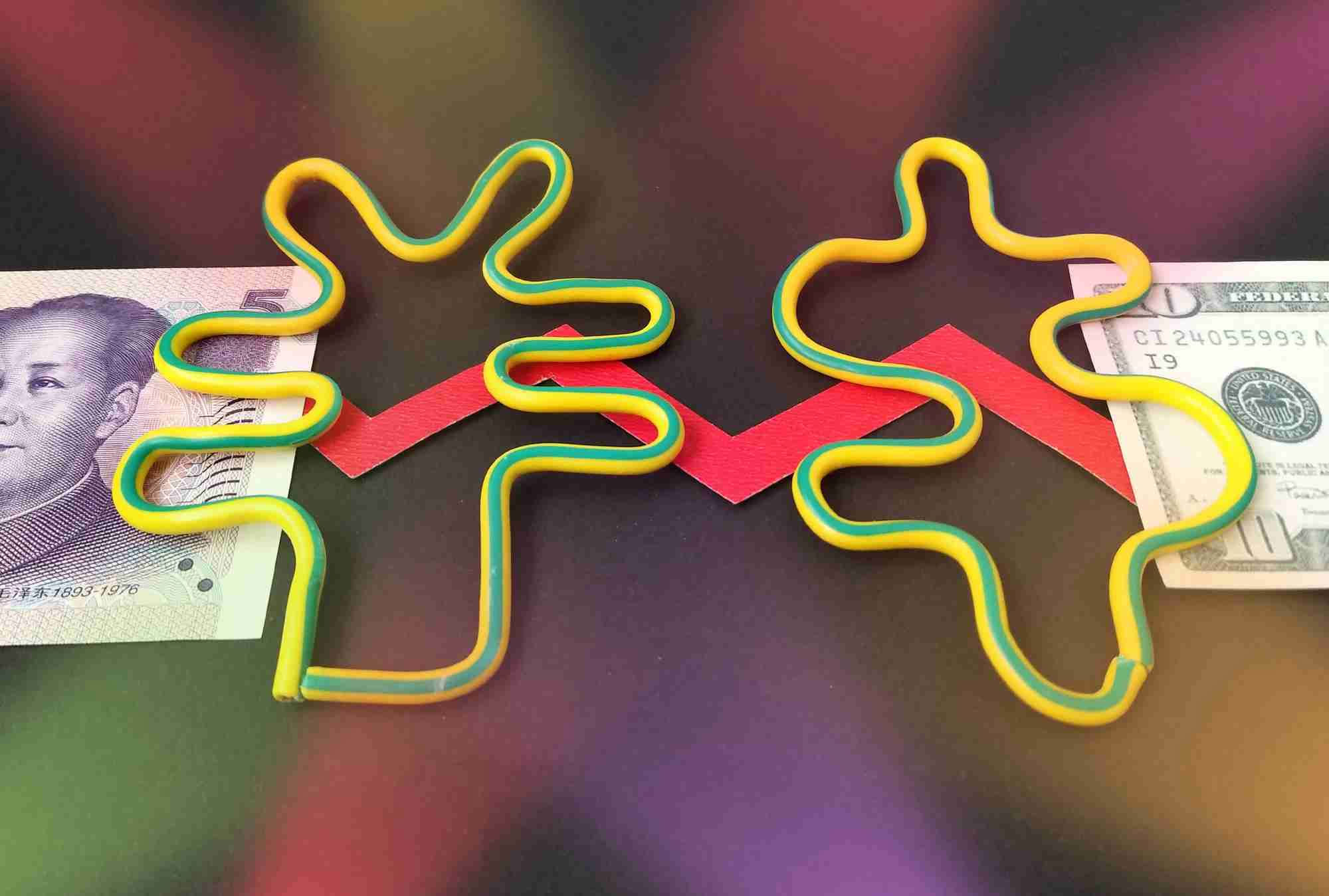

China, a global economic powerhouse, has taken a proactive stance towards foreign exchange (forex) trading. However, the legal landscape surrounding forex can be complex and subject to change. This article aims to unravel the intricacies of forex legality in China, empowering traders and aspiring investors with accurate and comprehensive information.

Image: www.mql5.com

A History of Forex in China

Forex trading in China traces its roots back to the early 1990s, when the country embarked on its market liberalization journey. The establishment of the Shanghai Foreign Exchange Trading Center in 1994 marked a significant milestone, solidifying China’s position in the international forex market.

Regulatory Evolution: Understanding the Framework

The Chinese government has implemented a comprehensive regulatory framework to oversee forex trading. The central authority responsible for formulating and enforcing these regulations is the People’s Bank of China (PBOC). Over the years, the PBOC has issued various regulations, including:

- The Foreign Exchange Management Regulations (2019)

- The Interim Provisions on Forex Margin Trading (2021)

- The Guidelines for Overseas Forex Brokers Providing Services to Domestic Residents (2022)

These regulations aim to maintain market stability, protect investors, and prevent money laundering activities.

Legality of Forex Trading in China

Forex trading is generally legal in China for domestic residents. However, there are specific stipulations and restrictions imposed by the PBOC. Key aspects of the legality include:

- Only certified brokers: Domestic residents can only trade forex through brokers licensed by the PBOC.

- Restrictions on leverage: Leverage, the borrowed capital used to magnify trading positions, is capped at 50:1 for major currency pairs and 20:1 for exotic pairs.

- KYC and AML compliance: Brokers are required to conduct rigorous know-your-customer (KYC) and anti-money laundering (AML) checks on all clients.

Image: news.cgtn.com

Opportunities and Risks: Navigating the Forex Market

China’s participation in the global forex market presents both opportunities and risks for traders.

Opportunities:

- Access to a growing market: China’s forex market is the largest in the world, offering immense liquidity and trading opportunities.

- Potential for high returns: Forex trading can potentially yield significant returns, especially in volatile markets.

- Diversification: Forex can enhance portfolio diversification, reducing overall risk.

Risks:

- Legal complexities: The regulatory framework can be complex, and it’s crucial to comply with all applicable rules and regulations.

- Market volatility: The forex market is highly volatile, and traders need to manage risk carefully.

- Scams and fraudulent brokers: Unscrupulous brokers may target inexperienced traders, so it’s essential to deal only with reputable and licensed entities.

Embracing the Future: Technology and Innovation

Technology is transforming the forex industry in China, with mobile trading platforms and automated trading algorithms gaining popularity. These advancements make forex trading more accessible and efficient. However, traders should exercise due diligence when exploring new platforms and technologies.

Is Forex Legal In China

Conclusion: Empowering Traders, Building Confidence

Understanding the legality and navigating the intricacies of forex trading in China empowers traders with the knowledge and confidence to maximize their opportunities while mitigating risks. By adhering to regulations, selecting reputable brokers, and staying abreast of industry developments, traders can harness the potential of the world’s largest forex market.