Image: proper-cooking.info

Trading foreign exchange (forex) through banks offers a unique blend of convenience, security, and expertise for both amateur and seasoned investors. However, navigating the complexities of forex trading can be daunting, especially when choosing the right financial institution to facilitate your transactions. This comprehensive guide will shed light on the benefits, strategies, and best practices for trading forex through a bank, empowering you to make informed decisions and optimize your trading outcomes.

Benefits of Trading Forex through Banks:

1. Enhanced Security: Banks adhere to strict regulations and employ cutting-edge security measures to safeguard your funds, personal information, and trading activities. This includes safeguarding your accounts from unauthorized access, theft, and fraud.

2. Trust and Reputation: Trading forex through reputable banks provides peace of mind, knowing that your transactions are being handled by established financial institutions with a long-standing track record of integrity and reliability.

3. Access to Expertise: Banks typically have teams of experienced forex traders and analysts who provide research, market insights, and guidance to clients. This valuable support can help traders make informed decisions based on expert analysis.

4. Competitive Spreads: Banks may offer competitive spreads, which directly impact your profitability. By minimizing the difference between the bid and ask prices, banks enable traders to capture more of the potential profit from each trade.

Strategies for Successful Forex Trading through Banks:

1. Risk Management: Implement sound risk management strategies to mitigate potential losses. Set clear trading limits, use stop-loss orders to limit downside risk, and diversify your portfolio to avoid undue exposure to any single currency pair.

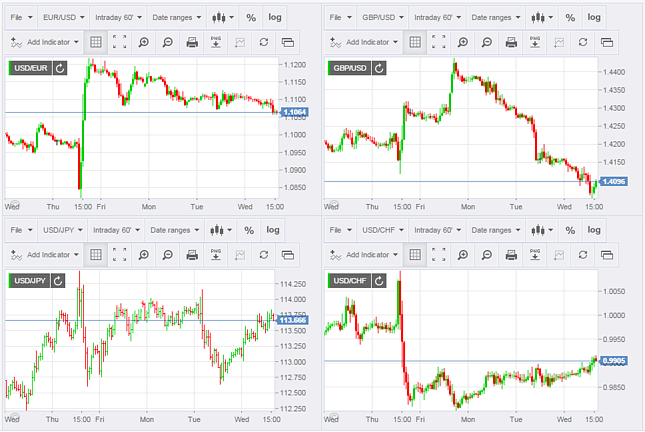

2. Technical Analysis: Study historical price charts and use technical indicators to identify trading opportunities. Technical analysis involves analyzing price patterns, support and resistance levels, and moving averages to forecast future market movements.

3. Fundamental Analysis: Consider macroeconomic factors, geopolitical events, and central bank announcements that can influence currency values. By staying abreast of global events, you can make informed decisions based on fundamental drivers of exchange rates.

4. Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and capital allocation. Trading with too much leverage can magnify potential losses, while trading with too little leverage limits your profit potential.

Best Practices for Choosing a Bank for Forex Trading:

1. Reputation and Regulation: Prioritize banks with a strong reputation and solid regulatory compliance. Conduct thorough research and consult industry reviews to assess a bank’s track record and trustworthiness.

2. Range of Currency Pairs: Choose a bank that offers a wide range of currency pairs to meet your trading needs. The more options, the greater your flexibility in selecting the most promising pairs for your trading strategy.

3. Fees and Spreads: Compare fees and spreads across different banks to identify the most cost-effective option. Consider factors such as account management fees, deposit fees, and the average spread offered by each bank.

4. Customer Support: Opt for a bank with reliable and responsive customer support. Quick and efficient support can be crucial in resolving issues promptly and ensuring a seamless trading experience.

5. Trading Platform: Choose a bank that provides a user-friendly and feature-rich trading platform. Look for platforms that offer advanced tools for analysis, order execution, and risk management.

Conclusion:

Trading forex through a bank can provide a safe, secure, and potentially lucrative opportunity for investors. By understanding the benefits and strategies involved, and carefully selecting a reputable bank, you can navigate the complexities of forex trading and maximize your chances of success. Remember, forex trading conlle

Image: realmfin.com

Trading Forex Through A Bank