A captivation introduction

Imagine the foreign exchange market as a tempestuous ocean, its waves surging and crashing relentlessly. Volatility, the unpredictable and often chaotic force that drives this market, can either sink your trading fortunes or propel you to unprecedented heights. Embrace it, and you possess the key to unlocking hidden profits. But heed this warning: Volatility is a formidable force, and navigating its treacherous waters requires skill, courage, and a deep understanding of the currents that shape its behavior. Welcome to your voyage into the enigmatic realm of forex volatility trading.

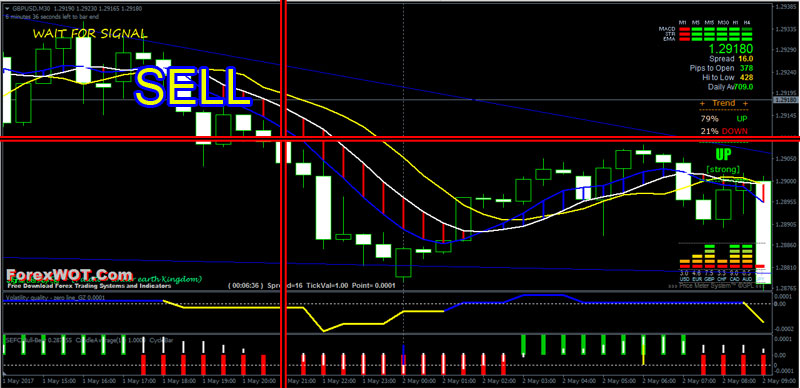

Image: forexwot.com

Defining and understanding volatility, the lifeblood of forex trading, is paramount to your success. In essence, volatility measures the extent of price fluctuations within a given currency pair over a specific time frame. High volatility signifies substantial price movements, while low volatility indicates a relatively stable market. This dynamic ebb and flow of prices presents opportunities for both profit and loss, and harnessing volatility to your advantage demands a keen ability to predict its movements.

Just like the ebb and flow of the tides, volatility in the forex market is subject to a multitude of factors. From major economic news releases to political events and central bank announcements, the slightest ripple in the global economy can send shockwaves through currency markets, causing prices to spike or plummet. Understanding these drivers of volatility is crucial for developing a successful trading strategy.

Unveiling the Secrets of Volatility Trading

Trading forex volatility is an art form, a delicate dance between risk and reward. Success in this arena requires a mastery of various trading techniques and strategies. One such technique is trading volatility breakouts, where traders capitalize on sudden and significant shifts in a currency pair’s price. Identifying these breakout points demands sharp technical analysis skills and the ability to recognize patterns in price movements.

Another approach is range trading, a strategy that flourishes in periods of relatively low volatility. By identifying well-defined support and resistance levels, traders can buy near support with the expectation of selling near resistance, or vice versa. However, this strategy requires patience and discipline, as it often involves waiting for the perfect setup.

Advanced traders often venture into options trading to amplify their potential profits. Options contracts provide the right but not the obligation to buy (call) or sell (put) a specific currency at a predetermined price within a set timeframe. By understanding the intricacies of options trading, you gain the ability to capitalize on volatility while limiting your downside risk.

Risk management in forex volatility trading cannot be overstated. Volatility, by its unpredictable nature, can inflict significant losses if not managed prudently. Establishing clear risk parameters, using stop-loss orders to limit your potential losses, and maintaining a disciplined trading approach are essential practices for preserving your capital and extending your longevity in the markets.

Image: analyticstrade.com

How To Trade Forex Volatility

A Call to Action

Embark on this extraordinary journey of forex volatility trading, but do so with knowledge, skill, and unwavering determination. Remember, the path to mastery is paved with lessons learned, both triumphs and setbacks. Embrace the roller coaster ride of volatility, navigate its treacherous currents with courage, and reap the bountiful rewards that await those who dare to tame the beast.