Forex Data: Unraveling the Market’s Past for Informed Decisions

To emerge victorious in the Forex arena, traders must possess a profound understanding of past market movements. Forex historical data provides this crucial foundation, enabling traders to discern patterns, identify trends, and make informed decisions. By downloading historical Forex data in CSV (Comma-Separated Values) format, traders can conveniently access this essential information and leverage it to elevate their trading strategies.

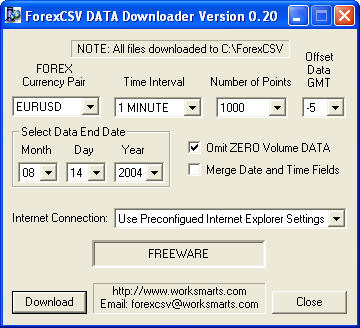

Image: www.moneytec.com

Step-by-Step Guide to Downloading Historical Forex Data

Selecting a Reputable Data Provider:

Embrace the wisdom of experience and seek reliable data providers like DataFeed, MetaQuotes, and FXCM. These reputable entities ensure data integrity and provide access to a vast repository of historical Forex quotes.

Specifying Timeframe and Currency Pairs:

Harness the granularity of historical data by selecting the timeframe that aligns with your trading strategies. Determine the specific currency pairs you wish to analyze, considering market liquidity, volatility, and your trading preferences.

Exporting to CSV Format:

Once the desired data is retrieved, opt for the CSV format to download. This ubiquitous spreadsheet format seamlessly integrates with a wide array of trading platforms and analysis tools, enhancing your data manipulation capabilities.

Utilizing APIs and Third-Party Tools:

Advance your data acquisition prowess by employing APIs (Application Programming Interfaces) or third-party tools. These resources empower you to automate data retrieval, streamlining your workflow and saving precious time.

Harnessing Historical Data for Enhanced Trading Strategies

Identify Market Cycles and Trends:

Historical data unveils the ebb and flow of the market. Study price patterns and discern recurring trends to anticipate future market behavior. Utilize this knowledge to capitalize on market movements and optimize your entry and exit strategies.

Evaluate Market Volatility and Risk:

Quantify market risk by assessing historical volatility data. Comprehend the degree of price fluctuations, enabling you to determine suitable stop-loss levels, position sizing, and risk management strategies.

Identify Support and Resistance Levels:

Seek out historical support and resistance levels, which represent pivotal price points where market momentum shifts. Embracing these levels empowers you to predict potential price reversals and refine your trading strategies accordingly.

Test and Optimize Trading Strategies:

Validate your trading strategies by applying them to historical data. Simulate trades, analyze results, and refine your approach until you achieve optimal performance. This invaluable testing process minimizes risk and enhances your confidence in live trading.

Gain Perspective on Historical Events:

Explore major historical events etched into the Forex market. Understand how political, economic, and global developments influence currency dynamics. Incorporating this knowledge into your analysis provides a comprehensive understanding of market behavior.

Image: forextradingplatforms3.blogspot.com

Forex Historical Data Download Csv

FAQs: Unraveling Common Forex Historical Data Queries

Q: Where can I access free historical Forex data?

A: Numerous websites and platforms offer complimentary historical Forex data, including ForexFactory, Investing.com, and FXStreet. However, the scope and accuracy of free data may vary.

Q: How often should I download historical data?

A: The frequency depends on your trading style and data requirements. For active traders, daily or weekly updates are recommended. Longer-term traders may opt for monthly or quarterly updates.

Q: Is it legal to download historical Forex data?

A: Generally, downloading historical Forex data for personal use is permissible. Ensure that you abide by the terms and conditions of the data provider and respect copyright laws.

Conclusion: Empowering Traders with Historical Forex Data

Unlock the gateway to informed Forex trading by harnessing the power of historical data. Embark on a data-driven journey, enriching your analysis with historical trends, patterns, and market insights. Whether you’re a seasoned trader or a curious novice, this comprehensive guide empowers you with the knowledge and tools to download and leverage historical Forex data effectively. Are you ready to elevate your trading prowess and conquer the Forex markets with confidence?