Introduction

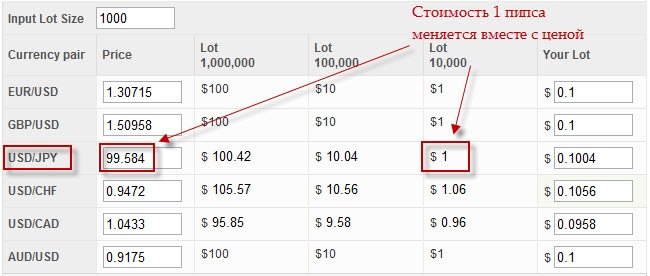

In the fast-paced world of forex trading, understanding the concept of pip value is crucial for making informed decisions and maximizing profits. A pip, short for “point in percentage,” represents the smallest increment of price movement in a currency pair. Accurately calculating pip value empowers traders to determine the potential profit or loss associated with specific price fluctuations.

Image: ayaluunpharm.mn

This article delves into the intricacies of pip value calculation, exploring the formula, factors influencing its value, and its practical applications in forex trading. By grasping these concepts, traders can gain an edge in navigating the dynamic forex market.

Understanding the Pip Value Formula

The pip value formula is:

Pip Value = (1 / Exchange Rate) * Contract Size

Let’s break down each component:

- Exchange Rate: This represents the current value of one currency in terms of another. For instance, if the EUR/USD exchange rate is 1.1850, one euro is worth 1.1850 U.S. dollars.

- Contract Size: This is the number of currency units in a single standard lot. In most cases, it is 100,000 units.

Factors Influencing Pip Value

Several factors influence the pip value of a currency pair:

- Currency Pair: Each currency pair has its own pip value. Major currency pairs, such as EUR/USD or GBP/USD, typically have a lower pip value compared to exotic pairs.

- Precision: Some currency pairs are quoted with five decimal places, while others are quoted with four. This difference affects the pip value calculation.

- Exchange Rate: As the exchange rate changes, so does the pip value. A higher exchange rate leads to a lower pip value, and vice versa.

Calculating Pip Value for Different Currencies

Let’s calculate the pip value for the EUR/USD currency pair:

Exchange Rate: 1.1850

Contract Size: 100,000 euros

Pip Value = (1 / 1.1850) * 100,000 = 84.36

Therefore, a one-pip movement in the EUR/USD exchange rate represents a value change of 84.36 U.S. dollars.

Image: acikubolex.web.fc2.com

Practical Applications of Pip Value

Understanding pip value is essential in various aspects of forex trading:

- Profit and Loss Calculation: By comprehending pip value, traders can precisely calculate potential profits or losses based on price fluctuations.

- Risk Management: Accurately estimating pip value enables traders to determine the appropriate position size and set stop-loss and take-profit orders effectively.

- Order Execution: Traders utilize pip value to determine the price at which their orders will be executed.

- Technical Analysis: Technical analysts rely on pip value to identify key support and resistance levels and predict future price movements.

How Is Pip Value Calculated In Forex

Conclusion

Understanding how to calculate pip value in forex is paramount for informed and profitable trading decisions. By mastering the formula and considering the influencing elements, traders can accurately assess potential profit or loss, effectively manage risk, and navigate the dynamic forex market with confidence. Embracing these concepts enhances trading acumen, improves risk-reward calculations, and sets the stage for financial success in the forex realm.