

Image: www.colibritrader.com

Unveiling Supply and Demand Zones: A Basic Primer

Supply zones represent price levels where a significant number of traders are willing to sell a particular currency pair. These often act as resistance levels, preventing further price appreciation. On the other hand, demand zones represent price levels where traders are eager to buy, thereby creating support levels that hinder price decline. When supply and demand reach an equilibrium, the market may consolidate within a range-bound movement, balancing the forces of supply and demand.

Characteristics of Supply Zones

- Defined selling pressure: High volume and numerous sellers at specific price levels

- Resistance to upward price action: Inability to break above supply zones indicates strong selling pressure

- Potential for short or sell trades: Traders may enter short positions or sell orders near supply zones, anticipating price declines

- Reduced buying interest: Demand fades as the market encounters supply, slowing down or reversing upward momentum

Identifying Demand Zones: Key Indicators

- Clear buying interest: Strong demand from traders leads to price increases

- Support against price declines: Undersupply in the market prevents further depreciation

- Potential for long or buy orders: Traders anticipate a price rebound and enter long positions or buy orders near demand zones

- Enhanced buying volume: High volume and numerous buyers at specific price levels

Image: forexbee.co

Trading with Supply and Demand Zones: Strategies

- Breakout Trading: Striking or entering trades in the direction of a breakout from a supply or demand zone, exploiting the potential for price continuation.

- Range Trading: Positioning trades within price ranges bounded by supply and demand zones, focusing on exploiting market consolidation and volatility.

- Pullback Trading: Utilizing retracements within supply and demand zones to adjust positions, improve risk management, and capitalize on price reversals.

Essential Tips for Successful Supply and Demand Zone Trading

- Confluence Analysis: Combining supply and demand zones with other technical indicators (support and resistance, trendlines, moving averages) enhances reliability.

- Volume Validation: Incorporate volume analysis to confirm the strength of supply and demand zones, filtering out potential false signals.

- Risk Management: Implementing stop-loss orders to limit potential losses and maintaining proper position sizing ensures responsible trading.

Frequently Asked Questions on Supply and Demand Zones

Q: How do I determine the validity of a supply or demand zone?

A: Assess the strength of the zone using volume, historical price behavior, and the presence of multiple touches.

Q: Can supply and demand zones be used for multiple time frames?

A: Yes, supply and demand zones are applicable across different time frames, allowing for flexibility in trading strategies.

What Are Supply And Demand Zones In Forex

Conclusion: Unlocking Market Insights with Supply and Demand Zones

Embracing the dynamics of supply and demand zones empowers traders with valuable market insights. By identifying areas of buying and selling pressure, traders can anticipate price movements, optimize entry and exit points, and increase trading success. Whether you are a seasoned trader or just starting your forex journey, comprehending and harnessing supply and demand zones will elevate your trading strategy and improve your profitability in the competitive foreign exchange market.

Are you fascinated by the world of supply and demand zones in forex? Dive deeper into this topic and explore numerous trading opportunities by accessing our exclusive resources and forums. Engage with like-minded traders, share your experiences, and refine your understanding of this powerful price action technique. Embrace the power of supply and demand zones and unlock your trading potential today!