Introduction

In the realm of forex trading, market participants are constantly seeking insightful tools and techniques to enhance their decision-making. One invaluable resource that has emerged over the years is the Commitment of Traders (COT) report. This comprehensive report sheds light on the positioning of large market players, known as Large Speculators or Commercials, thereby providing valuable insights into market sentiment and potential price movements.

The COT report, released weekly by the Commodity Futures Trading Commission (CFTC), is a valuable tool for Forex traders seeking to discern market sentiment and make informed trading decisions. By combining historical data with detailed analysis, this report offers a unique perspective on the positioning of major market participants, providing invaluable insights into potential price movements.

Image: forextraders.guide

Deciphering the COT Report

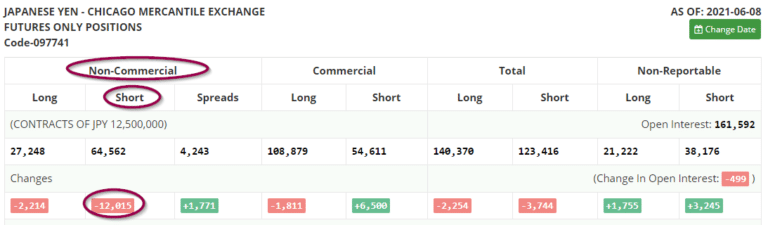

The COT report consists of two distinct sections: the futures-only section and the disaggregated section. The futures-only section provides an overview of non-commercial positions in futures contracts, while the disaggregated section offers a more granular breakdown of positions held by reporting traders, including commercials, non-commercials, and non-reportable traders.

- Commercial Traders: Commercial traders, typically composed of producers, processors, and end-users of a commodity, generally hold positions to hedge against price fluctuations. Their positions can offer insights into anticipated supply and demand dynamics.

- Non-Commercial Traders: Non-commercial traders, also known as speculators, hold positions with the primary goal of profiting from price movements. They are often the driving force behind short-term price movements.

- Non-Reportable Traders: This category encompasses smaller traders whose positions are not required to be reported to the CFTC. Their positions can sometimes provide insights into retail trader sentiment.

Interpreting COT Data

The COT report presents a wealth of data points that can be analyzed to gain insights into market sentiment and potential price movements. Key data points include:

- Net Positions: This figure represents the difference between the total long and short positions held by each category of traders. It offers a glimpse into the overall positioning of market participants.

- Changes in Net Positions: Analyzing changes in net positions over time can reveal shifts in market sentiment, indicating potential reversals or continuations of prevailing trends.

- Commitment of Traders (COT) Index: This index represents the ratio of non-commercial to commercial positions. It provides insights into the relative bullishness or bearishness of non-commercial traders.

- Speculative Positioning: The COT report also provides data on speculative positioning, which refers to the net positions held by non-commercial traders. This data can indicate potential price breakouts or reversals.

Using COT Data in Forex Trading

Traders can incorporate COT data into their forex trading strategies in several ways:

- Confirming Market Sentiment: Comparing COT data with other market indicators can bolster confidence in prevailing trends or alert traders to potential shifts in sentiment.

- Identifying Entry and Exit Points: Analyzing COT data can help traders identify potential entry and exit points, based on shifts in positioning by large market participants.

- Managing Risk: COT data can provide insights into the level of risk associated with a particular currency pair, helping traders adjust their risk management strategies accordingly.

- Understanding Market Sentiment:** COT data offers valuable insights into the overall market sentiment, providing traders with a broader perspective on market dynamics.

Image: www.forex-central.net

Limitations of COT Data

While the COT report is a valuable tool, traders should be aware of its limitations:

- Delayed Reporting: COT data is reported with a one-week lag, which means it reflects market conditions as of the previous week.

- Unpredictability of Speculators: Non-commercial traders, who often drive short-term price movements, can be unpredictable in their positioning, making it challenging to rely solely on COT data for trading decisions.

- Lack of Price Targets: The COT report does not provide specific price targets or predictions, requiring traders to combine COT data with other market analysis techniques.

Commitment Of Traders Report Forex

Conclusion

The Commitment of Traders (COT) report is a powerful tool that provides invaluable insights into the positioning of large market participants in the forex market. By analyzing COT data, traders can gain a better understanding of market sentiment and potential price movements, enhancing their decision-making and improving their overall trading performance. Remember to interpret the data with caution, considering its limitations alongside other market indicators and analysis techniques for a more comprehensive forex trading strategy.