Introduction

Are you looking for a thrilling financial venture that can yield substantial rewards? Look no further than forex trading, an arena where you can profit from currency fluctuations on the global market. This bustling market, with its constant ebb and flow, offers enticing opportunities for astute traders. However, embarking on this journey requires a comprehensive understanding of the intricacies involved, from fundamental concepts to practical execution. This article will equip you with a comprehensive guide to navigate the dynamic landscape of forex trading and unlock its potential rewards.

Understanding Forex Trading: A Layman’s Guide

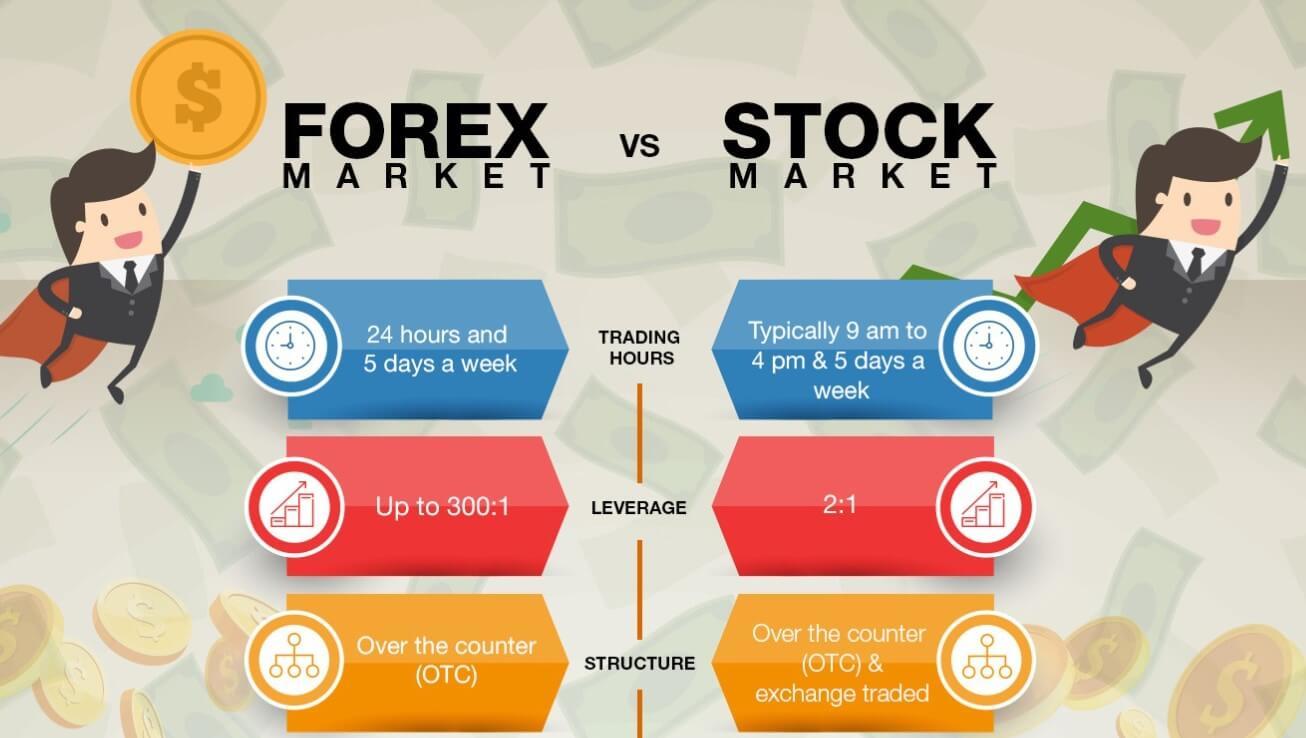

Forex trading, in essence, involves buying and selling currencies. The allure of forex lies in its inherent leverage, allowing traders to control substantial sums of money with relatively low capital. This characteristic amplifies both the potential profits and risks associated with this endeavor. Before diving in, traders must arm themselves with a thorough understanding of currency pairs, market analysis techniques, and risk management strategies.

Currency Pairs: The Forex Trading Toolkit

Forex trading revolves around the concept of currency pairs, which represent the relative value of two currencies. When trading a currency pair, you are essentially speculating on the appreciation or depreciation of one currency against the other. Major currency pairs, such as EUR/USD or GBP/USD, tend to exhibit higher liquidity and lower spreads (the difference between the bid and ask prices), making them popular among traders.

Market Analysis: Delving into Currency Dynamics

Mastering the art of market analysis is paramount in forex trading. By meticulously studying historical data, economic indicators, and market sentiment, traders can identify potential trading opportunities. Technical analysis involves deciphering price charts and patterns to predict future price movements. Fundamental analysis, on the other hand, focuses on economic and geopolitical factors that influence currency values. A combination of both approaches can provide a well-rounded perspective for making informed trading decisions.

Risk Management: Navigating the Unpredictable

Trading in the forex market is an inherently risky endeavor. However, prudent risk management strategies can help mitigate potential losses. Setting realistic profit targets, employing stop-loss orders to limit potential drawdowns, and maintaining appropriate leverage levels are crucial aspects of responsible trading. A disciplined approach and a deep understanding of risk management techniques can enhance your chances of long-term success.

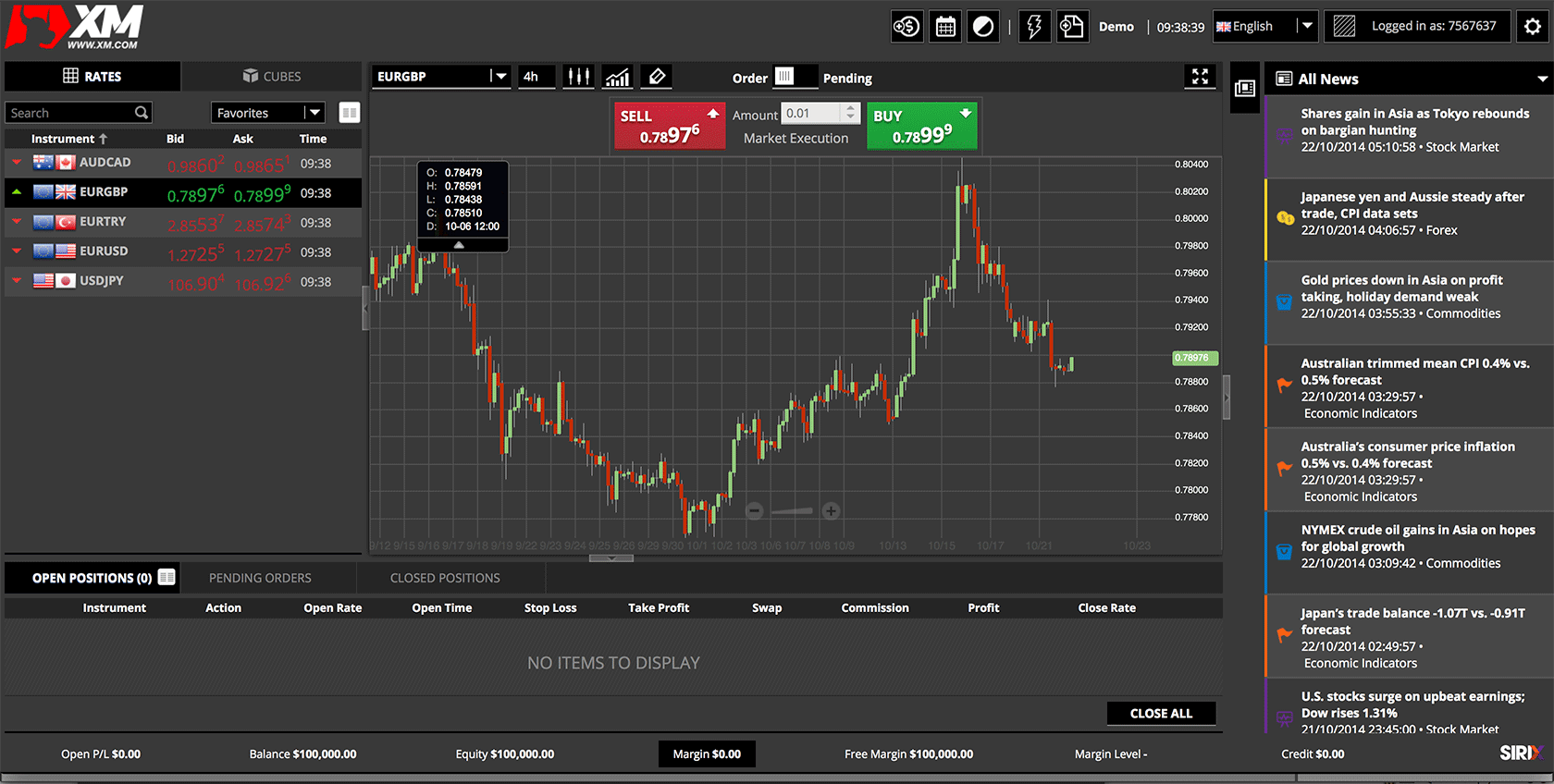

Trading Platforms: Your Gateway to the Market

Choosing a reliable and user-friendly trading platform is essential for executing trades efficiently. These platforms provide real-time market data, charting tools, and a variety of order types to facilitate trading. Explore different platforms, compare their features, and select one that aligns with your trading style and needs.

Strategies for Success: Unveiling Profitable Techniques

The realm of forex trading offers a plethora of trading strategies to cater to diverse market conditions and trader preferences. Scalping, day trading, and swing trading are popular approaches, each requiring a unique skillset and risk tolerance. Whether you favor short-term price fluctuations or long-term market trends, there is a strategy that can suit your trading objectives.

Education: The Path to Trading Proficiency

Continuous education is the cornerstone of successful forex trading. Dedicate time to learning the intricacies of the market, from fundamental concepts to advanced trading techniques. Take advantage of available resources such as books, online courses, webinars, and trading communities to expand your knowledge base. Engaging with other traders and sharing experiences can also contribute to your trading growth.

Practice and Discipline: The Keys to Consistency

Theoretical knowledge is only the first step in mastering forex trading. Practice is essential to hone your skills and build muscle memory for executing winning trades. Utilize demo accounts provided by trading platforms to test strategies and trade in risk-free environments before venturing into live markets. Discipline and consistency in your trading routine are paramount for long-term profitability.

Conclusion

The world of forex trading awaits you with both potential rewards and challenges. Embarking on this journey requires a deep understanding of market dynamics, risk management, and trading techniques. Through continuous education, practice, and a disciplined approach, you can unlock the potential for financial freedom and achieve lasting success in this ever-evolving market. Remember, the journey of forex trading is an ongoing adventure, full of learning, adaptation, and the thrill of navigating the global currency markets.

Image: www.forex.glass

Image: www.keenbase-trading.com

How Can I Do Forex Trading