In the volatile depths of forex trading, the concepts of support and resistance serve as beacons for traders, illuminating the ebb and flow of currency values. Understanding these principles is akin to possessing a compass, guiding you through the turbulent sea of currency fluctuations and enhancing your chances of profitability.

Image: forextradingxpo.blogspot.com

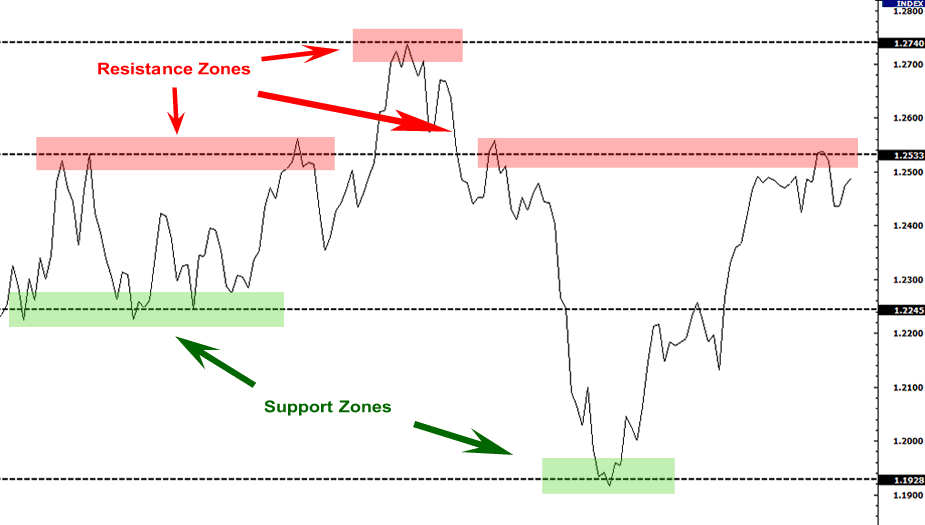

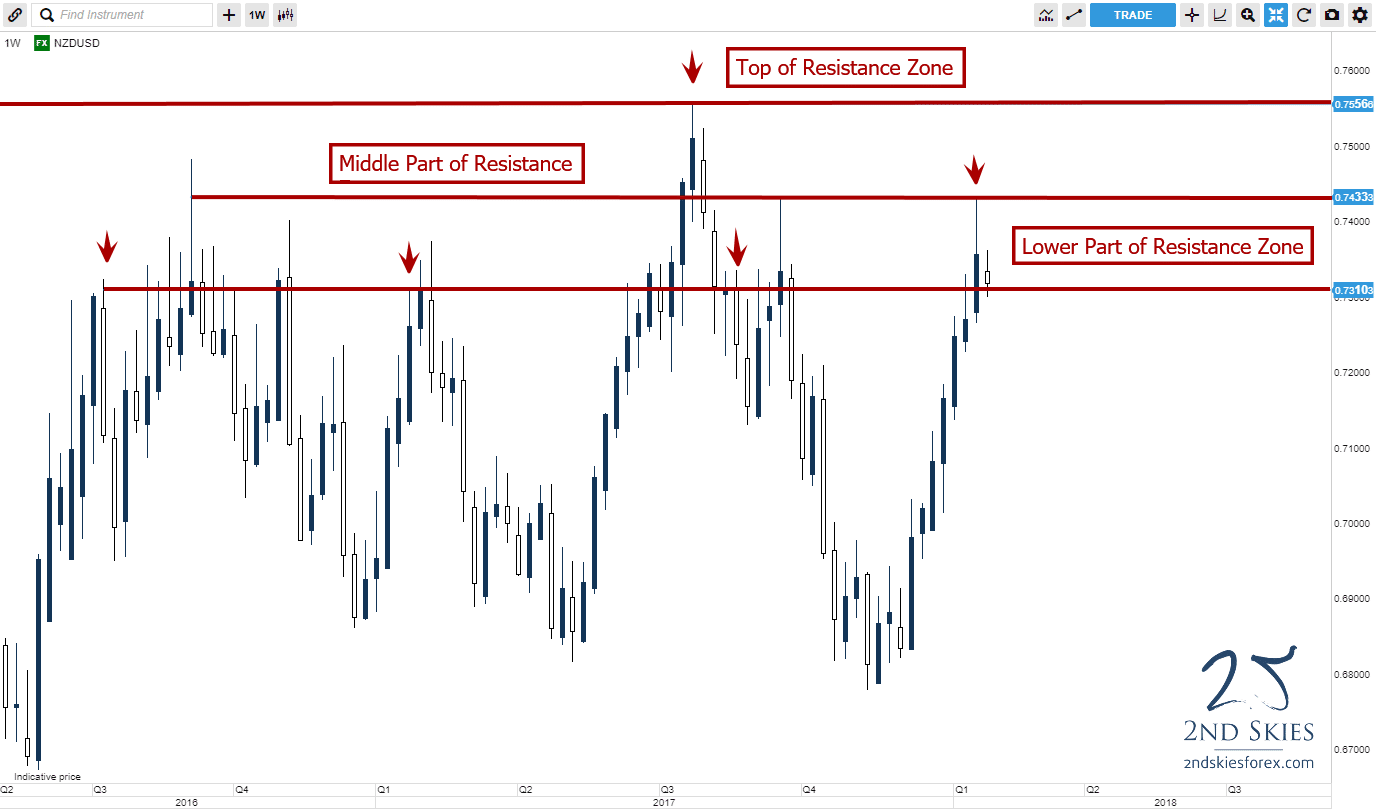

Support is a price level at which a currency’s downtrend is expected to pause or reverse, while resistance is a level where an uptrend is likely to stall or change direction. These levels emerge due to various factors, such as market psychology, technical analysis, and economic data. Identifying and leveraging these levels can significantly improve your trading success.

The Anatomy of Support and Resistance

Conceptualizing support and resistance is relatively straightforward:

- Support: This level marks the lower boundary of a currency pair’s recent price range, where buying forces tend to gather, preventing further decline.

- Resistance: This level signifies the upper boundary of a recent price range, where selling pressures tend to accumulate, obstructing continued appreciation.

Trading Strategies Utilizing Support and Resistance

The knowledge of support and resistance provides traders with a wealth of trading opportunities:

- Breakout Trading: When prices break through a support or resistance level, it often signals a potential trend reversal. Traders can anticipate this movement and position themselves accordingly.

- Retracement Trading: After a breakout, prices often retrace towards the broken support or resistance level before continuing in the breakout direction. Savvy traders can take advantage of these retracements for entry or exit strategies.

- Reversal Trading: When prices fail to break through a support or resistance level, it indicates a potential market reversal. Traders can time their trades accordingly.

Advanced Concepts in Support and Resistance

As traders delve deeper into these concepts, they encounter advanced techniques that enhance their trading acumen:

- Trendlines: Support and resistance levels can form trendlines, connecting multiple support or resistance points to indicate the overall market direction.

- Fibonacci Levels: Fibonacci retracement and extension levels provide additional support and resistance points, based on mathematical ratios often observed in financial markets.

- Moving Averages: Moving averages smooth out price data, creating dynamic support and resistance levels that adapt to changing market conditions.

Mastering Support and Resistance: A Path to Profits

Proficiently navigating the realm of forex trading requires a thorough grasp of support and resistance. By integrating these principles into your trading arsenal, you embark on a path towards enhanced profitability and risk management. Remember, the currency markets are ever-evolving entities, and constant education and practice are essential to staying ahead of the curve. Happy trading!

Image: 2ndskiesforex.com

Support And Resistance In Forex Trading