The vast realm of forex trading offers a myriad of strategies tailored to diverse market conditions and trader preferences. Navigating this labyrinth can be daunting, but we embark on a comprehensive exploration to unravel the intricacies of these strategies and empower you with the knowledge to forge your own path in the forex arena.

Image: myfxtools.com

1. The Scalping Strategy: Aiming for Swift Gains

Scalping is a high-octane strategy characterized by lightning-fast execution, targeting minuscule price movements. Traders employing this technique enter and exit positions within seconds or minutes, accumulating small profits over numerous trades. Success relies on lightning-fast reflexes, precise timing, and a sharp eye for market fluctuations. Scalpers thrive in high-liquidity markets with low spreads, seeking opportunities in rapid price changes.

2. Day Trading: Capitalizing on Daily Market Rhythms

Day traders are in-and-out warriors, holding positions for a day or less, capturing short-term price movements. Unlike scalpers, day traders patiently analyze market dynamics, identifying patterns and exploiting potential opportunities. They often employ technical analysis, relying on price charts to gauge market sentiment and make informed trading decisions. Understanding market open and close times, as well as news events, is crucial for day trading success.

3. Swing Trading: Harnessing Medium-Term Trends

Swing trading bridges the gap between day trading and longer-term strategies. Traders aim to ride market swings for a few days to several weeks, seeking to profit from medium-term price movements. Swing traders analyze market trends using both technical and fundamental analysis to identify potential trading opportunities. They typically trade with higher position sizes and have a sound understanding of risk management techniques.

Image: medium.com

4. Position Trading: Playing the Long Game for Substantial Gains

Position traders take the ultimate marathon approach to forex, holding positions for weeks, months, or even years. They seek to capitalize on major market trends and macroeconomic factors that drive long-term price movements. Position traders rely heavily on fundamental analysis, assessing economic data, interest rate decisions, and geopolitical events to shape their trading decisions. While offering potentially substantial gains, position trading requires an unwavering belief in the underlying trend and a tolerance for higher risks.

5. Carry Trade: Embracing Interest Rate Differentials

Carry trade involves borrowing a currency with a low-interest rate and investing it in a currency with a higher interest rate. Traders profit from the interest rate differential and any currency appreciation. This strategy requires a comprehensive understanding of interest rate dynamics and currency relationships. However, carry trades can be risky if the interest rate differential narrows or reverses or if the invested currency depreciates.

6. News Trading: Reacting to Market-Moving Events

News trading involves monitoring economic news, announcements, and events that have the potential to impact currency prices. Traders strive to anticipate the market reaction to these news releases and capitalize on the resulting volatility. This strategy demands lightning-fast execution capabilities, thorough knowledge of market fundamentals, and the ability to navigate potentially sharp price movements.

7. Range Trading: Exploiting Predictable Market Boundaries

Range trading involves buying near the bottom and selling near the top of an established market range. Traders identify support and resistance levels and execute trades within these boundaries. This strategy thrives in markets exhibiting defined trading ranges and requires traders to have a keen understanding of market dynamics and patience to wait for the right trading opportunities.

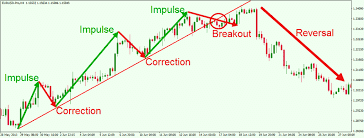

8. Breakout Trading: Capturing Impulsive Market Moves

Breakout traders seek to profit from sharp upward or downward price movements that occur when support or resistance levels are breached. They identify areas of price congestion and trade in the direction of the breakout, targeting substantial gains. Breakout trading necessitates precise timing, quick decision-making, and an understanding of risk management techniques to mitigate potential losses.

Different Types Of Forex Strategies

Conclusion

The world of forex strategies is a multifaceted and ever-evolving landscape, providing traders with a wide range of options to navigate the financial markets. Whether you seek swift scalping profits, aim to harness medium-term trends, or embrace the patience of position trading, understanding the various strategies available is paramount to developing a tailored approach. Remember, success in forex trading lies not solely in choosing the “best” strategy but in matching your trading style, risk tolerance, and market knowledge with the optimal approach. Let this comprehensive guide serve as your compass as you explore the diverse strategies and forge your own path to forex trading success.