In the ever-fluctuating world of forex trading, support and resistance levels are indispensable guideposts. Imagine being lost in a dense forest with no sense of direction. Just as finding a clearing brings relief, identifying support and resistance levels in the currency market provides clarity and guidance amidst the volatility.

Image: www.forexbeginner.com

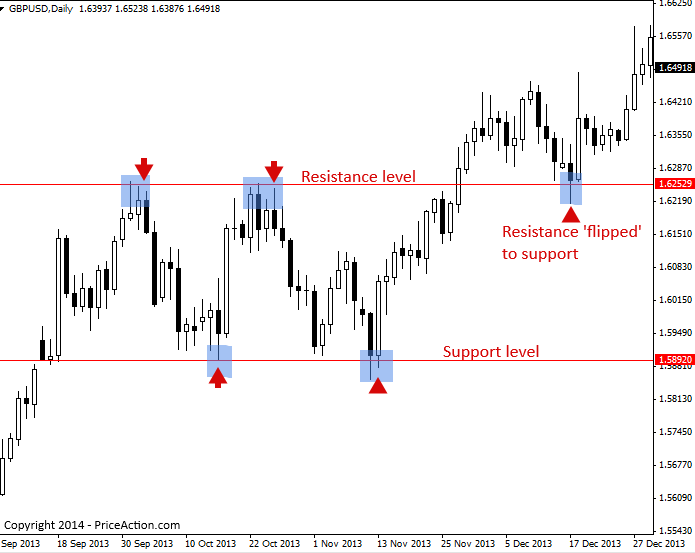

These levels are formed when price action consistently halts and reverses at specific points. It’s like a tug-of-war between buyers and sellers. When the buying pressure pushes prices higher and sellers step in to cash out their profits, the uptrend meets resistance and prices tend to fall. Conversely, when prices decline and buyers recognize a bargain, they step in, creating support and potentially reversing the downtrend.

Importance of Support and Resistance Levels

Pinpointing support and resistance levels offers several advantages:

- Forecasting: These levels provide crucial insights into future price movements, allowing traders to make informed decisions about potential buy and sell opportunities.

- Risk Management: By establishing support and resistance levels, traders can set stop-loss and take-profit orders with greater precision, minimizing potential losses and maximizing gains.

- Trade Planning: These levels help traders plan and execute their trades strategically, identifying potential entry and exit points with increased accuracy.

Identifying Support and Resistance Levels

Recognizing support and resistance levels requires some practice and technical analysis skills. Here’s how you can identify them:

- Historical Data: Analyze past price action to identify areas where prices consistently encountered difficulty moving higher (resistance) or lower (support).

- Trendlines: Draw trendlines connecting significant highs or lows to identify potential areas of bounce or reversal.

- Chart Patterns: Double tops, triple bottoms, and other chart patterns often signal the formation of support or resistance levels.

- Moving Averages: Exponential and Simple Moving Averages (EMAs/SMAs) can act as dynamic support and resistance levels when prices repeatedly touch and bounce off these technical indicators.

- Consider the Market Context: Don’t rely solely on support and resistance levels. Factor in macroeconomic factors, news events, and market sentiment to make informed trading decisions.

- Confirm Levels: Confirm potential support or resistance levels by observing price action at those levels over multiple time frames.

- Don’t Chase Levels: Instead of trading directly at support and resistance levels, wait for confirmation of a break and retracement before entering or exiting trades.

- Q: What is the best time frame to analyze support and resistance levels?

- A: It depends on trading style. Day traders often use intraday time frames, while swing traders analyze higher time frames such as 4-hour or daily charts.

- Q: Is it possible for support and resistance levels to break?

- A: Yes, but a strong break followed by a confirmation of the new level is crucial. False breakouts are common.

- Q: How many support and resistance levels should you consider?

- A: Market conditions determine the number of levels to observe. Focus on the most prominent and consistent levels.

Tips and Expert Advice

Seasoned traders emphasize the importance of the following:

Image: cilywadojup.web.fc2.com

Common Questions and Answers

Forex Support And Resistance Levels Daily

Conclusion

Forex support and resistance levels are invaluable tools for navigating the turbulent waters of currency trading. By understanding these levels and incorporating them into your trading strategy, you can gain a significant edge, increasing your chances for success. Remember, the key to profitable trading lies in knowledge, patience, and a disciplined approach.

So, are you ready to embark on your forex trading journey, armed with the power of support and resistance levels? Don’t hesitate to explore our educational resources, consult expert insights, and learn from experienced traders. You’ll be surprised how this invaluable knowledge can transform your trading success.