As an investor, staying informed about the financial health of the companies you invest in is crucial. One key metric that offers valuable insights is the price-to-earnings ratio (P/E ratio). In this article, we’ll delve into the Home Depot P/E ratio, exploring its significance, historical trends, and what it means for investors.

Image: www.historicalperatio.com

The P/E ratio measures the relationship between a company’s current stock price and its annual earnings per share. It indicates how much investors are willing to pay for each dollar of earnings. A higher P/E ratio typically signifies that investors are optimistic about a company’s future growth potential, while a lower P/E ratio suggests a more conservative outlook.

Historical Trends of Home Depot’s P/E Ratio

Home Depot, a leading home improvement retailer, has consistently maintained a relatively high P/E ratio compared to its peers in the industry. Over the past decade, its P/E ratio has fluctuated between 18 and 25, with an average of around 20.

This sustained high P/E ratio reflects investors’ confidence in Home Depot’s solid financial performance, stable growth trajectory, and dominance in the home improvement market. The company’s commitment to innovation, customer service, and operational efficiency has contributed to its consistent earnings growth, making it a reliable and attractive investment for many.

Significance of Home Depot’s P/E Ratio for Investors

Understanding Home Depot’s P/E ratio is crucial for investors to make informed decisions. A high P/E ratio indicates that the company is trading at a premium relative to its earnings, but it also implies that investors anticipate strong future growth and profitability.

Conversely, a low P/E ratio could suggest that the company is undervalued and presents a buying opportunity. However, it may also reflect lower growth expectations or market concerns. Therefore, it’s essential to evaluate the P/E ratio in the context of the company’s overall financial health, industry trends, and economic conditions.

Tips and Expert Advice for Evaluating Home Depot’s P/E Ratio

- Compare to Industry Peers – Examine Home Depot’s P/E ratio in relation to other home improvement retailers. This will provide a benchmark to assess whether it’s overvalued or undervalued.

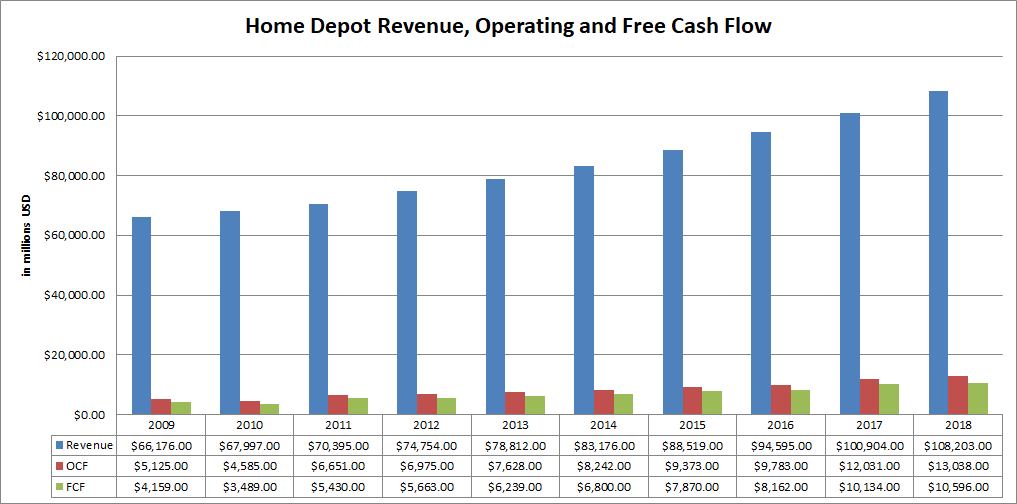

- Earnings Growth and Projections – Analyze Home Depot’s historical earnings growth and future earnings projections. A consistently increasing earnings trend supports a higher P/E ratio.

- Dividend Yield – Consider Home Depot’s dividend yield, which is the annual dividend per share divided by the current stock price. A low dividend yield may indicate that investors are prioritizing capital appreciation over income.

Remember, the P/E ratio is just one factor to consider when making investment decisions. It should be assessed alongside other financial metrics, industry dynamics, and economic forecasts to develop a comprehensive perspective.

Image: seekingalpha.com

FAQs About Home Depot’s P/E Ratio

- What is the current P/E ratio of Home Depot?

As of [Insert Date], Home Depot’s P/E ratio is around [Insert Value].

- Is Home Depot’s P/E ratio high?

Compared to its industry peers, Home Depot’s P/E ratio is relatively high, reflecting investors’ optimism about its growth potential.

- What does Home Depot’s P/E ratio imply for investors?

A high P/E ratio suggests that investors expect Home Depot to continue generating strong earnings and delivering long-term value.

Home Depot Pe Ratio

Conclusion

The Home Depot P/E ratio is a valuable metric that provides insight into the market’s valuation of the company’s financial performance and growth prospects. By understanding the historical trends, significance, and interpretation of the P/E ratio, investors can make informed decisions about their Home Depot investments.

Are you interested in learning more about the financial aspects of companies you invest in? If so, subscribe to our blog for regular updates and analysis. By staying informed, you can enhance your investment strategies and maximize your returns.