Embarking on the dynamic realm of foreign exchange (forex) trading can be both exhilarating and daunting. Before you take the plunge, it’s imperative to equip yourself with a thorough understanding of the rules and regulations governing forex trading in India. This comprehensive guide will provide you with the essential knowledge you need to navigate this complex landscape, ensuring compliance and maximizing your trading potential.

Image: www.earnforex.com

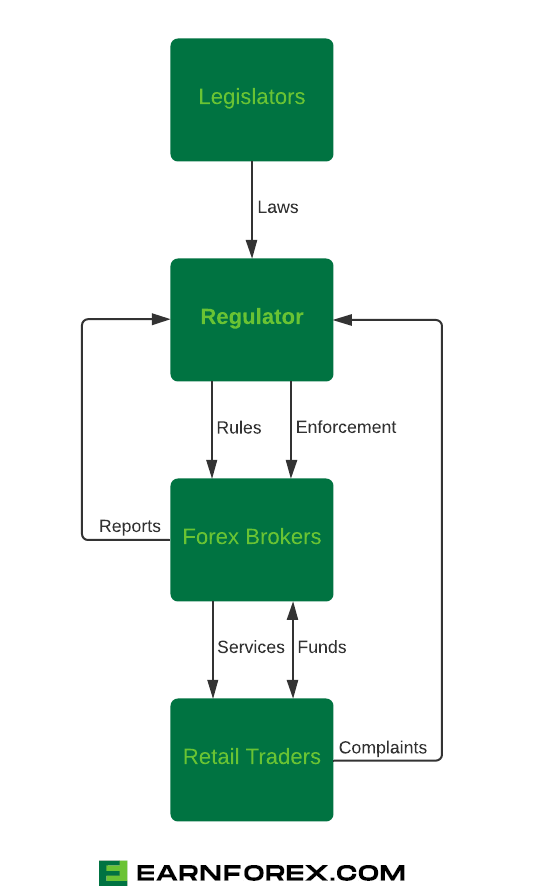

Forex trading in India is primarily regulated by the Reserve Bank of India (RBI), the country’s central bank. The RBI’s overarching goal is to maintain orderly financial markets, foster responsible trading, and protect the interests of Indian citizens participating in forex transactions. The RBI’s regulatory framework for forex trading encompasses a wide range of measures, including:

Authorization and Licensing Requirements:

Only authorized dealers (ADs) approved by the RBI are permitted to facilitate forex transactions in India. These ADs comprise banks, financial institutions, and other entities that meet stringent eligibility criteria and demonstrate a robust track record in the financial sector. The RBI closely monitors ADs to ensure adherence to regulations and safeguard the integrity of the forex market.

Documentation and Reporting Obligations:

To ensure transparency and accountability, ADs are obligated to maintain detailed records of all forex transactions executed on behalf of their clients. These records must include comprehensive documentation pertaining to the nature of the transaction, the parties involved, the underlying asset, and the relevant pricing information. ADs are also required to submit regular reports to the RBI, providing updates on their forex operations and compliance status.

Know Your Customer (KYC) Norms:

To combat money laundering and illicit financial activities, the RBI has implemented stringent KYC norms for forex transactions. ADs are obligated to gather and verify the personal and financial information of their clients, including their identity, address, occupation, and source of funds. By thoroughly understanding their clients’ background and risk profile, ADs can prevent the misuse of forex trading for illegal purposes.

Image: www.niveshmarket.com

Limits and Restrictions:

The RBI has imposed certain limits and restrictions on forex transactions to maintain market stability and minimize excessive speculation. These limits vary depending on the purpose of the transaction and the type of currency involved. For instance, individuals are typically subject to limits on the amount of foreign exchange they can purchase or remit overseas. These restrictions are periodically reviewed and adjusted by the RBI based on the prevailing economic conditions.

Cross-Border Transactions:

The RBI exercises oversight over all cross-border forex transactions to ensure compliance with India’s foreign exchange management regulations. These regulations govern the flow of foreign currency into and out of the country, aiming to promote balanced and sustainable economic growth. Individuals and businesses contemplating overseas investments or payments must adhere to these regulations and seek necessary approvals from authorized dealers.

Enforcement and Penalties:

The RBI possesses robust enforcement mechanisms to deter non-compliance with its forex regulations. Authorized dealers found guilty of violating the guidelines face severe penalties, including fines, license suspensions, or revocations. Individuals engaging in unauthorized forex transactions or attempting to circumvent regulations may also face legal consequences and forfeiture of their assets.

Forex Rules And Regulation In India

Conclusion

By comprehending and adhering to the rules and regulations governing forex trading in India, you can confidently participate in this global market, safeguard your interests, and contribute to a healthy and stable financial ecosystem. Remember, reputable authorized dealers, such as banks and licensed brokers, are your trusted partners in navigating the intricacies of forex trading. Seek their guidance, stay informed about regulatory updates, and trade responsibly to unlock the full potential of this dynamic financial instrument.