Introduction:

In the labyrinth of financial markets, where fortunes are forged and lost with each tick of the clock, forex trading stands as a formidable challenge, promising immense rewards but also fraught with perils. Yet, for those who dare to navigate these treacherous waters, there exists a hidden realm of knowledge and techniques that can transform ordinary traders into extraordinary profit-seekers. In this comprehensive guide, we shall unveil the secrets of forex mastery, empowering you with the strategies and tricks that have propelled successful traders to the pinnacle of success.

Image: app.jerawatcinta.com

Understanding Forex and Its Importance:

Foreign exchange (forex) trading involves the exchange of currencies, making it the most liquid and widely traded financial market globally. Its importance stems from the interdependency of global economies, creating a constant demand for currency conversion to facilitate international trade, investment, and tourism. By mastering the art of forex trading, individuals can potentially generate substantial profits by leveraging currency fluctuations, providing a lucrative income stream.

The Anatomy of a Successful Forex Trade:

A successful forex trade hinges upon a meticulous understanding of three key elements:

-

Technical Analysis: The study of historical price data to identify trends, patterns, and support and resistance levels that provide insights into future price movements.

-

Fundamental Analysis: The analysis of economic indicators, interest rates, political events, and news announcements to determine the underlying value and direction of currencies.

-

Risk Management: The practice of managing potential losses through strategic stop-loss orders, position sizing, and prudent leverage to safeguard profits and mitigate risks.

Leveraging Technical Indicators for Enhanced Accuracy:

Technical indicators are mathematical formulas applied to price data to detect trends, identify overbought and oversold conditions, and predict future price movements. By incorporating indicators such as moving averages, Bollinger Bands, and the relative strength index (RSI) into your trading strategy, you can gain an edge over the competition.

Image: paxforex.org

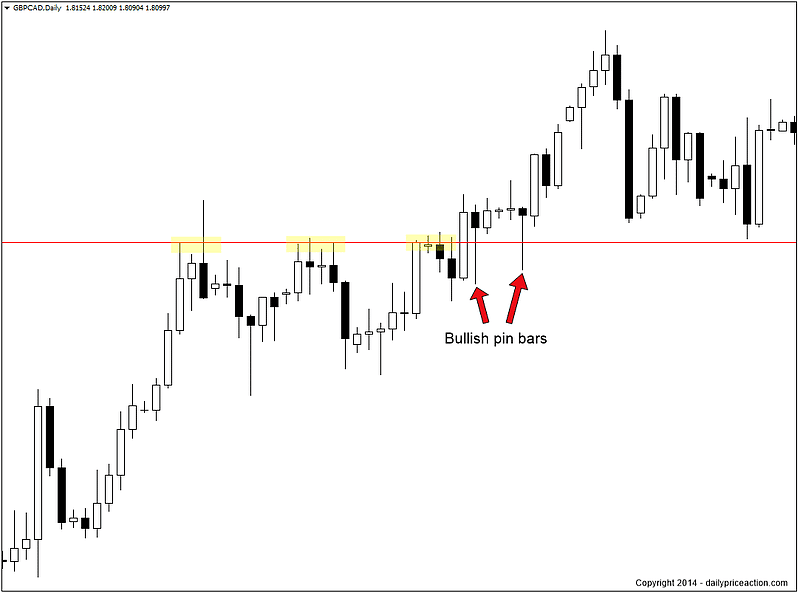

Exploiting Candlestick Patterns for Price Prediction:

Candlestick patterns, a form of technical analysis based on Japanese candlestick charts, provide valuable insights into market sentiment and price dynamics. Traders study candlestick patterns to identify potential reversals, support and resistance levels, and potential profit opportunities, enabling them to make informed trading decisions.

Mastering the Psychology of Trading:

Forex trading is not solely about technical and fundamental analysis; it also requires a deep understanding of the psychology of trading and the discipline to control emotions. Successful traders possess a strong sense of self-awareness, recognizing when their emotions cloud their judgment, and adhere strictly to pre-determined trading plans.

Risk Management: The Keystone of Forex Success:

In the realm of forex trading, risk management is paramount. Leverage, the ability to borrow funds to magnify potential profits, can also amplify losses if not handled responsibly. Traders must define clear risk parameters, including stop-loss and take-profit levels, to protect their capital and preserve profits. Proper position sizing, based on account balance, risk tolerance, and trading strategy, is also crucial for managing risk effectively.

Forex Trading Tricks And Techniques

Conclusion:

Forex trading, while challenging, offers the potential for significant financial success. By embracing the strategies and techniques outlined in this guide, aspiring traders can equip themselves with the knowledge and skills necessary to navigate this dynamic market. Moreover, by prioritizing risk management, traders can mitigate potential losses, preserve profits, and cultivate a disciplined approach to Forex trading. Remember, the path to forex mastery is not without its challenges, but for those who persevere, the rewards can be substantial.